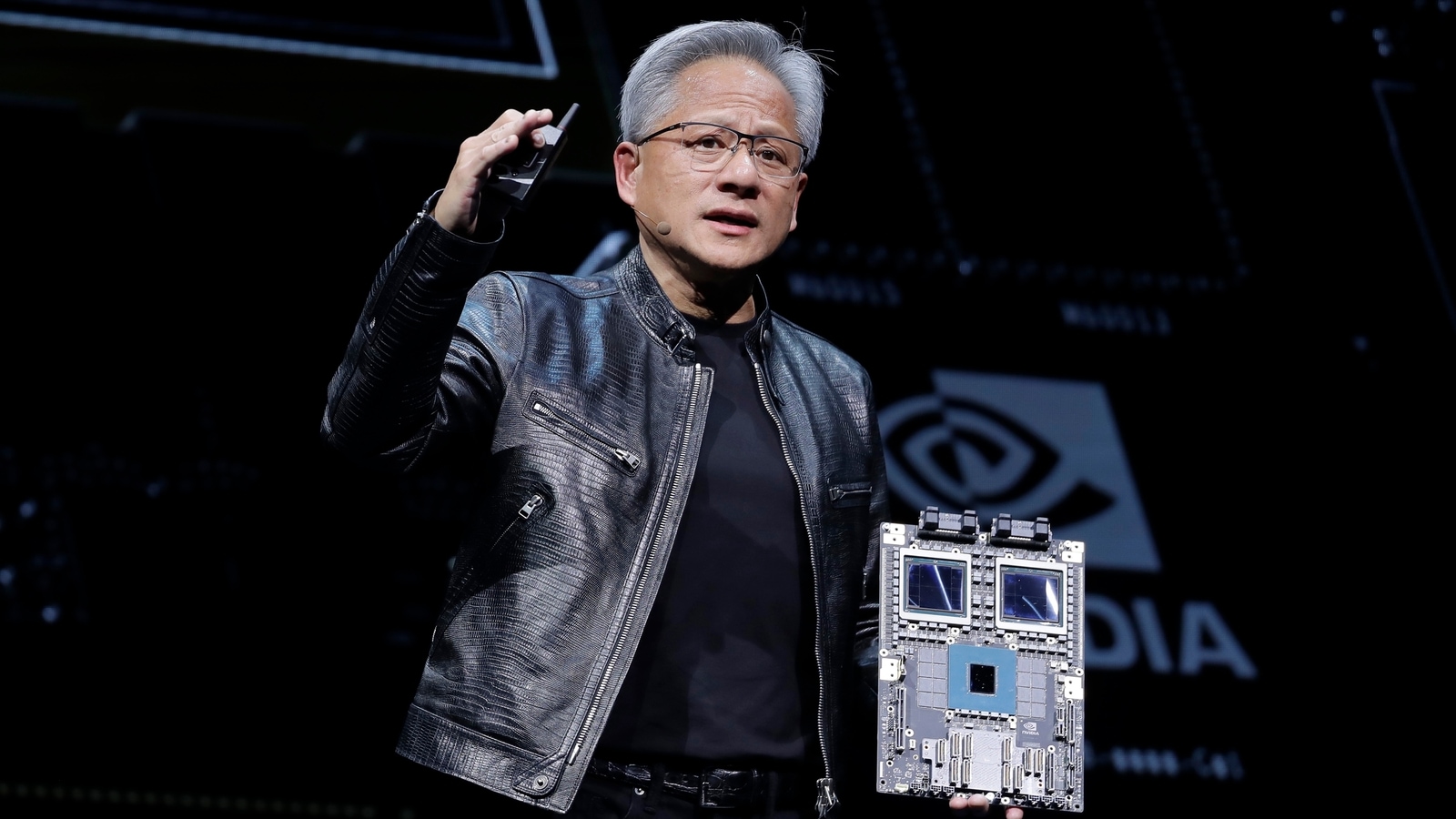

Report: Jensen Huang’s Nvidia could be worth more than the current S&P 500 index value in ten years

Nvidia could be worth nearly $50 trillion in a decade, more than the combined market value of the entire S&P 500 ($47 trillion), the Financial Times reported, citing James Anderson, one of the most successful technology investors known for his early bets on Tesla and Amazon.

Why is the market sentiment towards Nvidia so positive?

Nvidia is the biggest beneficiary of the AI boom because it has a near monopoly on manufacturing chips used to train and run powerful generative AI models such as OpenAI’s ChatGPT.

Also read: Bitcoin hits $60,000 and other cryptocurrencies gain as Trump’s shooting boosts his re-election chances

Nvidia shares rose 162% this year, and its market cap topped $3 trillion. That’s 20 times the chipmaker’s value in 2018, when it was worth $150 million. In June of this year, the company even briefly overtook Microsoft and Apple to become the world’s most valuable publicly traded company.

Who is James Anderson?

Anderson was best known for his four-decade work at Baillie Gifford, a Scottish investment firm that bought Nvidia shares in 2016 and eventually became a star of tech investing, the report said. Last year, he co-founded Lingotto Investment Management with the Italian billionaire Agnelli family, where he manages a $650 billion fund. The fund’s biggest investment is, of course, Nvidia.

Also read: Mercedes-Benz to assemble more electric vehicles in India: MD and CEO Santosh Iyer

Anderson believes that demand for AI chips is growing at about 60% annually. He said that over a 10-year period, this growth would translate into earnings of $1,350 per Nvidia share and a market capitalization of $49 trillion. He believes the probability of this happening is 10-15%.

What are Nvidia’s future goals?

Cloud service providers will get a high return on investment when they use Nvidia GPUs, Firstpost quoted Ian Buck, vice president and general manager of Nvidia’s hyperscale and HPC business, as saying during the Bank of America Securities 2024 Global Technology Conference.

For every dollar they spend on GPUs, cloud providers can earn $5 over four years, he said. For AI inference tasks, the return on investment is $7 for every dollar invested.

Also read: Elon Musk’s X is accused of violating EU digital laws. Musk says EU offered illegal secret deal

AI inference is the process by which a trained AI model draws conclusions from new data it is fed. Nvidia is addressing this demand with products such as NVIDIA Inference Microservices (NIMs), which support popular AI models such as Llama, Mistral and Gemma, the report said.

The company is also focusing on its new Blackwell GPU, which is used for inference tasks but consumes less power. The company will also launch its Rubin GPU for cloud providers, noting the importance of their development of the data center infrastructure needed to support the AI revolution.