These two top value stocks are down over 10% this year!

Many stocks currently appear to offer excellent value for money. However, with UK stock markets on the rise, this may soon no longer be the case.

Here are two brilliant picks that I think investors should consider buying this month.

JD sportswear

My first selection is JD sportswear (LSE: JD.) There is no sugarcoating it, the stock has had an incredibly disappointing performance this year, falling 30.1% year to date and 51.9% from its five-year high.

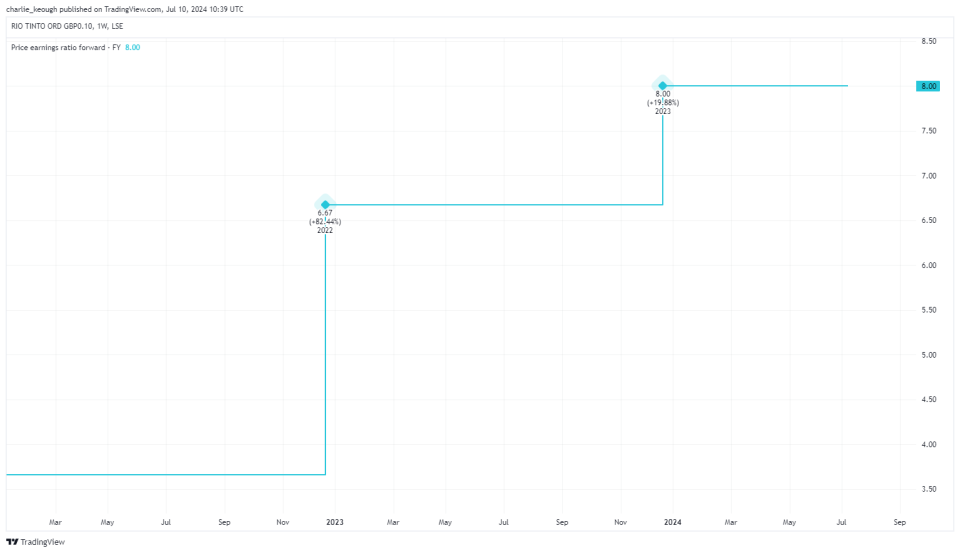

But for contrarian investors who like to find value, I think JD is worth considering. After the decline, the stock now looks dirt cheap, trading at 10.7 times earnings. As the chart below shows, it trades at just 9.6 times forward earnings.

Created with TradingView

The company has issued a few profit warnings recently, which has spooked investors, which also explains the low price. Consumers are still more frugal, so JD may struggle a little longer as tougher trading conditions continue.

That said, I could wait and try to buy at the bottom. But as the old saying goes, it’s better to spend time in the market than to time the market. I see plenty of value in JD stock today. I think it would be too risky to try to wait for the stock to bottom out.

When I look at the whole thing more closely, I see many reasons why I like JD. The company operates in the athleisure sector, which is expected to grow 9.3% annually through 2030. And although the company already has a strong market position, it continues to grow. Last year, 216 new stores were opened.

Analysts have set a price target for the stock of a whopping 160.2p over the next 12 months. That’s a massive 42.9% premium to the current price. These are just forecasts, of course, but I think they show how much potential JD has.

Rio Tinto

Next, under the microscope Rio Tinto (LSE: RIO). The FTSE100 Stalwart has fallen 11.6% so far this year. However, it is up 6.9% over the past 12 months.

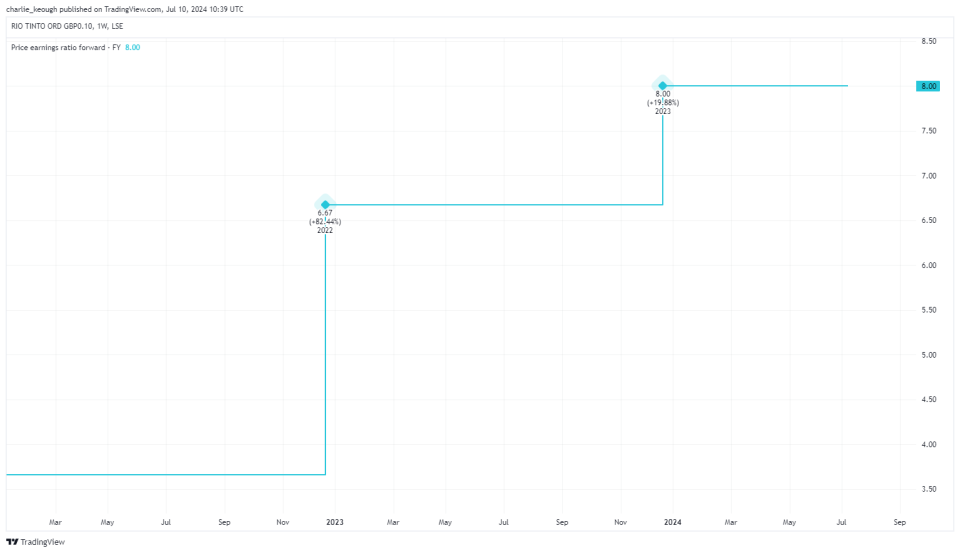

The 2024 drop means the stock trades at 10.8 times forward earnings, below the Footsie average, and as seen below, it trades at just 8 times forward earnings.

Created with TradingView

I think that’s an insane value for a company like Rio Tinto and I’m optimistic about the moves the company is making as it expands into the lithium sector, including the acquisition of the Rincon lithium project for £825 million a couple of years ago.

The lower price also means that the dividend yield has increased. The yield is 6.6%, making it one of the top 10 highest paying Footsie stocks. In addition, the company has been paying dividends consistently for over a decade.

The stock is cyclical, so we could see a few more outliers like the one this year. About half of the revenue comes from China, which can also cause complications.

However, in the long term, Rio Tinto could be a smart buy at the current price. Chinese demand has slowed, but we are seeing signs that it is picking up again.

Analysts have forecast a price target of £61.64 for the next 12 months, representing an increase of 18.4% from today’s price.

The post “These 2 top value stocks are down over 10% this year!” first appeared on The Motley Fool UK.

further reading

Charlie Keough does not own any of the stocks mentioned. The Motley Fool UK does not own any of the stocks mentioned. The views expressed in this article about the companies mentioned in this article are those of the author and as such may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024