Looking for bargains? Bank of America suggests 3 value stocks to consider

Every shopper wants to get a bargain. That’s one of the thrills of shopping for things. Finding what we want at a lower price than we were willing to spend – that’s always a little bit exciting. And that’s true in the stock market too. That’s the appeal behind value stocks.

According to Bank of America, the value stock segment, which is typically valued lower than underlying strength would suggest, has significantly underperformed growth stocks so far this year. Savita Subramanian, research equity and quant strategist at the bank, describes value stocks as “neglected and trading at very low multiples” and points to several sectors, including energy stocks, as an area where value investors can look for opportunities.

Subramanian’s colleague, Bank of America equity analyst Kalei Akamine, has taken that view further by taking a closer look at three low-priced energy stocks. All three are members of the S&P 500 Value Index, and BofA believes they are value stocks to consider right now.

According to the TipRanks database, Wall Street’s overall assessment of these stocks is clear: They’re rated “Buy” and offer solid double-digit upside potential. Let’s dive into the details and find out why Bank of America thinks they’re compelling portfolio choices.

ConocoPhillips (POLICE OFFICER)

We start with ConocoPhillips, one of the world’s largest independent oil and gas exploration and production companies. With a market capitalization of $131 billion, ConocoPhillips runs a global business from its headquarters in Houston, Texas, with operations in North America, Europe, Africa, the Middle East and the Asia-Pacific region.

If we look more closely, we find that ConocoPhillips is heavily involved in the production of most forms of fossil fuels. The company’s operations include all phases of discovery, exploitation, transportation, and distribution/marketing of hydrocarbon fuels and other products, including crude oil, natural gas, liquefied natural gas (LNG), and bitumen, also known as natural asphalt. ConocoPhillips produced an average of 1,826,000 barrels of oil equivalent per day last year and had proven reserves of approximately 6.8 billion barrels of oil equivalent in its land holdings and operations as of December 31 of this year. The company’s largest crude oil and natural gas production area was the U.S. Lower 48.

For yield-seeking investors, this company maintains its firm commitment to return capital back into the hands of shareholders. In 2023, the company returned $11 billion to shareholders, fulfilling its policy of returning over 30% of its cash flow from operations.

In the last quarter, Q1 2024, ConocoPhillips reported revenue and operating income of $14.5 billion, more than $480 million less than expected and based on total production of 1,902 Mboe/d for the quarter. The company’s earnings on non-GAAP measures were $2.03 per share, in line with expectations.

The U.S. oil and gas sector has seen several high-profile mergers and acquisitions in the past year, and BofA analyst Akamine believes this is a net gain for ConocoPhillips. He writes: “We believe the current M&A cycle has reshaped the competitive landscape in the U.S. E&P sector to the benefit of names with scale and growth. With the acquisition of Concho, Pioneer and Hess since the turn of the millennium, there is now a vacuum for exposure to high-quality, large-cap oil companies. We believe this will continue to push investors toward COP, the largest independent E&P by production and market cap…”

The analyst explains his long-term view on the stock, adding: “In our view, COP’s asset mix and resource depth are the undervalued aspects of the investment case. The depth of the US portfolio has enabled COP to offer competitively leading visibility with a 10-year plan targeting 4-5% average annual production growth. While that sounds modest, there is a compounding effect that leads to significant cash flow growth.”

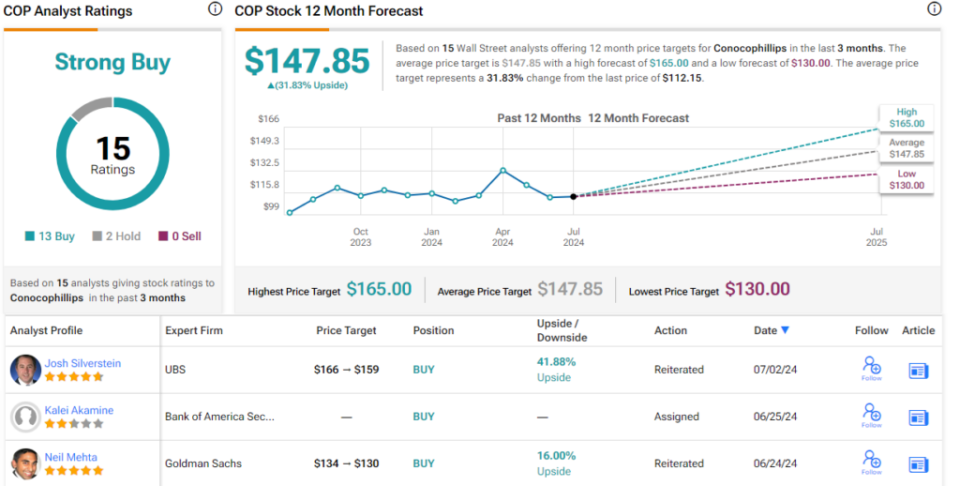

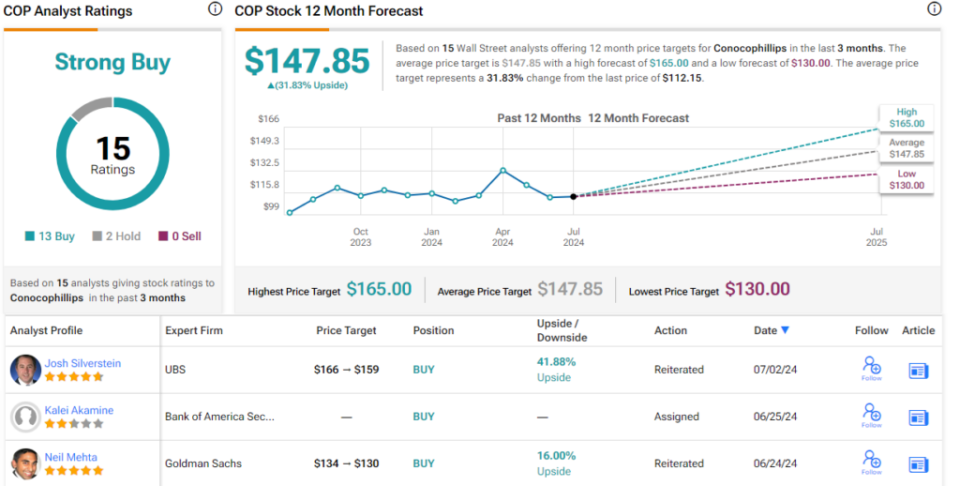

These comments support Akamine’s Buy rating on the shares, and his $147 price target implies a one-year upside of 31%. (To watch Akamine’s track record, click here.)

Overall, this oil and gas giant receives a consensus rating of Strong Buy from Wall Street based on 15 recent reviews, of which 13 recommend Buy and only 2 recommend Hold. The stock is priced at $112.15, and the average price target of $147.85 is only slightly more optimistic than BofA’s assessment. (See ConocoPhillips stock forecast.)

Devon Energy (DVN)

Next is Devon Energy, an independent exploration and production company based in Oklahoma. Devon focuses its operations on the extraction of recoverable energy products from onshore assets in the Americas. The company operates in five states – Texas, New Mexico, Oklahoma, Wyoming and North Dakota – and is active in some of the most energy-rich regions in the country, including the Williston Basin, the Delaware Basin and the Eagle Ford formation.

Devon, a roughly $30 billion company, has worked to build a robust asset portfolio designed to support strong future production growth while operating in an environmentally responsible manner. The company delivered solid production numbers in the first quarter of this year, reporting average daily production of 319,000 barrels of oil, 165,000 barrels of natural gas liquids and 1 billion cubic feet of natural gas. Overall production was 664,000 barrels of oil equivalent per day, exceeding previously issued guidance by 4%.

That production resulted in total revenue of $3.6 billion, down 5.8% year over year but in line with forecasts, while earnings per share of $1.16 on non-GAAP measures were a nickel above estimates. The company ended the first quarter with $1.15 billion in cash, a solid increase from the $887 million it expected to have in Q1 2023 — and from the $875 million it expected to have in Q4 2023.

Speaking with analyst Akamine, we find that the BofA energy expert is bullish on Devon, indicating that the company will outperform going forward. Akamine writes, “Our Buy rating on DVN reflects a recovery story where DVN is refocusing its drilling program on its best assets in Delaware, New Mexico and looking to re-establish itself as one of the sector’s leading operators… With the first guidance for 2024 following a difficult quarter in Q3 2023, we believe DVN has reset the course to ‘Exceed and Raise.’ In Q1 2024 results, DVN raised its FY 2024 oil guidance, attributing this to the strong performance of oil drilling in the Permian. It seems as though some of that operational momentum has been regained. By year-end 2024, we expect Permian oil to stabilize at around 212 million barrels per day, which could set the stage for a strong fiscal 2025 outlook.”

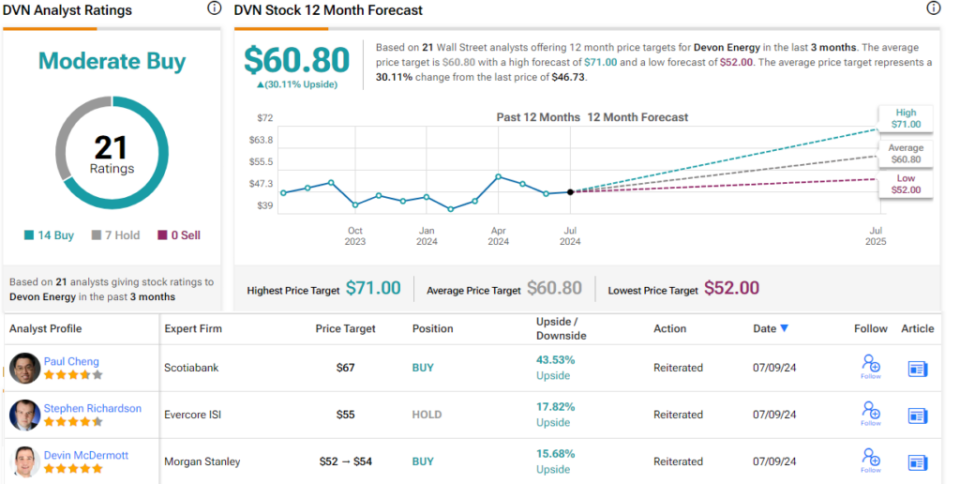

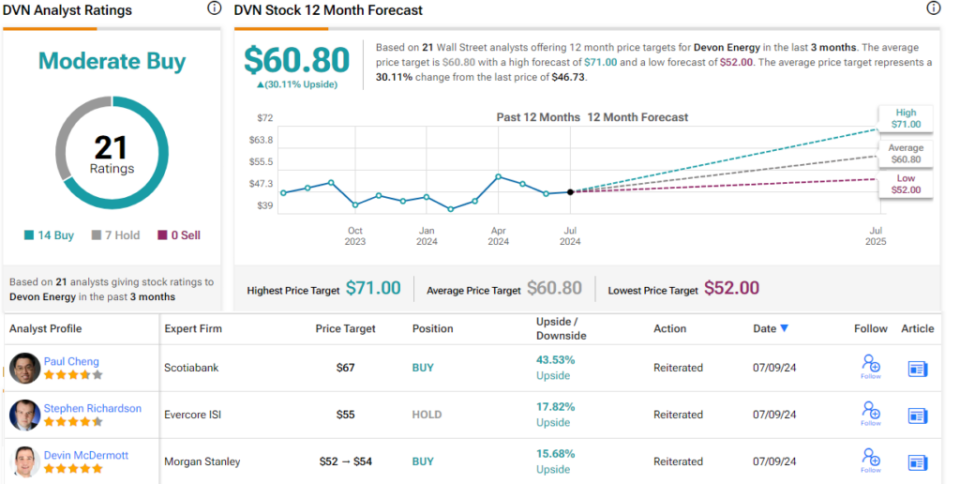

In addition to his buy recommendation, the analyst provides a price target of $64, which suggests an upside potential of 37% for the next 12 months.

Devon Energy has received a Moderate Buy rating from Wall Street consensus based on 20 recommendations, of which 14 are Buy and 7 are Hold. The stock is priced at $46.73 with an average price target of $60.80, suggesting potential for a one-year gain of 30%. (See Devon Stock Forecast.)

EOG Resources (EOG)

Last on our list of BofA-backed companies is EOG Resources, another large-cap North American independent energy company. EOG, with a market cap of approximately $72 billion, operates in the northern and southern Great Plains and Appalachian regions. The company has prolific oil and gas exploration and production activities in the Appalachian Basin, Eagle Ford Formation, Midland Basin, Permian Basin, Williston, Powder River and DJ Basins. In addition, the company operates an offshore operation in the Columbus Basin near the island nation of Trinidad & Tobago. EOG is based in Houston, Texas, near the epicenter of the 21st century energy renaissance.

On the production side, EOG exceeded the midpoint of its Q1 2024 forecast for crude oil, natural gas LPG and natural gas, posting modest increases over Q4 2023. The company’s Q1 crude oil production was 487.4 MBbld; natural gas LPG reached 231.7 MBbld and natural gas production was 1,858 MMcfd. The company’s total production for the quarter, converted to crude oil equivalent volumes, was reported at 1,028.8 MBoed.

Those production numbers underpinned EOG’s quarterly revenue of $6.12 billion, a modest 1.3 percent increase from a year ago but beating forecasts by nearly $1.8 billion. The company’s earnings of $2.82 per share on non-GAAP measures were 24 cents per share above expectations.

Not only does this company generate solid hydrocarbon production numbers, but it also generated a lot of money in Q1 2024. EOG’s cash flow from operations was reported at $2.9 billion. After deducting $1.7 billion in capital expenditures, the company reported free cash flow of $1.2 billion.

Checking in one last time with BofA’s analyst Akamine, we find that he likes this company for its combination of long-term staying power and cash generation. The energy analyst says, “EOG’s portfolio supports drilling in the Permian Basin at the current pace for 19 years, twice as long as the average of its peers. Post-COVID, valuations have been driven by FCF yields, which undervalues longer-term inventories. But as the industry depletes core locations and looks to replenish them through expensive M&A, we see EOG increasingly well-positioned and deserving of a premium multiple.”

Akamine continues to recommend these shares as Buys and sets a price target of $151, suggesting a one-year upside potential of 19.5%. (To watch Akamine’s track record, click here.)

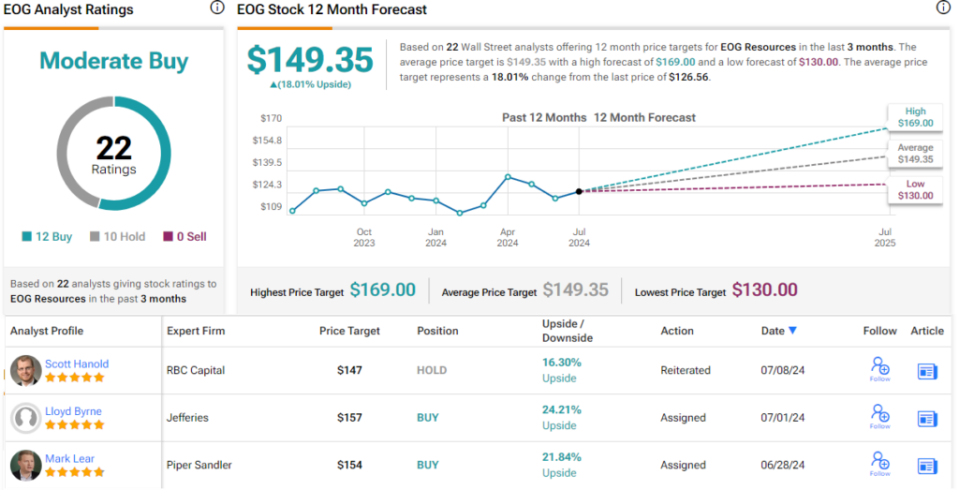

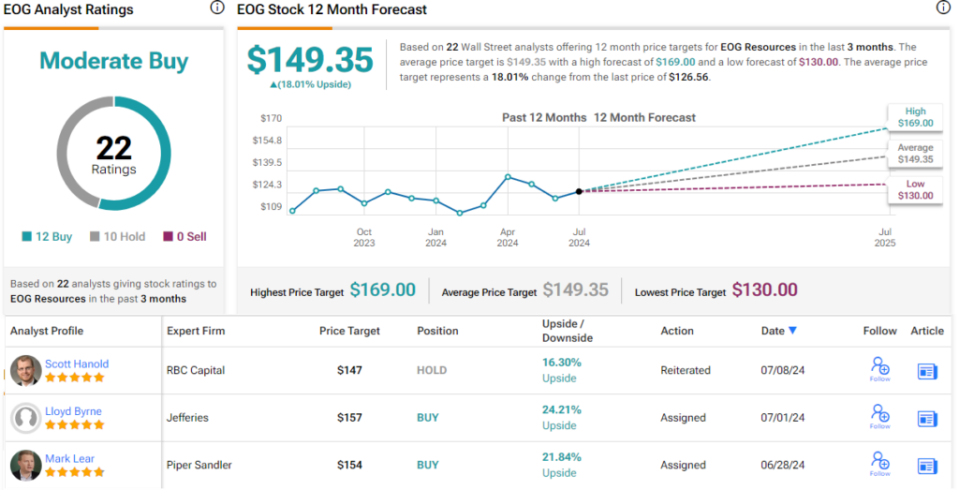

From the Street as a whole, EOG has a consensus rating of Moderate Buy based on 22 reviews with a 12 to 10 split favoring Buys over Holds. The stock is currently trading for $126.56 and its $149.35 average price target implies a one-year upside potential of 18%. (See EOG’s Stock Forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that brings together all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important that you conduct your own analysis before investing.

Related Posts

New summer concert series on nostalgic slopes in Park City

EU Bishop: Elections show that citizens are concerned about the Ukraine war