Examination of three ASX stocks whose prices are expected to be up to 27.8% below their intrinsic value

Despite a slight decline this week, the ASX200 has shown a diverse sector performance, with notable moves in healthcare and materials. As investors navigate these changes, identifying stocks that appear undervalued relative to their intrinsic value could provide opportunities for those potentially looking to enhance their portfolio given current market conditions.

The 10 most undervalued stocks in Australia based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

GTN (ASX:GTN) |

0,43 € |

0,85 € |

49.2% |

|

MaxiPARTS (ASX:MXI) |

2.04 A$ |

4,00 € |

49% |

|

Ansell (ASX:ANN) |

25,64 € |

49,46 € |

48.2% |

|

Oldest (ASX:ELD) |

8,42 € |

16,28 € |

48.3% |

|

Strike Energy (ASX:STX) |

0,23€ |

0,45 € |

48.8% |

|

IPH (ASX:IPH) |

6,21 € |

11,95 € |

48% |

|

ReadyTech Holdings (ASX:RDY) |

3,25 € |

6,22 € |

47.7% |

|

Millennium Services Group (ASX:MIL) |

1,145 € |

2,24 € |

48.9% |

|

Airtasker (ASX:ART) |

0,29 € |

0,57 € |

49.1% |

|

SiteMinder (ASX:SDR) |

5,30 € |

9,96 € |

46.8% |

Click here to see the full list of 53 stocks from our Undervalued ASX Stocks Based on Cash Flows screener.

We examine a selection of our screener results

Overview: Codan Limited is a technology solutions provider to United Nations organizations, mining companies, security and military groups, government agencies and private individuals with a market capitalization of approximately A$2.16 billion.

Operations: Codan Limited has revenues of A$291.50 million and A$212.20 million in the communications and metal detection sectors, respectively.

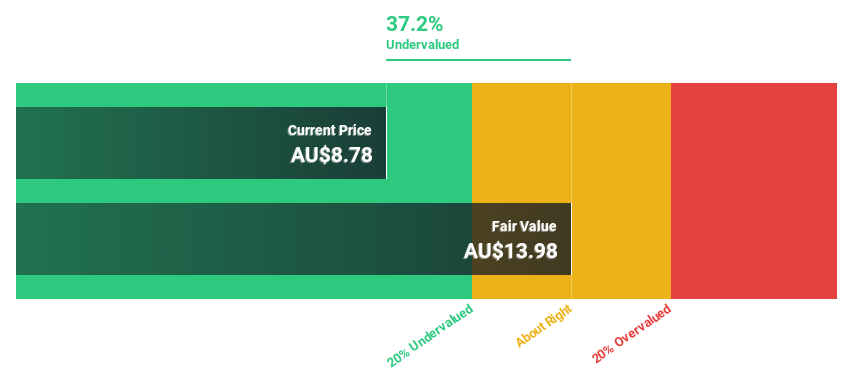

Estimated discount to fair value: 27.8%

Codan is considered undervalued based on a discounted cash flow analysis. The share price is AUD 11.91 compared to an estimated fair value of AUD 16.49, which represents a significant discount. The company’s earnings are expected to grow at 16.2% annually, outperforming the Australian market growth forecast of 13.1%. In addition, Codan’s revenue growth forecast is 9.1% per year, outperforming the general market expectation of 5.3%. This financial performance suggests potential for increased investor interest given the robust growth forecasts and current valuation levels.

Overview: Nickel Industries Limited is a company specialising in nickel ore mining and the production of nickel pig iron and nickel matte with a market capitalisation of approximately A$3.51 billion.

Operations: The company generates revenue from three main segments: nickel ore mining in Indonesia (AUD 36.81 million), HPAL projects in Indonesia and Hong Kong (AUD 32.58 million) and RKEF projects in Indonesia and Singapore (AUD 1.81 billion).

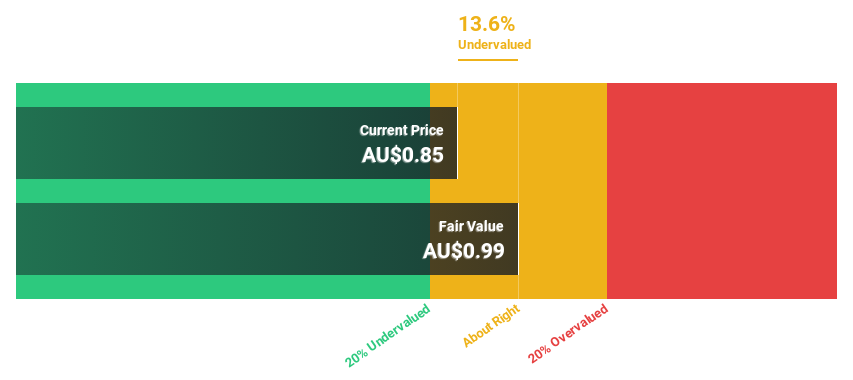

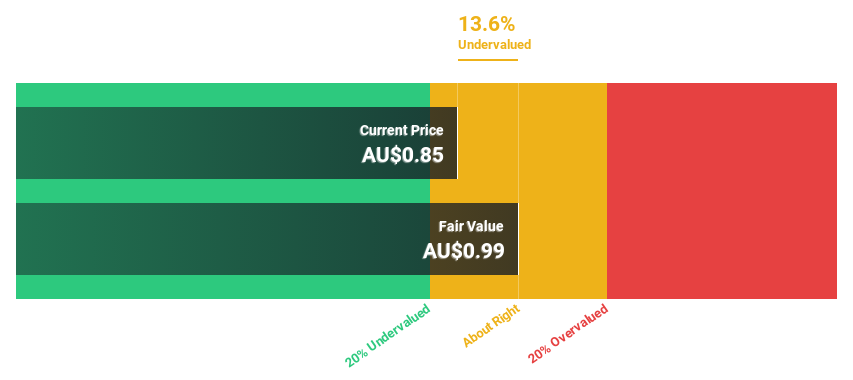

Estimated discount to fair value: 15.2%

Nickel Industries is currently valued at A$0.82, below its estimated fair value of A$0.97. Based on a discounted cash flow analysis, this represents a moderate undervaluation. Despite this, the company’s earnings are expected to grow at 37.1% annually, comfortably outperforming the Australian market growth rate of 13.1%. However, the sustainability of the dividend is questionable as it is not well covered by cash flows. Recent financial activity includes securing a sizeable $250 million loan to support strategic acquisitions and expansion.

Overview: Sandfire Resources Limited is a mining company focused on the exploration, evaluation and development of mineral deposits and projects and has a market capitalization of approximately A$4.15 billion.

Operations: The Company generates its revenues primarily from its MATSA Copper Operations and Degrussa Copper Operations, which contributed US$581.75 million and US$94.49 million, respectively.

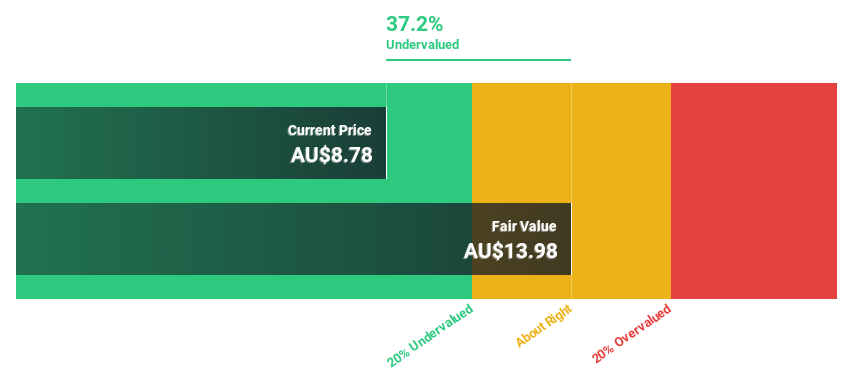

Estimated discount to fair value: 17.4%

Sandfire Resources trades at AUD 9.08 and is considered undervalued, trading 17.4% below its calculated fair value of AUD 10.99. Analysts are forecasting robust annual earnings growth of 52.64%, significantly exceeding general market expectations. Revenue growth is estimated at 15.5% per year, outperforming the Australian market average of 5.3%. However, return on equity is expected to be a modest 9.9% over three years.

Seize the opportunity

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ASX:CDA ASX:SFR and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]