Three Chinese stocks are estimated to be trading 10 to 35.5 percent below their intrinsic value

Against the backdrop of mixed economic indicators from China, including a decline in the manufacturing sector and slight losses in major equity indices, investors may find potential opportunities in stocks that appear undervalued relative to their intrinsic value. Identifying such stocks requires careful analysis of financial health and market position, especially in a volatile economic environment marked by both domestic challenges and global uncertainties.

The 10 most undervalued stocks in China based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Ningbo Dechang Electrical Machinery Manufactured (SHSE:605555) |

17.59 CNY |

33.90 CN¥ |

48.1% |

|

Beijing Kawin Technology Share-Holding (SHSE:688687) |

24.22 CN¥ |

46.47 CN¥ |

47.9% |

|

Anhui Anli Material Technology (SZSE:300218) |

13.52 CNY |

26.59 CNY |

49.2% |

|

DongHua Testing Technology (SZSE:300354) |

31.92 CNY |

58.88 CNY |

45.8% |

|

Thunder Software Technology Ltd (SZSE:300496) |

CN¥44.16 |

84.37 CNY |

47.7% |

|

China Film (SHSE:600977) |

10.78 CNY |

20.17 CN¥ |

46.6% |

|

INKON Life Technology (SZSE:300143) |

7.87 CNY |

14.64 CN¥ |

46.3% |

|

Jiangsu Chuanzhiboke Education Technology (SZSE:003032) |

9.47 CNY |

17.49 CNY |

45.9% |

|

iFLYTEK LTD (SZSE:002230) |

41.20 CN¥ |

76.02 CN¥ |

45.8% |

|

Beijing Aosaikang Pharmaceutical (SZSE:002755) |

9.84 CNY |

18.84 CNY |

47.8% |

Click here to see the full list of 100 stocks from our Undervalued China Stocks Based on Cash Flows screener.

Let’s review some notable picks from our reviewed stocks

Overview: AVIC Industry-Finance Holdings Co., Ltd. operates in China and focuses on industrial investment, equity investment and investment advisory. The company has a market capitalization of approximately 19.77 billion Chinese yen.

Operations: The company’s revenues come from industrial investments, equity investments and investment advisory services in China.

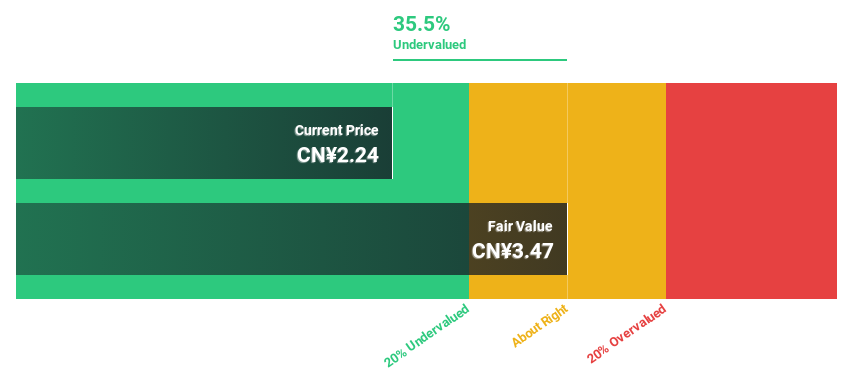

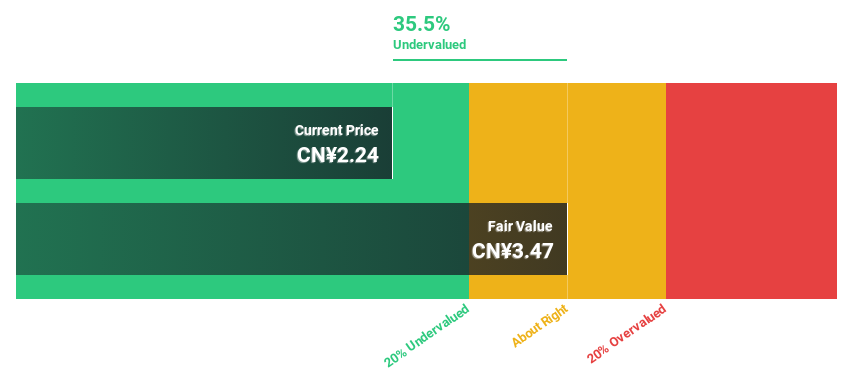

Estimated discount to fair value: 35.5%

AVIC Industry-Finance Holdings trades at CN¥2.24, below the estimated fair value of CN¥3.47, which represents a significant undervaluation based on a discounted cash flow analysis. Despite recent financial setbacks, with a reported net loss in the first quarter of 2024 and declining year-on-year revenues, the company is expected to become profitable within three years. The forecast revenue growth rate of 16.7% annually exceeds the broader China market forecast of 13.6%, suggesting recovery and growth potential despite current challenges.

Overview: Haisco Pharmaceutical Group Co., Ltd. is a China-based company focused on the research, development, manufacturing and distribution of pharmaceuticals with a market capitalization of approximately 34.52 billion Chinese yen.

Operations: The company generates its revenue mainly through the research, development, manufacture and sale of pharmaceutical products in China.

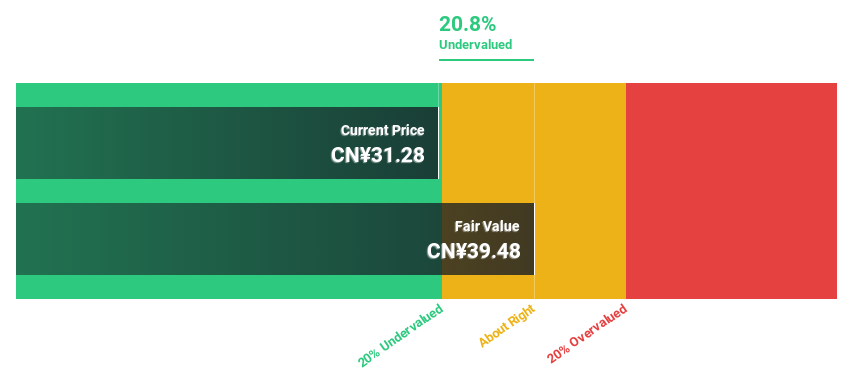

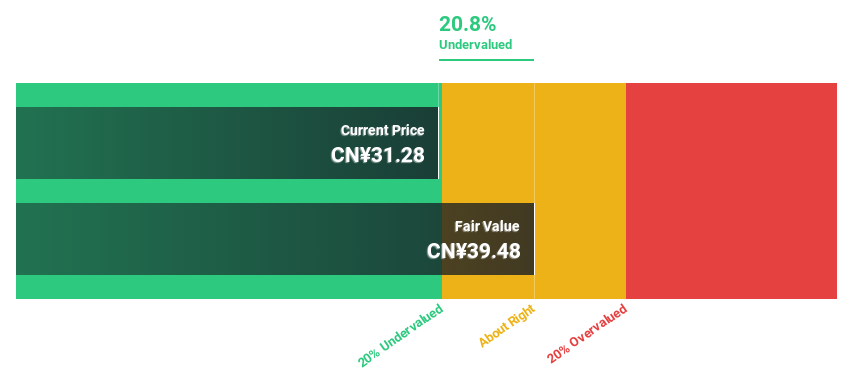

Estimated discount to fair value: 20.8%

Haisco Pharmaceutical Group shows promising financial health, with a recent increase in profit to CN¥295.11 million and revenue of CN¥3,355.07 million. The share price is currently at CN¥31.28, which is 20.8% below the calculated fair value of CN¥39.48 and indicates a potential undervaluation based on cash flows. Forecasts suggest robust annual earnings growth of 36.9%, comfortably outperforming the market value of 22.2%. However, the projected return on equity in three years of 13.6% could raise concerns about future profitability efficiency.

Overview: Zhejiang Jolly Pharmaceutical Co., LTD specializes in the research, production and marketing of Chinese pharmaceuticals. The company operates both in the People’s Republic of China and internationally and has a market capitalization of 10.93 billion CNY.

Operations: The company generates revenue from the research, production and marketing of Chinese medicines.

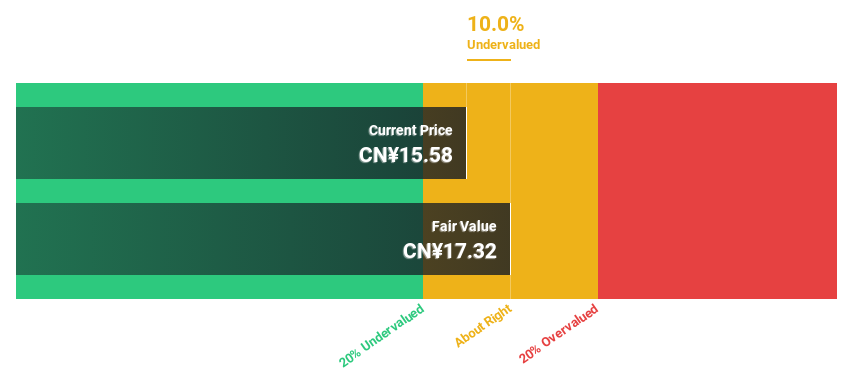

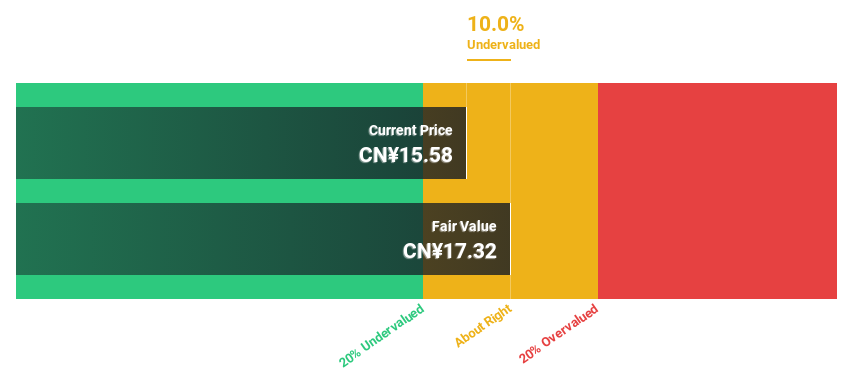

Estimated discount to fair value: 10%

Zhejiang Jolly Pharmaceutical Co., LTD, trading at CNY 15.58, appears to be undervalued by 10%, with its fair value estimated at CNY 17.32. Earnings grew 41.8% last year and are expected to grow 22.31% annually, beating the China market forecast of 22.2%. Despite robust revenue growth forecasts of 23.1% per year, dividend coverage is weak due to insufficient cash flow support, raising sustainability concerns in light of aggressive expansion strategies evident in recent significant equity issuances.

Next Steps

Interested in other options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

The companies discussed in this article include SHSE:600705, SZSE:002653 and SZSE:300181.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]