2 super cheap growth stocks that I think could rise in value!

There are plenty of growth stocks available for bargain hunters today. Here are two whose share prices could skyrocket in the coming weeks and months.

Pan-African Resources

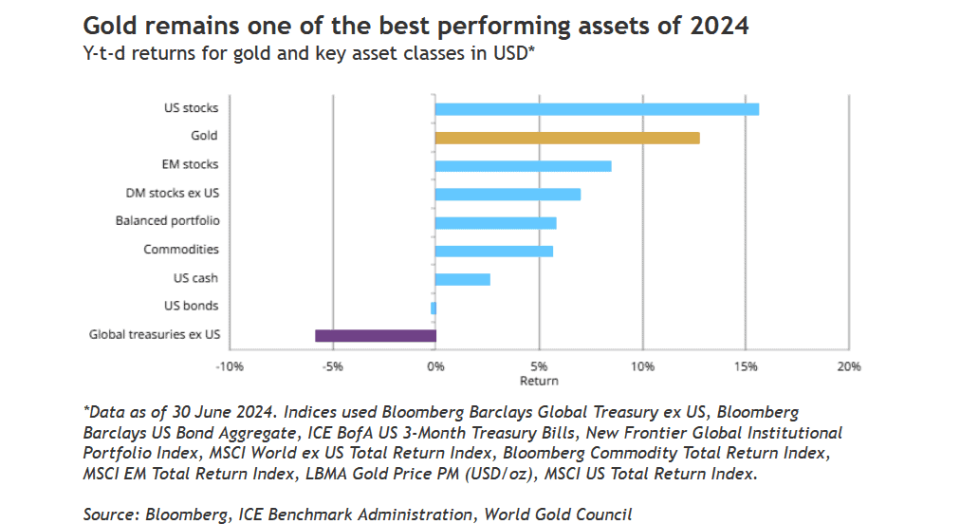

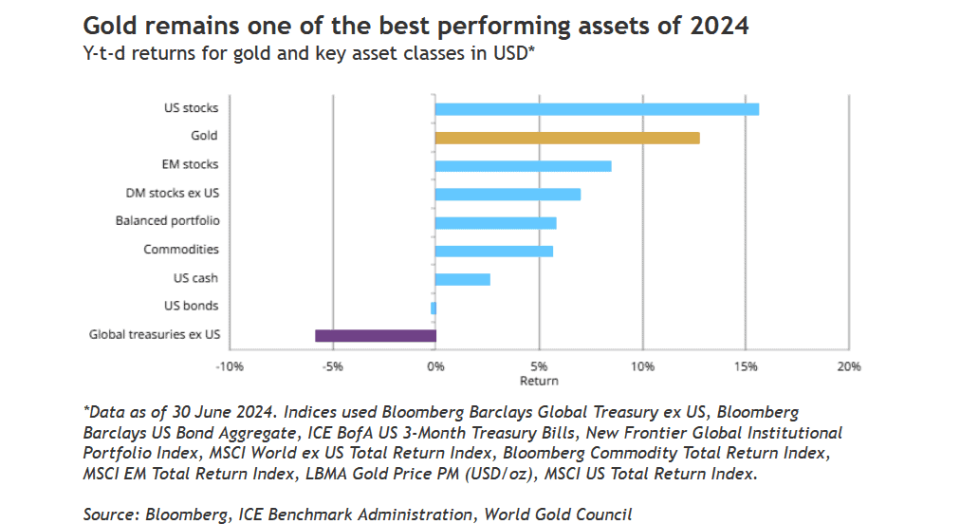

The rise in gold prices to new record highs has been one of the biggest investment stories this year. As the chart below shows, the yellow metal’s popularity has skyrocketed recently, a symptom of growing fears about the global economy.

The price of gold has fallen by about $90 from its record high of around $2,450 an ounce in May. However, many experts believe that the commodity is on the verge of new highs.

Analysts from Goldman SachsFor example, they predicted that the precious metal will end the year at around $2,700. This is due to “Solid demand from emerging market central banks and Asian households“.

Fears of sluggish inflation, election uncertainty in the US and Europe, and growing geopolitical tensions could also push the safe haven to new highs. Buying gold stocks could therefore prove to be a good idea.

One such candidate is Pan-African Resources (LSE:PAF), a company that has already seen stratospheric share price increases.

City analysts expect earnings to rise 31 percent in the current financial year (ending in June 2025), with a further 24 percent increase forecast for next year, reflecting the company’s plans to increase production by 25 percent.

Investing in gold mining companies through a gold tracking fund can be a risky business. Operating problems often arise, which can put a heavy burden on profit forecasts.

However, I believe this may be related to Pan African Resources’ low valuation. At 27.8 pence per share, the company’s price-to-earnings (P/E) ratio is only 7.7.

In addition, certain gold mining companies also offer a dividend, while a fund or the physical metal itself offers no income potential. The dividend yield at Pan African Resources is also a solid 3%.

Central Asia Metals

Central Asia Metals (LSE:CAML) is another discounted growth stock in the mining sector that I believe is worth serious consideration for investors today.

Like gold, copper has also seen a stratospheric rise in 2024 amid concerns about supply. With inflation falling and interest rate hikes expected, demand for metals could rise significantly, fueling concerns about shortages, pushing prices even higher.

In May, copper prices on the London Metal Exchange reached their highest level in two years at around $10,860 per tonne.

This positive price outlook means that Central Asia Metals – owner of the Kounrad copper mine in Kazakhstan – is expected to see earnings rise by 27% in 2024. At 205 pence per share, this equates to a P/E ratio of 9.9. Earnings are also expected to rise by 12% in 2025.

China’s rocky economic recovery could put those projections at risk. But for now, Central Asia Metals looks to be in good shape for strong earnings growth in the near future and beyond. Copper demand is expected to boom over the next decade as decarbonization efforts advance and global urbanization continues at a rapid pace.

The post “2 mega-cheap growth stocks that I think could soar!” first appeared on The Motley Fool UK.

further reading

Royston Wild does not own any of the stocks mentioned. The Motley Fool UK does not own any of the stocks mentioned. The views expressed in this article about the companies mentioned in this article are those of the author and as such may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Related Posts

Ian Machado Garry joins exclusive club

Damien Molony takes on the role of John Nettles in the new series