How to invest in the semiconductor value chain with these ETFs

The semiconductor industry has undergone remarkable growth and transformation since its inception, and plays a critical role in shaping the modern technology landscape. While Nvidia has seemingly become the most recognizable name for many who know about the semiconductor industry, other players are also crucial.

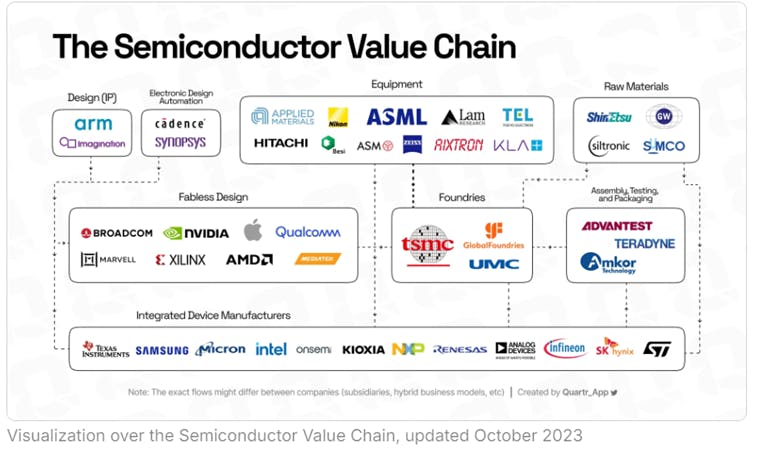

The semiconductor value chain is a complex network of companies and processes involved in the development, manufacturing, testing, packaging and distribution of semiconductor components. It includes a number of phases and participants, each of which plays a critical role in bringing semiconductor products from concept to end user. The value chain involves collaboration between semiconductor manufacturers, foundries, equipment suppliers, design houses and other companies.

This article provides an overview of the current semiconductor industry and the wealth creation opportunities available along the value chain. Below is a summary of the various participants in the semiconductor supply chain:

Chip designer

Semiconductor chip designs are created for either specific or general product applications. Integrated device manufacturers (IDMs) such as Intel, AMD and Samsung handle all processes of semiconductor production from planning to manufacturing of the final products. In contrast, fab design companies such as Qualcomm and Nvidia focus on the design of semiconductor components but outsource the manufacturing process to third-party foundries.

Equipment and material suppliers

In the semiconductor industry, a few key manufacturers are crucial because they enable the production of ever smaller and more efficient chips. Companies such as ASML, Applied Materials and Lam Research provide the tools and machinery needed to manufacture semiconductors. Various companies supply materials such as silicon wafers, chemicals and gases that are essential to semiconductor production.

Manufacturing/Wafer manufacturing

Silicon wafers go through a complex and extensive series of manufacturing steps. Companies such as Taiwan Semiconductor Manufacturing Company (TSMC), GlobalFoundries and Samsung Foundry specialize in manufacturing semiconductor wafers based on designs provided by fabless design companies, or IDMs.

Testing and packaging

Semiconductor chips are assembled into packages to form electronic components that can be mounted on printed circuit boards. Outsourced Semiconductor Assembly and Testing (OSAT) companies such as Amkor Technology and ASE Group specialize in packaging and testing semiconductor devices, ensuring that the chips function under various electrical and temperature conditions.

Invest in the whole, not in individual parts

Semiconductors have become an essential part of the global economy, as evidenced by their integration into vehicles, smartphones and appliances, and the technological infrastructure of our modern society. Given their integral nature, investors would benefit from exposure to this industry in their portfolio. Looking at the annual returns of the U.S. iShares Semiconductor ETF (ticker: SOXX) for the past decade, investors have benefited tremendously from extensive exposure to the semiconductor industry.

For Canadian investors, the Canadian iShares Semiconductor Index ETF (Ticker: XCHP) offers access to US-listed stocks from the semiconductor industry. It should be noted that XCHP was only recently listed and was only launched on September 6, 2023, so it has less than a year of performance. Alternatively, the Global X Semiconductor Index ETF (Ticker: CHPS/CHPS.U) seeks to participate in the performance of global, publicly traded companies that manufacture and develop semiconductors and semiconductor equipment. Launched on June 21, 2021, this fund has an established track record and offers comprehensive exposure to the global semiconductor industry.

Given the excitement surrounding the semiconductor industry, more AI-focused ETF solutions have recently entered the market, providing exposure to companies that will benefit from the advancement and use of artificial intelligence (AI) in their products and services.

Global X Canada launched the Global X Artificial Intelligence & Technology Index ETF (Ticker: AIGO)which is designed to track the Indxx Artificial Intelligence & Big Data Index, which tracks companies that benefit from the development and use of artificial intelligence (“AI”) technology in their products and services, as well as companies that manufacture hardware used in artificial intelligence to analyze big data. Invesco Canada has also launched an AI-focused solution, the Invesco Morningstar Global Next Gen AI Index ETF (Ticker: INAI/INAI.F), which tracks the Morningstar® Global Next Generation Artificial Intelligence Index™; designed to provide unprecedented, thematically pure exposure to cutting-edge artificial intelligence technologies, including generative artificial intelligence and adjacent products and services.

As demand for semiconductors increases worldwide, investors who maintain some exposure to this industry will benefit significantly now and in the years to come.

Please note that this article is for informational purposes only and does not constitute investment advice in any way. It is important that you seek advice from a registered financial professional before making any investment decision.