Fair value estimate of Corby Spirit and Wine Limited (TSE:CSW.A)

Key findings

-

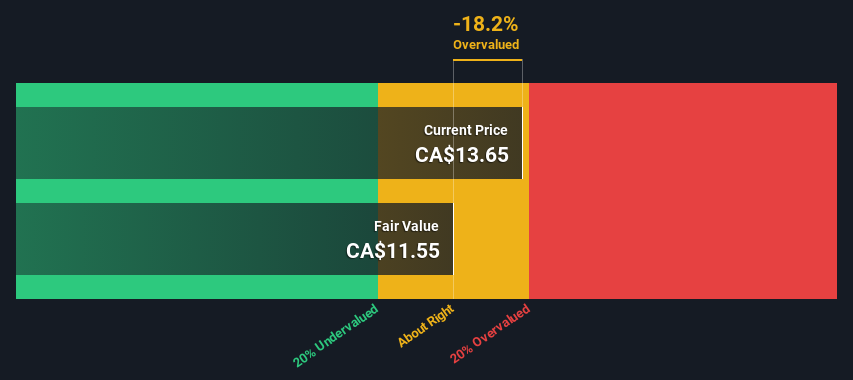

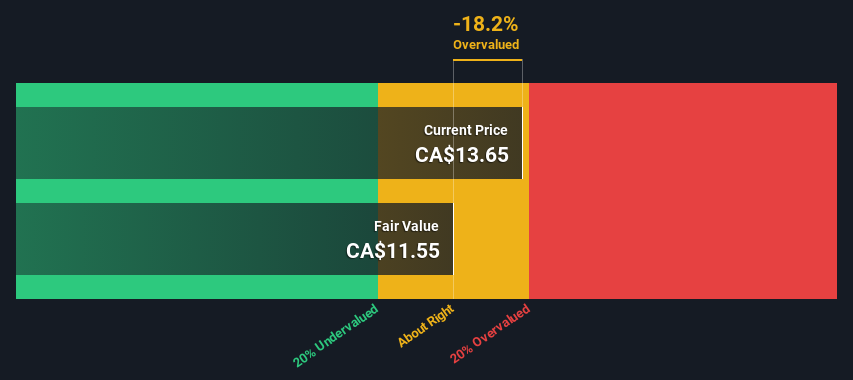

The estimated fair value of Corby Spirit and Wine is CA$11.55 based on the dividend discount model.

-

With a share price of CA$13.65, Corby Spirit and Wine appears to be trading close to its estimated fair value

Today we will run through a simple valuation method to help us assess the attractiveness of Corby Spirit and Wine Limited (TSE:CSW.A) as an investment opportunity. To do this, we will estimate the company’s future cash flows and discount them to their current value. Our analysis will use the Discounted Cash Flow (DCF) model. This may sound complicated, but it’s actually quite simple!

We generally believe that the value of a company is the present value of all the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without its flaws. If you still have some burning questions about this type of valuation, take a look at Simply Wall St’s analysis model.

Check out our latest analysis for Corby Spirit and Wine

Step by step through the calculation

Because Corby Spirit and Wine operates in the beverages sector, we need to calculate intrinsic value a little differently. Rather than using free cash flows, which are difficult to estimate and often unreported by analysts in this industry, dividend payments per share (DPS) are used. Unless a company pays out the majority of its free cash flow as dividends, this method will typically underestimate the value of the stock. It uses the “Gordon Growth Model,” which simply assumes that dividend payments will continue to grow at a sustainable growth rate forever. For a number of reasons, a very conservative growth rate is used, which cannot exceed that of a company’s gross domestic product (GDP). In this case, we used the 5-year average 10-year Treasury bond yield (2.1%). The expected dividend per share is then discounted to today’s value using a cost of equity of 5.8%. Relative to the current share price of CA$13.7, the company appears to be about fair value at the time of writing. However, ratings are imprecise instruments, much like a telescope: move a few degrees and you end up in a different galaxy. Keep that in mind.

Value per share = Expected dividend per share / (Discount rate – Perpetual growth rate)

= CA$0.8 / (5.8% – 2.1%)

= 11.5 CA$

Important assumptions

The key inputs to a discounted cash flow are the discount rate and of course the actual cash flows. If you don’t agree with these results, try the calculation yourself and play with the assumptions. The DCF also doesn’t take into account the possible cyclicality of an industry or a company’s future capital needs, and so doesn’t provide a complete picture of a company’s potential performance. Since we’re viewing Corby Spirit and Wine as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC), which takes debt into account. In this calculation, we used 5.8%, which is based on a levered beta of 0.800. Beta is a measure of a stock’s volatility relative to the overall market. We get our beta from the industry average beta of globally comparable companies, with a set limit between 0.8 and 2.0, which is a reasonable range for a stable company.

SWOT Analysis for Corby Spirit and Wine

Strength

weakness

Opportunity

Danger

Next Steps:

Although the DCF calculation is important, ideally it should not be the only analysis you look at for a company. The DCF model is not a perfect tool for stock valuation. Rather, you should apply different cases and assumptions and see how they affect the valuation of the company. If a company grows differently or its cost of equity or risk-free rate changes significantly, the result may look very different. For Corby Spirit and Wine, we have put together three other aspects that you should examine in more detail:

-

Risks: For example, we found 4 warning signs for Corby Spirit and Wine (1 makes us a little uncomfortable) you should know.

-

Other high-quality alternatives: Like a good all-rounder? Explore our interactive list of high-quality stocks to get a sense of what else you might be missing out on!

-

Other environmentally friendly companies: Are you concerned about the environment and believe that consumers will increasingly buy environmentally friendly products? Browse through our interactive list of companies thinking about a greener future and discover some stocks you may not have thought of yet!

PS. Simply Wall St updates its DCF calculation for each Canadian stock daily, so if you want to find out the intrinsic value of another stock, just search here.

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

Related Posts

The impending war between Israel and Hezbollah will have an impact on the region and the world

3 teenagers arrested after series of armed robberies in Indy