CFPB takes enforcement action against former HECM servicing partners

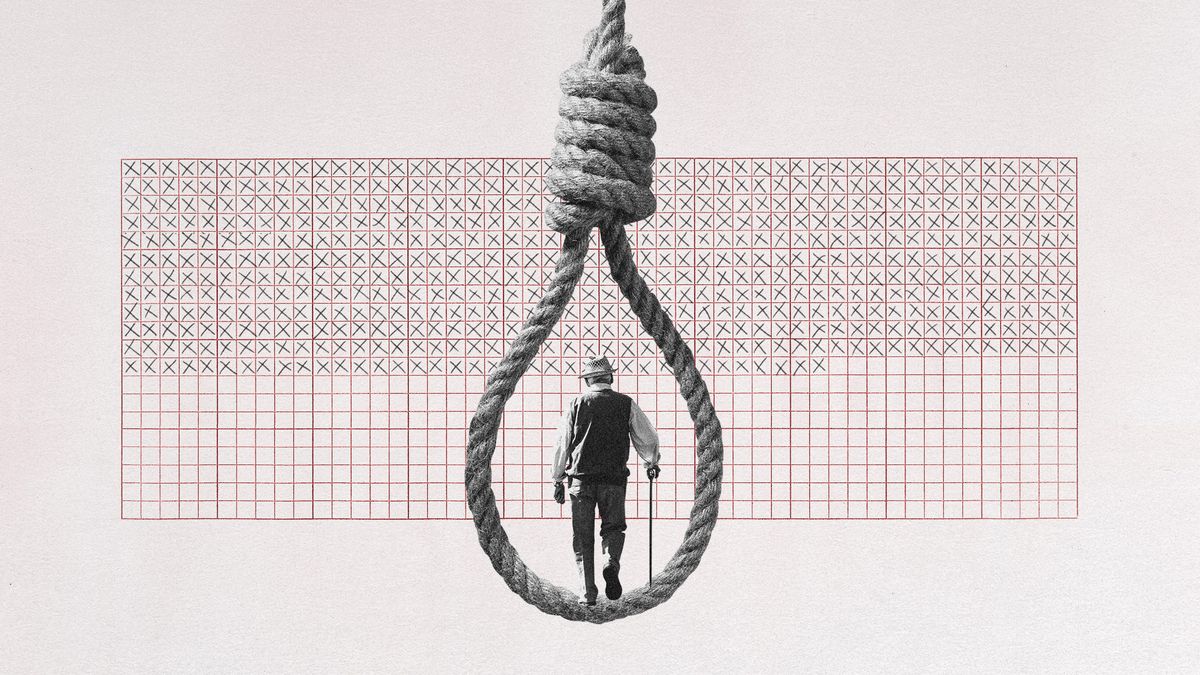

The Consumer Protection Office for Finance (CFPB) announced on Tuesday a series of enforcement actions against two companies, citing “illegal activities” that have “harmed older homeowners and caused them to fear losing their homes.”

The lawsuits were filed against the Pittsford, New York-based Sutherland Global and based in Landover, Maryland NOVAD Management Consultingwho together operate a Home Equity Conversion Mortgage (HECM) service operation on behalf of U.S. Department of Housing and Urban Development (HUD) is displayed.

NOVAD, which held the HUD HECM servicing contract for subrogated loans from 2014 to 2022, worked with Sutherland to set up the HECM loan servicing operation on HUD’s behalf. But the bureau alleges the companies did not have adequate staff to serve up to 150,000 borrowers per year, which the government says led to neglect (and fear) of the senior borrowers they were contractually supposed to serve.

“This resulted in systematic failures in responding to thousands of homeowner assistance requests and financial harm to borrowers, including losses on home sales and payment of unnecessary costs,” the bureau said.

Federal law requires mortgage servicers to respond to consumer inquiries in a timely manner, a requirement that is even more important for reverse mortgage borrowers, the bureau said.

“This requirement is important to protect borrowers with reverse mortgages, who remain responsible for property taxes, insurance, and other applicable fees and charges,” the CFPB explained. “However, many borrowers were unable to reach anyone at loan servicing. In fact, the firms systematically failed to respond to thousands of homeowners’ requests for loan repayment statements, distress sales, transfers in lieu of foreclosure, lien releases, and requests for general information.”

Due to the lack of response, the companies “allowed problems to escalate to a critical point,” including many borrowers who feared eviction through foreclosure. The companies “left homeowners in the lurch” by preventing HECM borrowers from meeting their annual occupancy requirement, obtaining loan repayment notices and finding alternatives to foreclosure, the bureau said.

Communication deficiencies also resulted in homeowners being falsely told they were facing foreclosure when they were not, the CFPB added.

“The companies sent elderly homeowners false repayment letters claiming that their mortgage loans were due and required repayment within 30 days due to a default, even though no such triggering event had occurred,” the CFPB explained. “The companies then improperly ignored attempts by mortgage borrowers to address and correct the ‘due and payment obligation letters.'”

The enforcement order prohibits Sutherland Global – and its subsidiaries Solutions for the Sutherland Government And Sutherland Mortgage Services — as well as NOVAD from “engaging in reverse mortgage activities, establishes strict compliance requirements for future reverse mortgage activities of Sutherland Mortgage Services, requires the Sutherland entities to pay $11.5 million in restitution to affected consumers, and requires all entities to pay a civil penalty of approximately $5 million, which will be deposited into the CFPB’s Victim Assistance Fund.”

However, NOVAD’s fine is capped at $1.

“As a result of NOVAD’s declaration of insolvency, the order requires NOVAD to pay $1 to the CFPB’s Victim Assistance Fund,” the announcement said. “By requiring NOVAD to pay at least $1 in penalties, the CFPB may make consumers eligible for additional assistance from the CFPB’s Victim Assistance Fund in the future.”

CFPB Director Rohit Chopra described the actions that led to the enforcement orders as the result of a negligent attitude.

“Sutherland and NOVAD were unprepared to assist the hundreds of thousands of elderly homeowners whose reverse mortgages the defendants were responsible for,” Chopra said in a statement. “The defendants ignored complaints and cries for help and allowed the problems to spiral into disasters. Elderly homeowners did not choose Sutherland and NOVAD as their reverse mortgage servicer, and the CFPB holds these defendants responsible for their unlawful neglect.”

Celink was awarded the HECM maintenance contract for 2022. NOVAD filed a protest in June of the same year, but Celink took over the contract in December.

Representatives of Sutherland could not immediately be reached for comment. A person who answered the phone number listed for NOVAD said the company had no comment.

Educator for the reverse mortgage industry and Understanding reversal Author Dan Hultquist gave RMD his perspective on the matter.

“Many reverse mortgage professionals take pride in their work. Some even view it as a type of service that improves the quality of a homeowner’s retirement and gives them peace of mind as they age in their home,” he said. “So if a homeowner or their heirs have a negative experience with the reverse mortgage process, it becomes more difficult to help other homeowners.

“NOVAD’s failure to properly service the reverse mortgages assigned by HUD has hurt the reverse mortgage industry. However, the move to transfer the HUD servicing contract to Compu-Link was a good start to correct the problem. The reverse mortgage community has also made efforts to restore confidence over the past two years.”