3 SGX stocks potentially trading up to 47.2% below their estimated intrinsic value

With the Singapore market showing signs of strong activity and innovative companies like Currensea successfully raising significant funds through crowdfunding, this is an indication of growing investor confidence and interest across various sectors. In this context, identifying stocks that may be trading below their intrinsic value could present attractive opportunities for investors looking to capitalize on current market conditions.

The 5 most undervalued stocks in Singapore based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Singapore Technologies Engineering (SGX:S63) |

4.29SGD |

8.12SGD |

47.2% |

|

LHN (SGX:41O) |

0.335SGD |

0.37SGD |

10.1% |

|

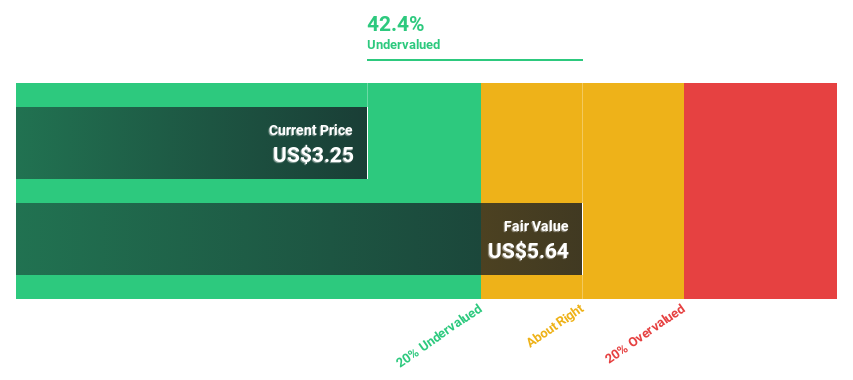

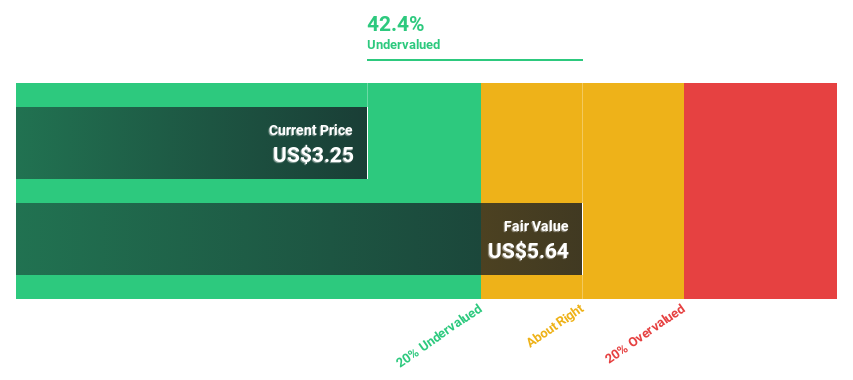

Hong Kong Land Holdings (SGX:H78) |

3.24 US dollars |

5.78 euros |

43.9% |

|

Seatrium (SGX:5E2) |

1.44 SGD |

2.59 SGD |

44.4% |

|

Frasers Logistics & Commercial Trust (SGX:BUOU) |

0.945SGD |

1.65SGD |

42.9% |

|

Digital Core REIT (SGX:DCRU) |

0.58 euros |

1.11 euros |

47.8% |

|

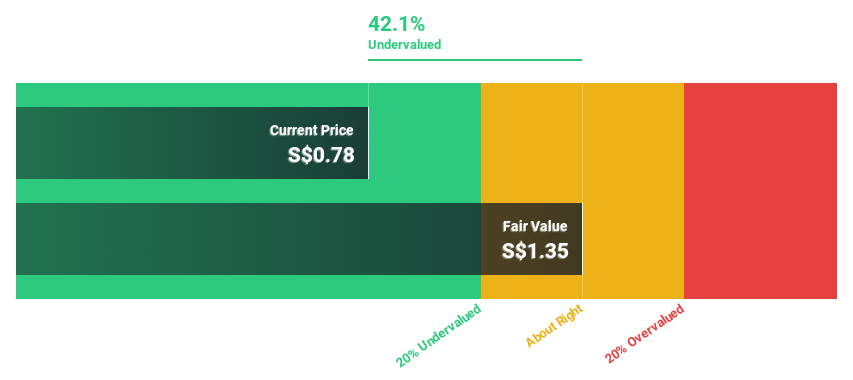

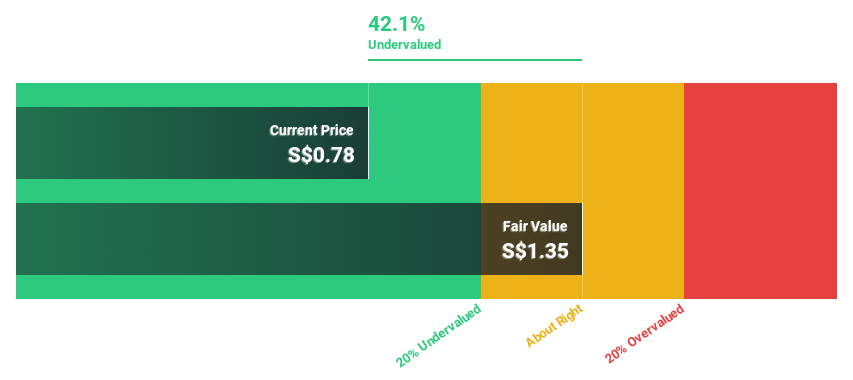

Nanofilm Technologies International (SGX:MZH) |

0.83SGD |

1.45SGD |

42.7% |

Click here to see the full list of 7 stocks from our Undervalued SGX Stocks Based on Cash Flows screener.

Below we present some of our favorites from our exclusive screener

Overview: Hongkong Land Holdings Limited is engaged in real estate investment, development and management in Hong Kong, Macau, Mainland China, Southeast Asia and other international locations and has a market capitalization of approximately US$7.15 billion.

Operations: The company generates revenue in two main segments: Investment Properties, which generated $1.08 billion, and Development Properties, which contributed $0.76 billion.

Estimated discount to fair value: 43.9%

Hongkong Land Holdings’ current price is S$3.24, below the estimated fair value of S$5.78, suggesting significant undervaluation on a discounted cash flow basis. Despite forecast revenue growth of 4.6% per year, lagging behind market leaders, earnings are expected to grow at 43.34% annually over the next three years, suggesting potential for future profitability improvements. However, the low forecast return on equity of 2.4% and a dividend yield of 6.79%, not well covered by earnings, reflect some financial vulnerabilities.

Overview: Nanofilm Technologies International Limited is engaged in nanotechnology solutions in Singapore, China, Japan and Vietnam and has a market capitalization of approximately SGD 540.34 million.

Operations: Nanofilm Technologies International’s revenue is generated from four main segments: Syndrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million) and Industrial Equipment (SGD 37.17 million).

Estimated discount to fair value: 42.7%

Nanofilm Technologies International is valued at a current price of SGD 0.83 below the calculated fair value of SGD 1.45, indicating significant undervaluation. Despite a recent decline in net profit margin to 1.8%, the company forecasts robust revenue growth of 15.1% annually and even stronger earnings growth expected to be 50.7% annually, significantly outperforming the Singapore market average. The optimistic financial outlook for FY 2024 underpins these expectations, although the forecast return on equity remains modest at 9%.

Overview: Singapore Technologies Engineering Ltd is a global technology, defence and engineering group with a market capitalisation of approximately SGD 13.38 billion.

Operations: The company generates revenue in three main segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion) and Defense & Public Safety (SGD 4.29 billion).

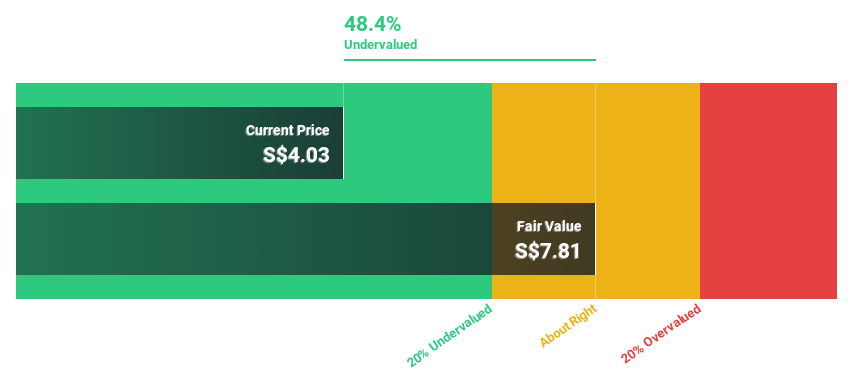

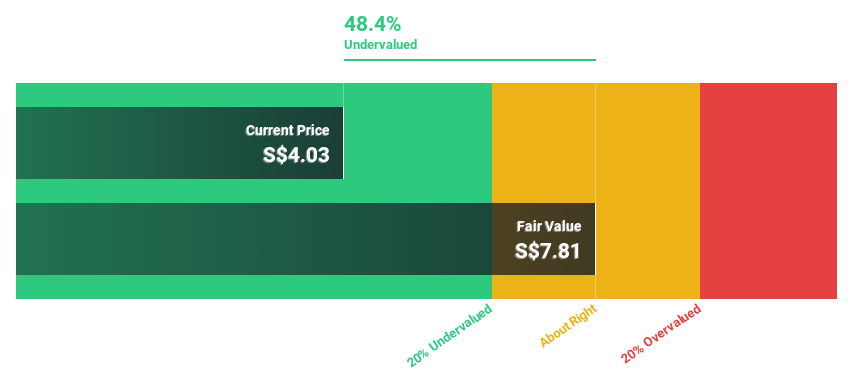

Estimated discount to fair value: 47.2%

Singapore Technologies Engineering is trading at S$4.29 below its estimated fair value of S$8.12, suggesting significant undervaluation on a discounted cash flow basis. The company’s earnings have grown a modest 1.1% annually over the past five years and are expected to grow at 11.62% per year going forward. Although the company is highly leveraged, its revenue growth is expected to outperform the Singapore market average at 6.9% per year versus 3.6%. Recent initiatives include a share buyback program and regular dividend payments, which boost shareholder returns despite an unstable dividend record.

The central theses

Would you like to explore some alternatives?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include SGX:H78, SGX:MZH and SGX:S63.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]