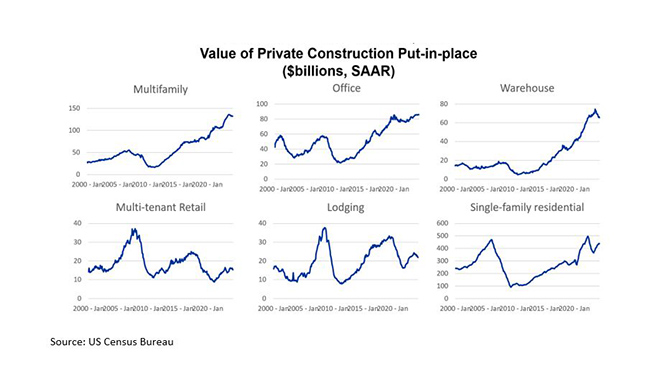

MBA Chart of the Week: Value of Private Construction Projects

(Source: US Census Bureau)

Physicists have protons, neutrons and electrons. Biologists have DNA and RNA. And economists have supply and demand – the building blocks on which most of our understanding of the market is based.

In commercial real estate, demand is driven by a number of economic, demographic and other factors that occasionally fluctuate but generally increase. This increases the overall demand for commercial real estate space, but there are also periods of decline or consolidation.

Supply is driven by developers who see opportunities to provide space at a construction cost lower than the value the property will achieve at expected market earnings and valuations. When the provision cost is lower than the market value, project development flows.

The amount of private construction for different property types is like a tree ring, showing the periods and conditions that have moved developers forward. This week’s Chart of the Week shows trends in the value of private construction for the different property types using data from the U.S. Census Bureau.

In the case of multifamily housing and industrial/warehouse properties, supply and demand imbalances caused rents, incomes and values to soar. Low interest rates, capitalization rates and values then attracted developers in droves – driving development values to record levels.

Conversely, construction of retail and lodging properties increased before the pandemic but declined when shutdowns and other societal and governmental responses immediately and dramatically impacted these property types.

In hindsight, the scale of new office construction may seem odd, but office real estate—and its credit—performed well in the early days of the pandemic as companies continued to pay rent even when they weren’t using their space and then migrated to the highest-quality (newest) space when leases came up for renewal.

Census data on housing starts show that multifamily developers have already revised their new construction downward in response to interest rates, capitalization rates and supply/demand conditions. The same is certainly true for other types of real estate.

In the dance of supply and demand, demand generally takes the lead, but as with any great dancing couple, the follower, in this case supply, determines the extent to which the couple stays in sync.

-Jamie Woodwell ([email protected])