Impinj, Inc. (NASDAQ:PI – Get Free Report) CEO Chris Ph.D. Diorio sold 6,519 shares of the company’s stock on Monday, June 24. The shares were sold at an average price of $148.01, for a total value of $964,877.19. Following the completion of the transaction, the CEO now owns 289,474 shares of the company’s stock, valued at approximately $42,845,046.74. The sale was disclosed in a legal filing with the SEC, which is available through the SEC’s website.

Impinj, Inc. (NASDAQ:PI – Get Free Report) CEO Chris Ph.D. Diorio sold 6,519 shares of the company’s stock on Monday, June 24. The shares were sold at an average price of $148.01, for a total value of $964,877.19. Following the completion of the transaction, the CEO now owns 289,474 shares of the company’s stock, valued at approximately $42,845,046.74. The sale was disclosed in a legal filing with the SEC, which is available through the SEC’s website.

Chris Ph.D. Diorio also recently made the following trades:

- On Tuesday, June 18, Chris Ph.D. Diorio sold 5,000 shares of Impinj. The shares were sold at an average price of $150.92, for a total value of $754,600.00.

- On Tuesday, June 11, Chris Ph.D. Diorio sold 5,000 shares of Impinj. The average price of the shares was $146.49, for a total value of $732,450.00.

- On Friday, April 26, Chris Ph.D. Diorio sold 26,661 shares of Impinj. The average price of the shares was $147.02, for a total value of $3,919,700.22.

- On Monday, April 15, Chris Ph.D. Diorio sold 1,244 shares of Impinj. The shares were sold at an average price of $118.67, for a total value of $147,625.48.

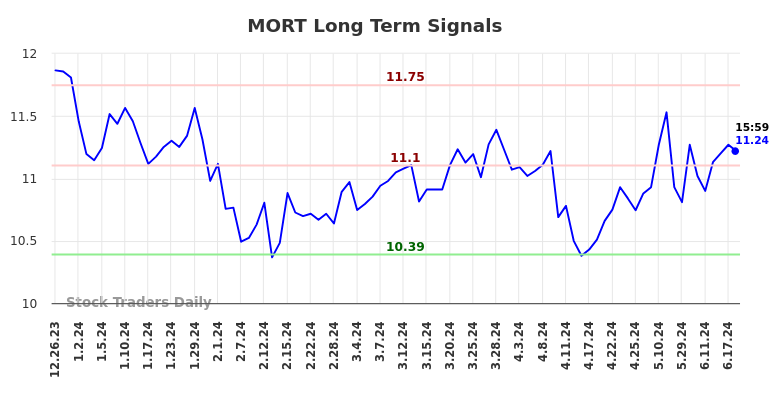

Impinj price history

NASDAQ PI shares opened at $150.96 on Wednesday. The company has a current ratio of 9.42, a quick ratio of 6.87 and a debt-to-equity ratio of 3.29. The stock has a 50-day moving average price of $154.84 and a 200-day moving average price of $122.06. Impinj, Inc. has a 12-month low of $48.39 and a 12-month high of $175.41.

Impinj (NASDAQ:PI – Get Free Report) last released its quarterly earnings results on Wednesday, April 24. The company reported earnings per share of -$0.17 for the quarter, beating analysts’ consensus estimates of -$0.31 by $0.14. Impinj had a negative net margin of 1.90% and a negative return on equity of 60.13%. The company had revenue of $76.83 million for the quarter, compared to analysts’ expectations of $73.57 million. On average, analysts expect Impinj, Inc. to report earnings per share of $0.02 for the current fiscal year.

Hedge funds comment on Impinj

Several large investors have recently made changes to their holdings of PI. Future Financial Wealth Management LLC acquired a new position in shares of Impinj in the first quarter valued at about $32,000. GAMMA Investing LLC acquired a new position in shares of Impinj in the fourth quarter valued at about $40,000. Headlands Technologies LLC acquired a new position in shares of Impinj in the fourth quarter valued at about $58,000. Whittier Trust Co. acquired a new position in shares of Impinj in the fourth quarter valued at about $90,000. Finally, Benjamin F. Edwards & Company Inc. increased its position in shares of Impinj by 117.9% in the first quarter. Benjamin F. Edwards & Company Inc. now owns 963 shares of the company’s stock valued at $124,000 after acquiring an additional 521 shares in the last quarter.

Analysts set new price targets

Several equities analysts have recently commented on the company. Goldman Sachs Group downgraded their rating on Impinj from “buy” to “neutral” and set a $156.00 price target on the stock in a research note on Monday, May 20th. Roth Mkm raised their price target on Impinj from $125.00 to $145.00 and gave the stock a “buy” rating in a research note on Thursday, April 25th. Canaccord Genuity Group raised their price target on Impinj from $130.00 to $150.00 and gave the stock a “buy” rating in a research note on Thursday, March 14th. StockNews.com downgraded their rating on Impinj from “hold” to “sell”. This happened in a research note on Tuesday, May 21st. Finally, Piper Sandler reiterated an “Overweight” rating and set a price target of $150.00 (previously $130.00) on shares of Impinj in a research note on Thursday, April 25. Two equities analysts have rated the stock with a “Sell,” one has rated it with a “Hold,” and seven have rated it with a “Buy.” According to data from MarketBeat.com, the company has an average rating of “Moderate Buy” and a consensus price target of $143.10.

Read our latest analysis on Impinj

About Impinj

(Get free report)

Impinj, Inc. operates a cloud connectivity platform in the Americas, Asia Pacific, Europe, the Middle East and Africa. The platform connects objects wirelessly and delivers data about the connected objects to business and consumer applications. The company’s platform consists of endpoint ICs, miniature radios on a chip that attach to a host object and contain a number to identify the object.

Selected items

Get daily news and reviews for Impinj – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Impinj and related companies with MarketBeat.com’s FREE daily email newsletter.