Will English clubs comply with UEFA’s financial rules?

Last week I looked at the clubs’ position on the Premier League’s profitability and sustainability rules, but found that the leading clubs also have to face the challenges of UEFA’s rules.

These are stricter than in the Premier League as the allowable losses are lower, although these have been increased in the updated guidelines. In addition, clubs are also struggling with the new cost control ratio for the squad.

So this week we will look at UEFA’s rules in detail to see if the seven English clubs that qualified for Europe are complying with them:

-

Champions League – Manchester City, Arsenal, Liverpool and Aston Villa

-

Europa League – Tottenham Hotspur and Manchester United

-

European Conference – Chelsea

In 2022, UEFA introduced amended regulations to focus on the financial sustainability of clubs, monitoring three main pillars:

-

Solvency

-

stability

-

Cost control

Solvency requirements have been addressed by tightening rules on overdue debts for football clubs, tax authorities and employees to better protect creditors. These include mandatory valuations and quarterly payment deadlines (15 days to settle overdue amounts).

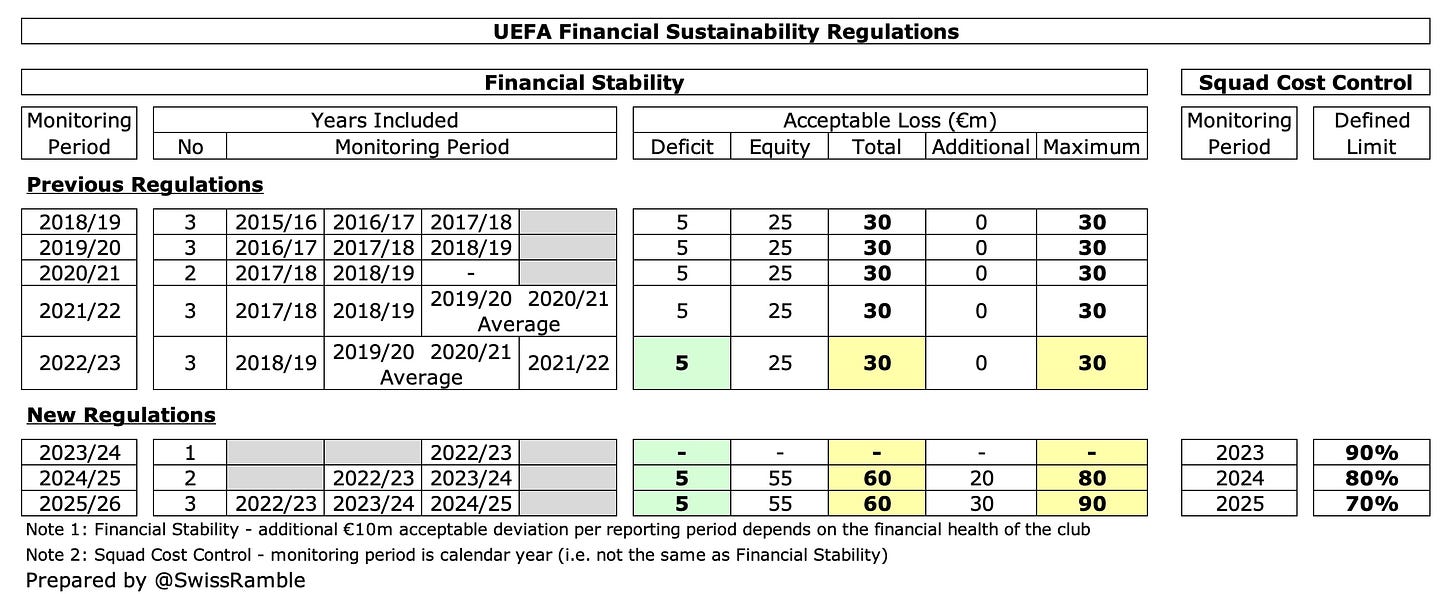

Stability is covered by the previous Financial Fair Play (FFP) rules, which limit a club’s loss to an “acceptable deviation” during the three-year monitoring period.

However, the limit has been doubled from EUR 30 million to EUR 60 million, provided that the amount exceeding EUR 5 million is covered by an equity contribution from the owner.

In addition, an association that is financially sound may be granted an additional grant of up to EUR 10 million per reporting period, i.e. EUR 30 million over the three-year monitoring period.

This would mean that a club’s permissible losses under the FFP could potentially triple (from EUR 30 million under the old rules to a maximum of EUR 90 million).

For the 2023/24 sports season, no UEFA deviation test had to be passed, as the counter was set to zero during the transition to the new regulations and the clubs therefore did not have to worry about an evaluation.

The reasoning was that UEFA wanted to put the COVID years clearly behind it so that future evaluations would not be complicated by the need to adapt to the effects of the pandemic.

However, UEFA’s regulations also apply to the 2024/25 monitoring period, although this only covers two years, namely 2022/23 and 2023/24.

Only from the 2025/26 monitoring period onwards will UEFA take into account the three previous years (i.e. 2022/23, 2023/24 and 2024/25).

The biggest change in the new rules was the introduction of squad cost controls, which ultimately capped the ratio of player salaries, transfers and agent fees at 70% of revenue plus profits from player sales.

By introducing the new cost control ratio, UEFA pursued the following objectives:

-

Ensure direct measurement of cadre costs and revenues to encourage more performance-related costs.

-

Limit the inflationary influence of players’ salaries and transfer fees.

Unlike the stability and solvency rules, the cost control rule has no predecessor in the old FFP rules. Although UEFA had previously recommended keeping salaries below 70 percent of revenue, a similar value has now been included as one of the three formal pillars in the latest regulations.

This is interesting because it is practically the first time that UEFA has applied a salary cap, albeit in a ‘soft’ version, while the financial sanctions could be described as a kind of ‘luxury tax’.

As we have already seen, ahead of next season’s UEFA competitions, we need figures for the 2022/23 and 2023/24 seasons for the stability calculation. We have the actual results for 2022/23, but unfortunately we have to estimate for 2023/24 as these figures will not be published for many months.