These could be the best performing value stocks through 2030

While the market continues to rise, with the S&P500 Although stocks continue to reach new highs, there is at least one sub-sector of the market that is significantly undervalued relative to its historical price. That is the energy midstream sector.

Even better, the midstream industry as a whole is in much better shape today than it was a decade ago, when stocks were trading at much higher valuations. Let’s take a look at the industry’s momentum and some of the sector’s stocks that are expected to outperform over the next few years.

The midstream sector of the energy industry

While midstream companies are best known for their pipeline assets, they perform a wide variety of functions in the energy complex, from gathering crude oil and natural gas at the wellhead to separating the hydrocarbons (such as processing and fractionation) to water supply and disposal (fracking requires a lot of water). They also manage storage, long-distance transportation, marketing, compression and other services.

Midstream companies tend to prefer fee-based contracts, where they take on no commodity or spread risk. And when new projects are built, they often come with take-or-pay clauses, whereby the company gets paid regardless of whether its services are used or not. Or minimum volume commitments (MVCs), whereby the midstream company receives compensation payments if a customer does not use all of its volume.

Image source: Getty Images.

Some contracts still contain pricing components that allow midstream companies to participate in rising commodity prices, usually on the natural gas and natural gas liquids (NGL) side. For example, in a percentage-of-process contract, a midstream company sells residual gas and/or NGLs to the market on behalf of a producer and keeps a percentage of the sale. Another type of contract is keep-whole agreements, where natural gas processors keep the NGLs they withdraw but must replace them with an equivalent amount of gas on a BTU basis. This exposes a company to price fluctuations between NGLs and natural gas.

However, the trend in recent years has been towards fee-based contracts, which provide a lot of transparency to these companies. And while there is volume risk, this is usually somewhat mitigated by take-or-pay and MVC clauses. Tying assets to demand centers or stronger basins also helps mitigate risk, as demand for power by utilities tends to remain strong, while basins with better economics tend to hold up better during periods of lower prices.

At the same time, energy demand is increasing due to the boom in artificial intelligence (AI) from data centers, and companies involved in natural gas transportation appear well positioned to benefit from the current AI wave. Goldman Sachs recently predicted that data center electricity demand will increase 160% by 2030, resulting in an additional natural gas demand of 3.3 billion cubic feet per day.

Utilities will need to invest in new generation capacity, and new pipelines will be needed to support this growth. Midstream companies with well-established systems in areas with cheap natural gas reserves, such as the Permian and Appalachian Mountains, will benefit the most.

Low historical industry valuations

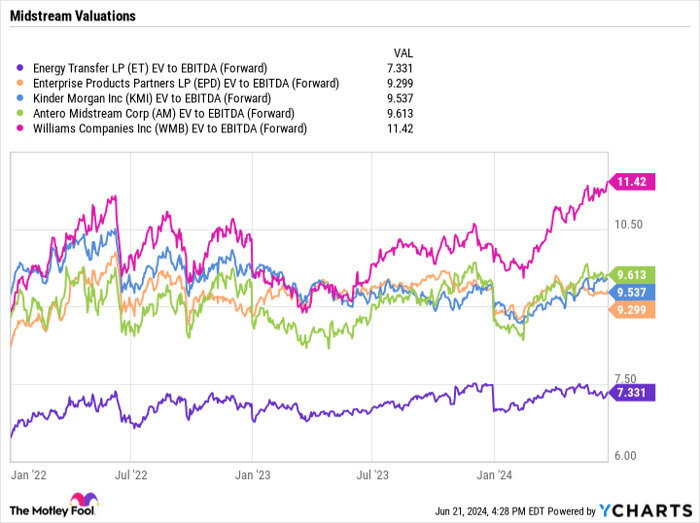

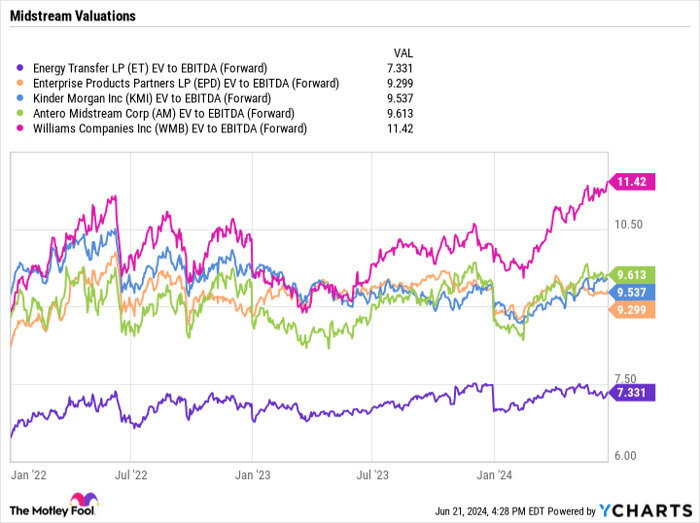

Between 2011 and 2016, midstream companies traded on average at an enterprise value to EBITDA (earnings before interest, taxes, depreciation and amortization) ratio of over 13.5. This is one of the most commonly used metrics to value these companies because it takes into account their net debt and the depreciation costs associated with pipeline expansion. Today, multiples are much lower across the industry.

Ironically, companies in this space are in much better shape today than they were then. Leverage (debt divided by EBITDA) has fallen significantly across the industry, while payout ratios have increased and midstream companies generally generate strong free cash flow.

It is also worth noting that the energy producers (E&Ps) that are customers of midstream companies are typically better positioned financially, which contributes to lower customer risk. Additionally, the industry is now more focused on free cash rather than chasing volume as was the case in the past.

Midstream stocks are likely to perform better

Historically low valuations combined with improving financials and strong growth as a result of increased natural gas demand driven by artificial intelligence put the industry in a position to potentially return to the valuation levels these stocks reached in their heyday.

The top stocks that will benefit include Energy transfer (NYSE:ET), Enterprise Product Partners (NYSE: EPD)And Kinder Morgan (NYSE: KMI)all of which have large integrated systems and a strong presence in the Permian. Williams Companies (NYSE: WMB) is another solid option as the company has a large natural gas pipeline system running from the Appalachian region to energy demand centers in the Southeast. However, the company’s stock trades at a premium compared to its peers.

Of the stocks highlighted above, Energy Transfer stands out due to its low valuation and growth prospects and is my favorite stock in the space. Energy Transfer and Enterprise also have the most attractive yields of the group at 8.1% and 7.2%, respectively.

A lesser-known name that could benefit is Antero Midstream (NYSE: AM)which has determined how much electricity data centers in the Marcellus shale region require and what their main consumer is, Antero Resources (NYSE: AR)have seen. Antero Midstream is a well-managed natural gas producer that supplies Antero. It benefits from rebate cuts (it previously gave Antero Resources a discount when natural gas prices were low) and appears poised to increase its distribution rate in the future.

Energy Transfer, Enterprise, Kinder Morgan and Antero Midstream all trade at EV/EBITDA multiples of less than 10, while Williams trades at under 11.5.

ET EV to EBITDA (Forward) data from YCharts

Given the opportunities they face and their current price relative to historical valuations, these undervalued stocks could be some of the best performing value stocks over the next few years.

Should you invest $1,000 in Energy Transfer now?

Before you buy Energy Transfer shares, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $723,729!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Geoffrey Seiler holds positions in Energy Transfer and Enterprise Products Partners. The Motley Fool holds positions in and recommends Goldman Sachs Group and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.