Top three Indian stocks expected to trade below market value in June 2024

The Indian stock market has witnessed a remarkable growth of 46% over the past year, with earnings expected to grow at 16% annually. In this context, identifying potentially undervalued stocks can provide investors with an opportunity to gain significant value in a thriving market environment.

Top 10 undervalued stocks in India based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Updater Services (NSEI:UDS) |

290,60 € |

476,83 € |

39.1% |

|

IOL Chemicals and Pharmaceuticals (BSE:524164) |

405,10 € |

574,52 € |

29.5% |

|

Vedanta (NSEI:VEDL) |

454,05 € |

634,93 € |

28.5% |

|

Mahindra Logistics (NSEI:MAHLOG) |

490,55 € |

801,82 € |

38.8% |

|

Strides Pharma Science (NSEI:STAR) |

€ 947,00 |

1,520.38 € |

37.7% |

|

TV18 broadcast (NSEI:TV18BRDCST) |

41,94 € |

69,93 € |

40% |

|

PVR INOX (NSEI:PVRINOX) |

1,428.10 € |

2224,30 € |

35.8% |

|

Delhivery (NSEI:DELHIVERY) |

395,95 € |

610,04 € |

35.1% |

|

Camlin Fine Sciences (BSE:532834) |

106,93 € |

155,94 € |

31.4% |

|

Godrej Properties (NSEI:GODREJPROP) |

3,077.20 € |

4584,15 € |

32.9% |

Click here to see the full list of 18 stocks from our Undervalued Indian Stocks Based on Cash Flows screener.

Let’s examine some outstanding options from the results in the screener

Overview: Mahindra Logistics Limited is an integrated logistics and mobility solutions provider in India and internationally and has a market capitalization of approximately Rs 35,340 crore.

Operations: The company generates its revenue primarily from two segments: Supply Chain Management at ₹51.78 billion and Enterprise Mobility Services at ₹3.28 billion.

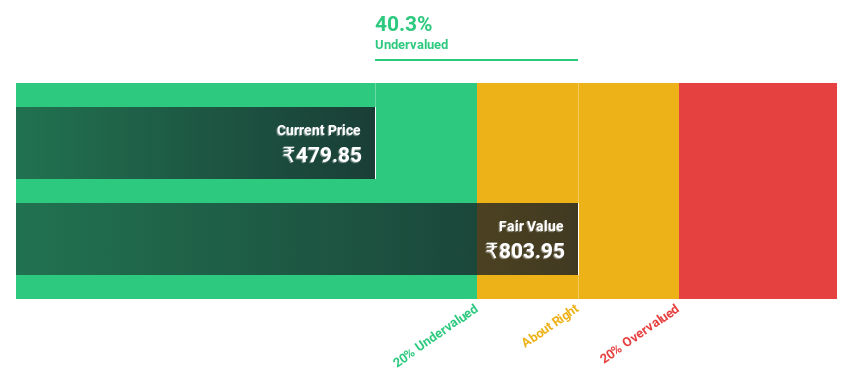

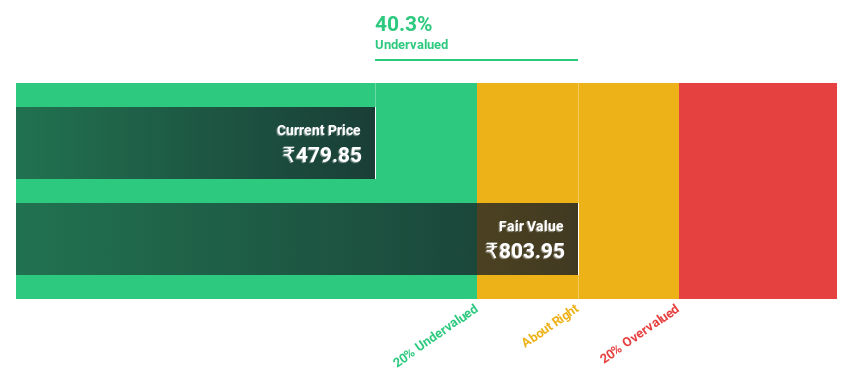

Estimated discount to fair value: 38.8%

Mahindra Logistics (₹490.55) trades at a significant discount, 38.8% below its estimated fair value of ₹801.82, suggesting potential undervaluation based on discounted cash flow analysis. Despite recent financial difficulties, including a net loss in Q4 2024 and the full year, the company is forecast to grow earnings at 61.09% per annum over the next three years, beating average market growth expectations. However, dividend coverage is weak and interest payments are barely covered by earnings, suggesting some financial pressure, despite optimistic growth projections and strategic expansions such as the recent joint venture with Seino Holdings for warehousing and trucking services in India.

Overview: PVR INOX Limited is a cinema company in India and Sri Lanka focused on the exhibition, distribution and production of films and has a market capitalization of around Rs. 140.13 billion.

Operations: The company generates revenue primarily from film exhibitions and contributes Rs 60.71 billion. Additional revenue from related segments amounts to Rs 31.7 billion.

Estimated discount to fair value: 35.8%

PVR INOX is currently trading at ₹1428.1, which appears to be undervalued by over 20% against an estimated fair value of ₹2224.3 based on discounted cash flow projections. Despite recent expansions and strategic alliances that broaden the company’s operating footprint, the company’s financial performance reflects a challenging period with a significant reduction in net loss and continued unprofitability. PVR INOX is expected to be profitable within three years and the revenue growth forecast of 11.3% annually is slightly above the market average, suggesting potential for recovery and value realization in the medium term.

Overview: Vedanta Limited is a diversified resource company engaged in exploration, extraction and processing of minerals and oil & gas with operations in India, Europe, China, USA, Mexico and other international markets. Its market capitalization is around Rs 1.68 trillion.

Operations: The company’s revenues mainly come from Aluminium (₹48.37 billion), Zinc – India (₹27.93 billion), Copper (₹19.73 billion), Oil & Gas (₹17.84 billion), Power (₹6.15 billion), Iron Ore (₹9.07 billion) and Zinc – International (₹3.56 billion).

Estimated discount to fair value: 28.5%

Vedanta Limited, with a current trading price of ₹454.05, is trading below the estimated fair value of ₹634.93, indicating a potential undervaluation based on discounted cash flow analysis. Despite a dividend yield of 4.85%, earnings coverage remains weak. The company’s debt reduction efforts are ongoing and it plans to save another USD 3 billion at Vedanta Resources within three years. Recent strategic moves include approval to raise INR 10,000 crore through warrant bonds and intention to monetize its steel business at favorable market conditions, targeting the right pricing to effectively manage debt levels.

The central theses

-

Get a detailed look at all 18 undervalued Indian stocks based on cash flow using our screener here.

-

Are you interested in these stocks? Improve your management by using the Simply Wall St. portfolio, which offers intuitive tools to help you optimize your investment results.

-

Improve your investing skills with the Simply Wall St app and enjoy free access to important market information from every continent.

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include NSEI:MAHLOG NSEI:PVRINOXNSEI:VEDL and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]