Nvidia loses around £339 billion in market value in three-day sell-off

US computer chip maker Nvidia has lost around $430 billion (£339 billion) in value over the course of a three-day sell-off, ending its short-lived spell as the world’s most valuable technology giant.

The company’s value has fallen nearly 13 percent since it briefly overtook Microsoft as Wall Street’s most valuable stock last week, hitting an all-time high of over $3.3 trillion (£2.6 trillion).

Rapidly rising demand for Nvidia chips for artificial intelligence (AI) applications has helped the US stock market reach new record highs in recent weeks, despite uncertainty about the overall economy and persistently high interest rates.

However, the rapid AI boom has raised concerns about a possible stock market bubble.

Nvidia lost more than 6 percent on Monday alone, losing around $200 billion (£158 billion) in US overnight trading, dragging the broader technology-focused Nasdaq Composite Index down 1.1 percent.

Derren Nathan of Hargreaves Lansdown stressed that Nvidia still saw impressive growth last year despite recent declines.

He said: “To put things in context, (Nvidia) shares are still up 190% on a 12-month basis, so it’s no surprise that some investors are taking some profits, including CEO Jensen Huang, who is said to have sold around $95 million (£74.9 million) worth of shares in recent days.”

He added: “Contrary to recent rumors, the markets are about more than just one stock.”

While the Nasdaq posted sharp declines on Monday, the Dow Jones Industrial Average rose 260 points, or 0.7 percent, in a mixed session on Wall Street.

“Even though Nvidia had to sneeze, the broader market didn’t catch a cold,” Nathan said.

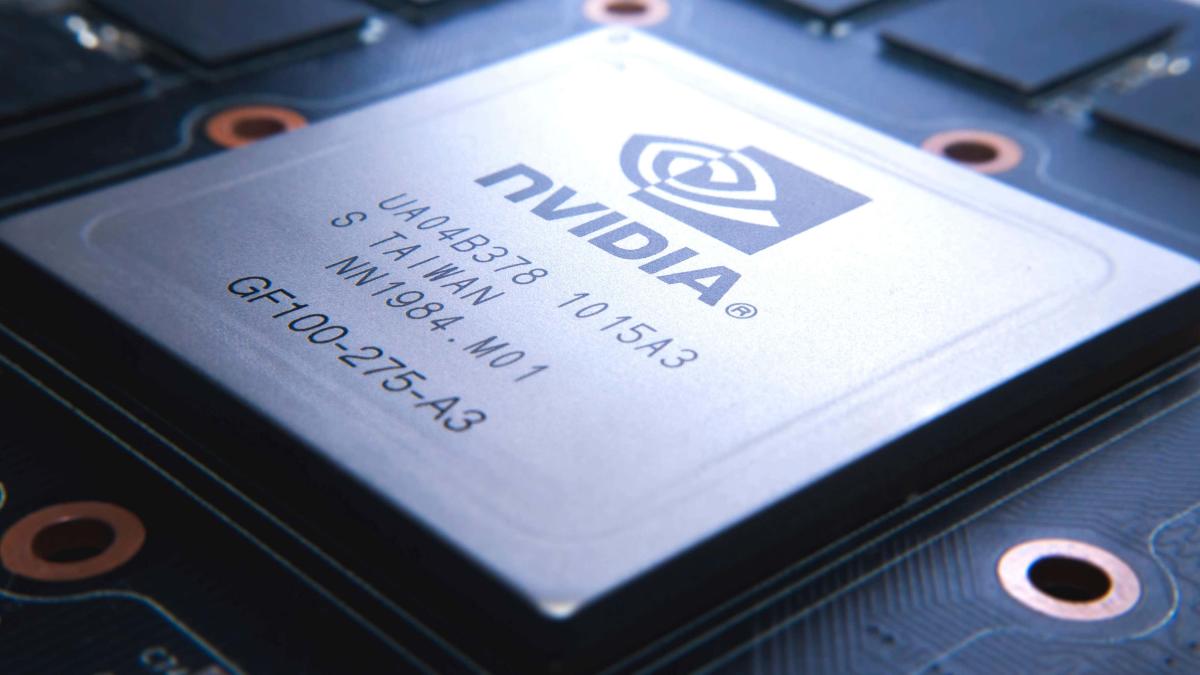

Nvidia is one of the major manufacturers of computer chips needed to power AI software, a technology that has exploded in popularity in recent years thanks to the emergence of generative AI products like ChatGPT and the rapid adoption of this technology to keep up with the latest trends in the industry.

As a result, demand for Nvidia products has skyrocketed, boosting the company’s revenue and profits as tech giants like Microsoft, Google, Meta, Amazon and Apple race to develop new AI-powered products.

The increasing focus of the largest technology companies on AI products had led some investors to believe that Nvidia’s earnings could continue to rise, which further boosted the company’s stock price.

Kathleen Brooks, head of research at XTB, said she believes the recent drop in Nvidia shares was a natural correction.

“Technology is a multi-year theme, especially artificial intelligence, so we don’t expect a steep drop in Nvidia’s share price, but a decline is to be expected,” she said.

“In addition, it is normal for investors to pause and consider whether a stock seems overvalued, even a stock like Nvidia.”

:max_bytes(150000):strip_icc():focal(749x0:751x2)/Kathy-Griffin14-11252019-3605ad19a9e740b180074daf0cbb9958.jpg)