Investigating investment opportunities in three stocks on Euronext Paris that may be trading below their estimated fair value

Against a backdrop of volatile global markets, the French CAC 40 index recently saw a significant decline, losing 2.46%, as broader European indices grappled with increasing trade tensions and economic uncertainty. This changing environment presents an interesting opportunity to explore potentially undervalued stocks on Euronext Paris that may be poised for a recovery or growth given current market conditions.

The 10 most undervalued stocks in France based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Cogelec (ENXTPA:ALLEC) |

11,20 € |

20,46 € |

45.2% |

|

NSE (ENXTPA:ALNSE) |

25,50 € |

50,92 € |

49.9% |

|

Wavestone (ENXTPA:WAVE) |

57,00 € |

93,32 € |

38.9% |

|

Thales (ENXTPA:HO) |

152,50 € |

267,31 € |

43% |

|

Lectra (ENXTPA:LSS) |

28,25 € |

43,91 € |

35.7% |

|

Tikehau Capital (ENXTPA:TKO) |

23,15 € |

32,50 € |

28.8% |

|

ENENSYS Technologies (ENXTPA:ALNN6) |

0.624 € |

1,09 € |

42.5% |

|

Vivendi (ENXTPA:VIV) |

10,865 € |

16,36 € |

33.6% |

|

Figeac Aero Société Anonyme (ENXTPA:FGA) |

5,70 € |

9,99 € |

42.9% |

|

OVH Group (ENXTPA:OVH) |

5,56 € |

7,51 € |

25.9% |

Click here to see the full list of 15 stocks from our Undervalued Euronext Paris Stocks Based on Cash Flows screener.

Let’s go through some notable picks from our reviewed stocks.

Overview: Antin Infrastructure Partners SAS is a private equity firm specialising in infrastructure investments with a market capitalisation of around EUR 2.25 billion.

Operations: The company generates sales of EUR 282.87 million, primarily through its asset management division.

Estimated discount to fair value: 17.7%

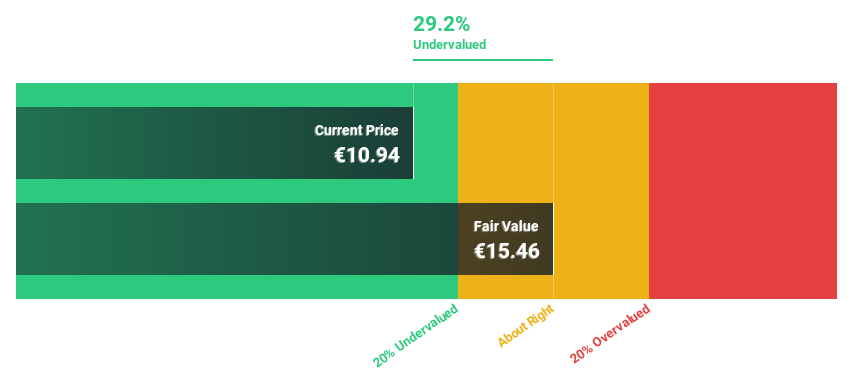

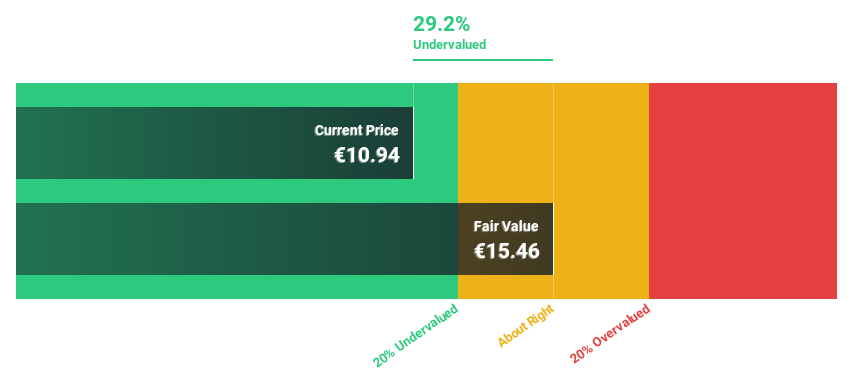

Antin Infrastructure Partners SAS trades at €12.56, 17.7% below our estimated fair value of €15.25, reflecting a slight undervaluation based on cash flows. Despite recent dividend increases to €0.71 per share, the payout is not well supported by earnings or free cash flows, pointing to potential sustainability issues. Earnings growth is robust and is estimated at 25.2% annually over the next three years – outperforming the French market average – despite experiencing shareholder dilution over the last year.

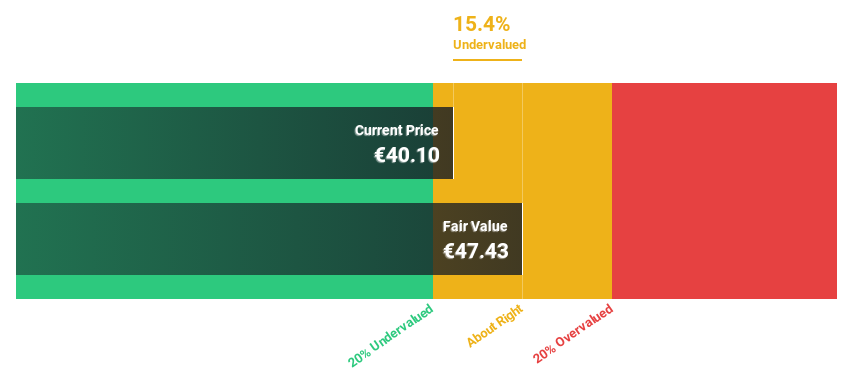

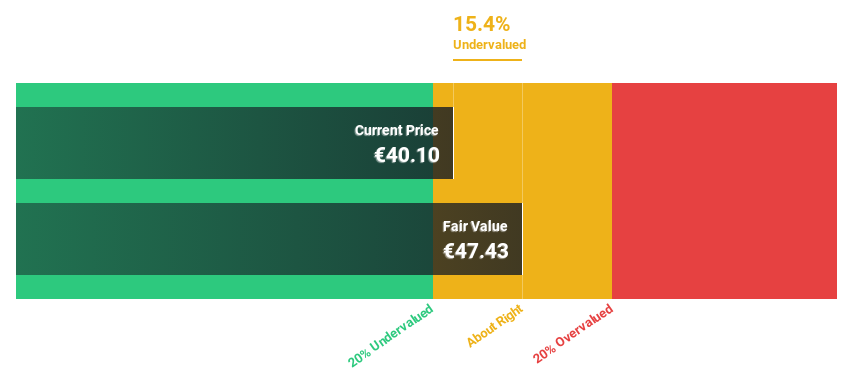

Overview: Edenred SE operates a global digital platform that offers services and payment solutions for companies, employees and merchants and has a market capitalization of around EUR 10.28 billion.

Operations: The company generates its revenue primarily in the business services sector, which generates sales of EUR 2.31 billion.

Estimated discount to fair value: 13.5%

Edenred is considered undervalued at €41.29, with its fair value estimated at €47.71, reflecting modest potential for price appreciation. The company is expected to deliver significant earnings growth of 20.15% annually over the next three years, beating the French market’s forecast of 10.9%. However, the company is highly leveraged and its dividend coverage by earnings is weak. In addition, revenue growth forecasts, while strong relative to the market, do not exceed 20% annually.

Overview: Tikehau Capital is a private equity and venture capital firm offering a range of financing products such as senior secured debt, equity and mezzanine capital and has a market capitalization of approximately EUR 4.00 billion.

Operations: The company generates its revenue in two main segments: investment activities, which generated EUR 179.19 million, and asset management activities, which contributed EUR 322.32 million.

Estimated discount to fair value: 28.8%

Tikehau Capital is trading at €23.15 below its calculated fair value of €32.5, suggesting a potential undervaluation. Despite a decline in net profit margins from 53.2% to 35.2%, the company’s revenue and profit are expected to grow by 20.1% and 31.3% annually respectively – both rates well above the market average. However, dividends are barely covered by free cash flows and the forecast return on equity is low at 12.6%. The recent strategic partnership with Nikko Asset Management could strengthen the company’s investment opportunities in Asia.

Summarize everything

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ENXTPA:ANTIN, ENXTPA:EDEN, and ENXTPA:TKO.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

Related Posts

A’s lose series finale, beaten by the Angels

“Love & Marriage: Huntsville” star Keke Jabbar reportedly dead (condolences)