Institutions and retail investors holding significant stakes in NIO Inc. (NYSE:NIO) come under pressure, losing 8.4% of their holding value

Key findings

-

Significant retail investor control over NIO means that the general public has more influence on management and governance-related decisions

-

A total of 19 investors own the majority of the company with 50% each

-

Institutional ownership of NIO is 21%

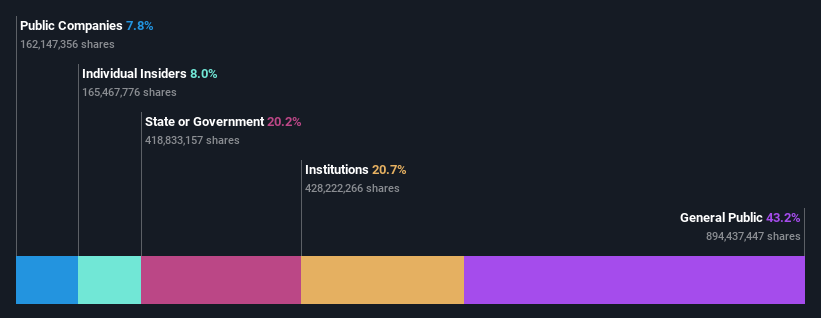

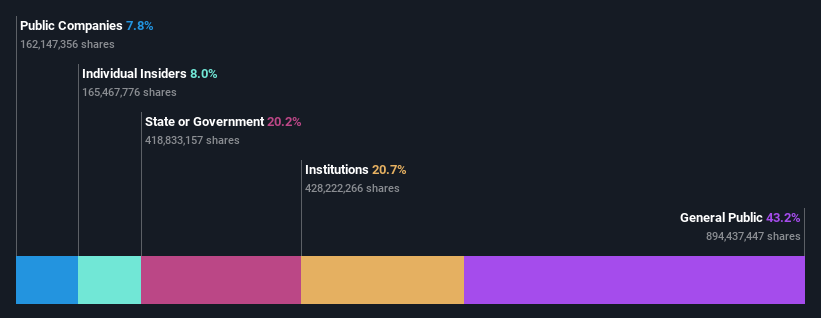

Any investor in NIO Inc. (NYSE:NIO) should be aware of the most powerful shareholder groups. We can see that retail investors own the lion’s share of the company at 43%. In other words, the group that stands to gain (or lose) the most from their investment in the company.

Retail investors suffered the biggest losses after the stock price fell 8.4% last week, but institutions, which own 21% of the shares, also took a hit.

In the graphic below we zoom in on the different ownership groups of NIO.

Check out our latest analysis for NIO

What does institutional ownership tell us about NIO?

Institutional investors often compare their own returns to those of a commonly followed index, so they typically consider buying larger companies included in the relevant benchmark index.

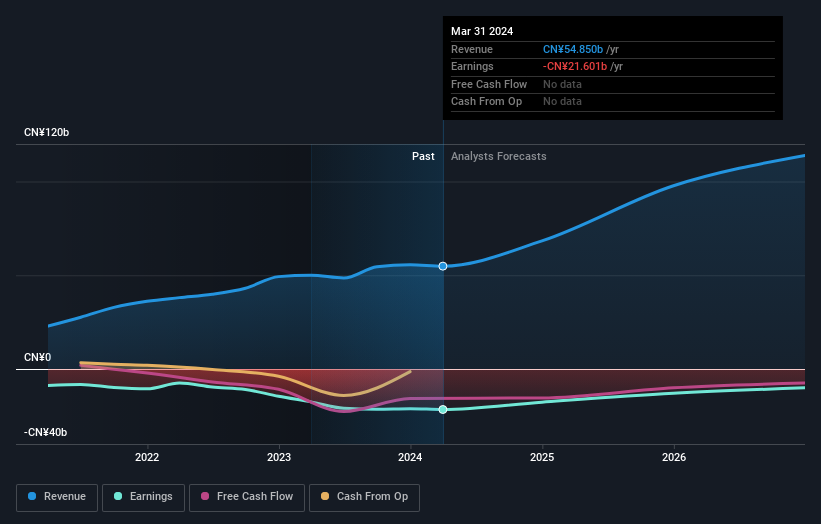

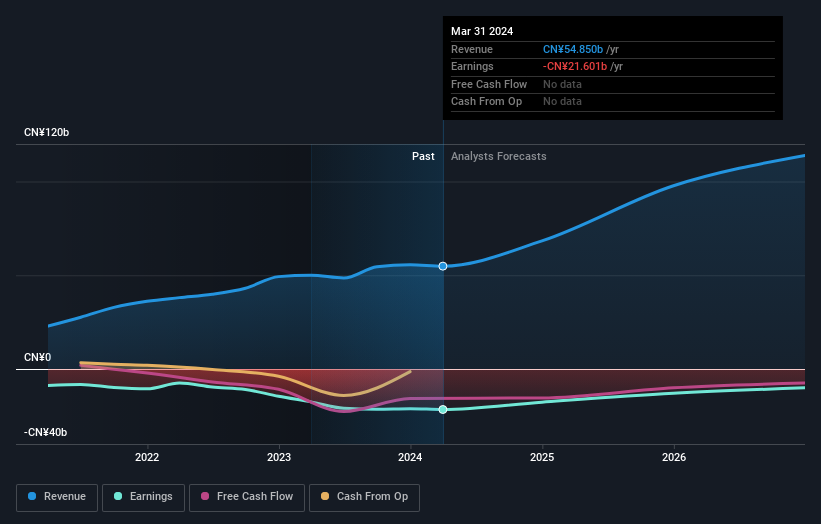

NIO already has institutions on the share registry. In fact, they own a sizable chunk of the company. This means that the analysts working for those institutions have looked at the stock and they like it. But like anyone else, they could be wrong. It’s not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time, so it’s worth checking out NIO’s past earnings trajectory (see below). Of course, keep in mind that there are other factors to consider as well.

Hedge funds don’t own a lot of shares in NIO. Looking at our data, we can see that the largest shareholder is Abu Dhabi (Emirate) with 20% of the outstanding shares. For comparison, the second largest shareholder holds about 8.0% of the outstanding shares, followed by a 7.8% stake by the third largest shareholder. William Li, the second largest shareholder, also happens to be the Chief Executive Officer.

A look at the shareholder register shows that 50% of the ownership is controlled by the 19 largest shareholders. This means that no single shareholder has a majority stake in the ownership.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be done by studying analyst opinions. There are many analysts covering the stock, so it might be worth looking at their forecasts as well.

Insider ownership of NIO

While the exact definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management is accountable to the board, which should represent the interests of shareholders. Notably, sometimes top executives are themselves on the board.

I think insider ownership is generally a good thing. However, in some cases it makes it harder for other shareholders to hold the board accountable for decisions.

We can report that insiders own shares in NIO Inc. The insiders own a significant stake worth $751 million. Most would say this shows a good alignment of interests between shareholders and the board. Still, it might be worth checking to see if these insiders have been selling.

Public property

The general public, usually retail investors, owns 43% of NIO. While this group does not necessarily call the shots, it can certainly have a real influence on how the company is run.

Ownership of public companies

It appears to us that publicly traded companies own 7.8% of NIO. This is difficult to say for sure, but it suggests that their business interests are intertwined. This could be a strategic stake, so it’s worth watching this space for changes in ownership.

Next Steps:

While it is worth considering the different groups that own a company, there are other factors that are even more important. A typical example: We found 2 warning signals for NIO You should be aware.

If you’re like me, you might want to think about whether this company will grow or shrink. Luckily, you can check out this free report showing analyst forecasts for the future.

NB: The figures in this article are calculated using the last twelve months’ data, which refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the figures in the annual report.

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]