Swedish Stock Exchange highlights three stocks whose prices are below their estimated intrinsic value

Against a backdrop of volatile global markets, the Swedish stock market offers attractive investment opportunities for value-oriented investors. With recent economic data influencing market dynamics, certain stocks on the Swedish stock exchange appear to be trading below their estimated intrinsic value, potentially offering attractive entry points for sophisticated investors.

The 10 most undervalued stocks in Sweden based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

RVRC Holding (OM:RVRC) |

45.76 SEK |

86.78 SEK |

47.3% |

|

Gränges (OM:GRNG) |

138,50 SEK |

259,34 SEK |

46.6% |

|

Truecaller (OM:TRUE B) |

35,50 SEK |

70.71 SEK |

49.8% |

|

RaySearch Laboratories (OM:RAY B) |

145,00 SEK |

277,86 SEK |

47.8% |

|

Nolato (OM:NOLA B) |

60,50 SEK |

115.62 SEK |

47.7% |

|

Dometic Group (OM:DOM) |

70,35 SEK |

129,69 SEK |

45.8% |

|

TF Bank (OM:TFBANK) |

268,00 SEK |

517,40 SEK |

48.2% |

|

Sinch (OM:SINCH) |

23.22 SEK |

43.40 SEK |

46.5% |

|

Image systems (OM:IS) |

1,505 SEK |

2.84 SEK |

47% |

|

Bactiguard Holding (OM:BACTI B) |

71,40 SEK |

132.42 SEK |

46.1% |

Click here to see the full list of 52 stocks from our Undervalued Swedish Stocks Based on Cash Flows screener.

Let’s go through some notable picks from our reviewed stocks.

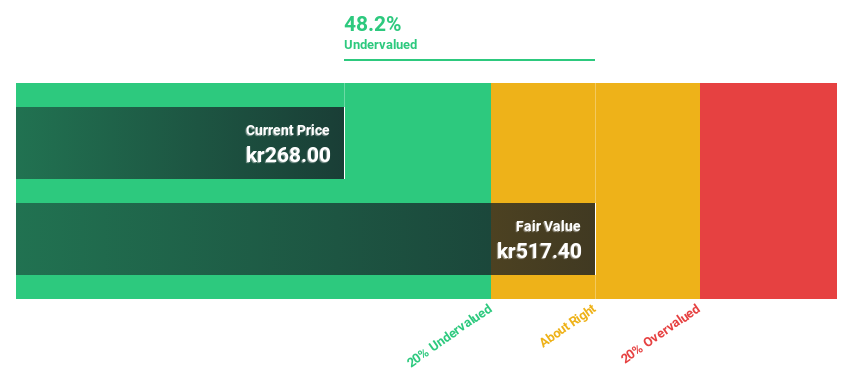

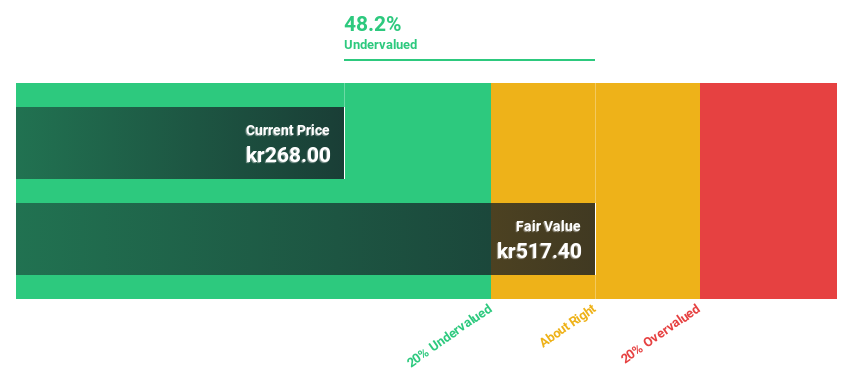

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions through its proprietary IT platform and has a market capitalization of SEK 5.76 billion.

Operations: The bank generates revenue in three main segments: credit cards (SEK 511.24 million), consumer loans (SEK 607.24 million) and e-commerce solutions without credit cards (SEK 363.28 million).

Estimated discount to fair value: 48.2%

TF Bank, with a current trading price of SEK 268, is well below our fair value estimate of SEK 517.4, highlighting the undervaluation based on cash flows. Recent earnings show robust growth, with net interest income and net income for H1 2024 rising to SEK 911.53 million and SEK 210.54 million, respectively. Despite a high bad loan ratio of 10.6%, TF Bank’s revenue and profit growth is expected to significantly outperform the Swedish market average. Expected annual revenue growth is an impressive over 20%, and profits are expected to grow by around 27.76% annually over the next few years.

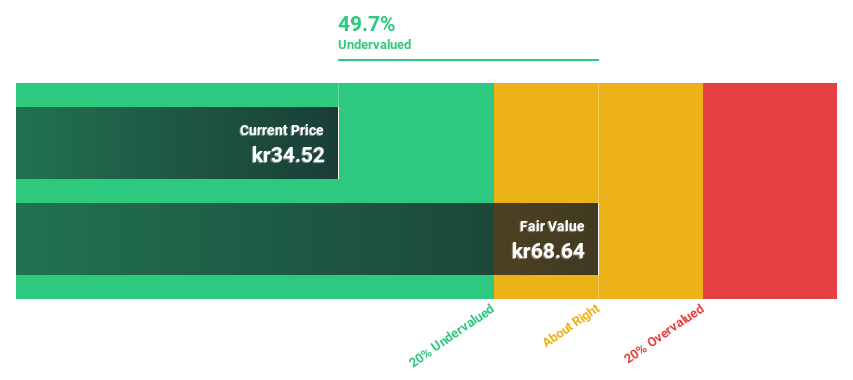

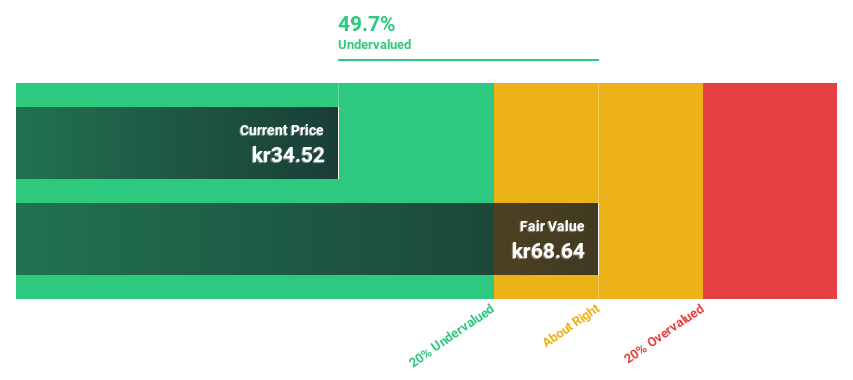

Overview: Truecaller AB operates globally, developing and publishing mobile caller ID applications for individuals and businesses in regions such as India, the Middle East and Africa with a market capitalization of SEK 12.28 billion.

Operations: The company’s sales amounted to SEK 1.78 billion and are primarily in the communications software segment.

Estimated discount to fair value: 49.8%

Truecaller is priced at SEK 35.5, well below our fair value estimate of SEK 70.71, indicating a significant undervaluation based on discounted cash flows. The company’s earnings have grown 52.4% annually over the past five years and are expected to grow 17.6% annually going forward, outperforming the forecasted growth of the Swedish market. In addition, Truecaller’s recent strategic initiatives include the launch of Truecaller Fraud Insurance in India and a follow-on equity offering of SEK 517.5 million, which could support future growth trajectories and enhance user security features globally.

Overview: Volvo Car AB (publ.) is a global automobile manufacturer based in Sweden, specializing in the design, development, manufacture and sale of passenger cars and has a market capitalization of approximately SEK 95.73 billion.

Operations: The company’s main revenue comes from the automotive business and amounts to SEK 397.52 billion.

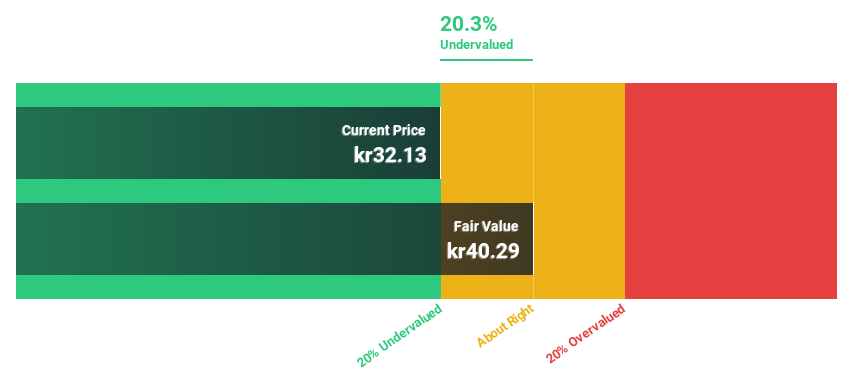

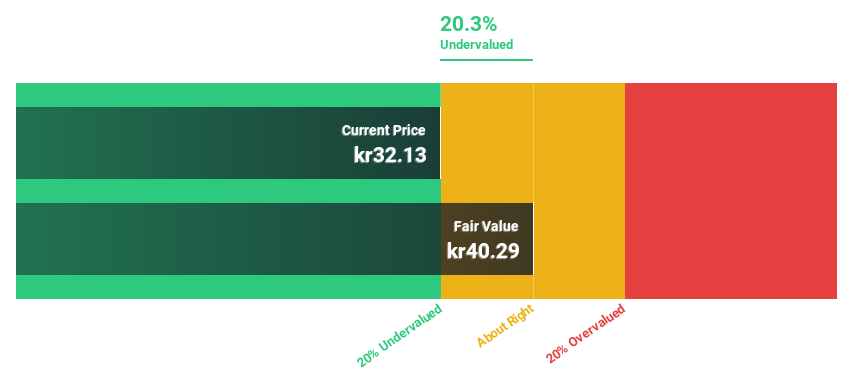

Estimated discount to fair value: 20.3%

Volvo Car AB appears to be undervalued with a current trading price of SEK 32.13 versus our fair value estimate of SEK 40.29, reflecting a potential undervaluation based on cash flows. Although forecasts predict a modest return on equity of 13.9% in three years, the company’s revenue and earnings growth are promising. Volvo is expected to deliver annual earnings growth of 23.65% over the next three years, beating forecasts for the Swedish market. This shows Volvo to have robust financial health, especially given the recent increase in sales in key markets and the successful green bond issuance of EUR 500 million.

Take advantage

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include OM:TFBANKOM:TRUE B OM:VOLCAR B.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]