July 2024 Insights into three undervalued German stocks

Amid a generally buoyant global market, Germany’s DAX index showed a positive trend last week, gaining 1.48%, reflecting investor optimism fueled by lower-than-expected US inflation figures. In this context of market stability, identifying undervalued stocks becomes crucial as they can provide opportunities for value-oriented investment strategies in the current economic climate.

The 10 most undervalued stocks in Germany based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Kontron (XTRA:SANT) |

19,69 € |

30,44 € |

35.3% |

|

Stabilus (XTRA:STM) |

43,90 € |

79,33 € |

44.7% |

|

technotrans (XTRA:TTR1) |

18,00 € |

29,31 € |

38.6% |

|

SAP (XTRA:SAP) |

183,26 € |

282,20 € |

35.1% |

|

Stratec (XTRA:SBS) |

42,50 € |

81,66 € |

48% |

|

SBF (DB:CY1K) |

2,90 € |

5,71 € |

49.2% |

|

CHAPTERS Group (XTRA:CHG) |

24,40 € |

46,30 € |

47.3% |

|

MTU Aero Engines (XTRA:MTX) |

249,00 € |

417,43 € |

40.3% |

|

R. STAHL (XTRA:RSL2) |

18,70 € |

29,08 € |

35.7% |

|

Your family entertainment (DB:RTV) |

2,56 € |

4,53 € |

43.5% |

Click here to see the full list of 26 stocks from our Undervalued German Stocks Based on Cash Flows screener.

Below we present a selection of stocks that our filter has filtered out.

Overview: Basler Aktiengesellschaft specializes in the development, manufacture and distribution of digital cameras for professional users in Germany and worldwide and has a market capitalization of around 323.35 million euros.

Operations: The company generates sales of 190.30 million euros with its digital cameras division.

Estimated discount to fair value: 28.1%

Basler is considered an undervalued stock in Germany and trades at €10.52, well below the estimated fair value of €14.63. Based on discounted cash flows, this represents an undervaluation of 28.1%. Despite recent challenges with a decline in quarterly revenue to €43.51 million and an increased net loss of €3.9 million, the company is expected to perform positively with forecast revenue growth of 13.2% per year and expected profitability within three years. However, the forecast return on equity remains modest at 9.2%.

Overview: CHAPTERS Group AG operates in the DACH region and offers software solutions through its subsidiaries. The market capitalization is around 0.44 billion euros.

Operations: The company generates its turnover mainly from data processing services and amounts to a total of 70.77 million euros.

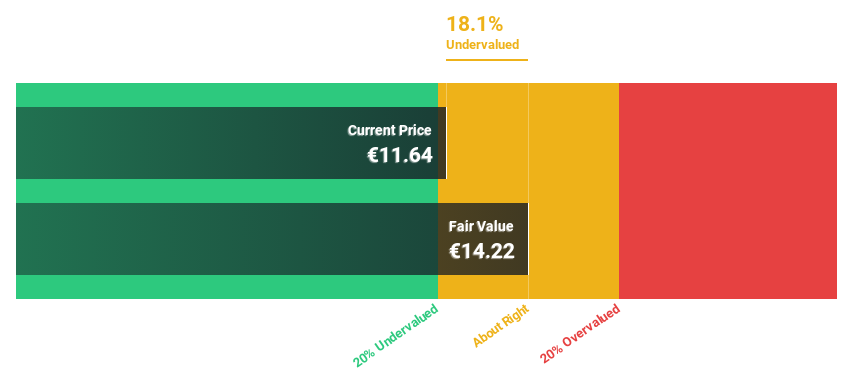

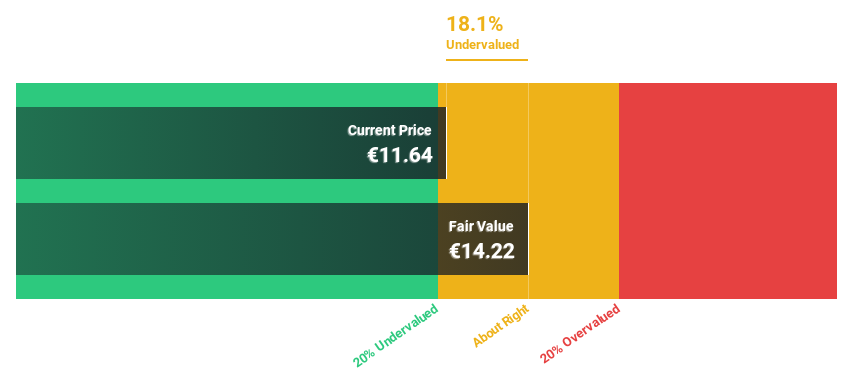

Estimated discount to fair value: 47.3%

CHAPTERS Group AG shows growth potential as revenues increased to €70.77 million from €42.07 million last year and net loss was reduced to €4.08 million. The company is trading at €24.4 million, well below the estimated fair value of €46.3 million, indicating a significant undervaluation based on discounted cash flows. CHAPTERS is expected to be profitable within three years and forecasts revenue growth of an aggressive 20.8% annually – higher than the German market average of 5.2%. However, last year saw a dilution of shares due to a private placement that raised €52 million.

Overview: Stratec SE operates worldwide and specializes in the development and manufacture of automation and instrumentation solutions for in-vitro diagnostics and life sciences. The company has a market capitalization of around EUR 0.52 billion.

Operations: The company generates its revenue from the development and manufacture of automation and instrumentation solutions for the in vitro diagnostics and life sciences industries in Germany, the European Union and other international markets.

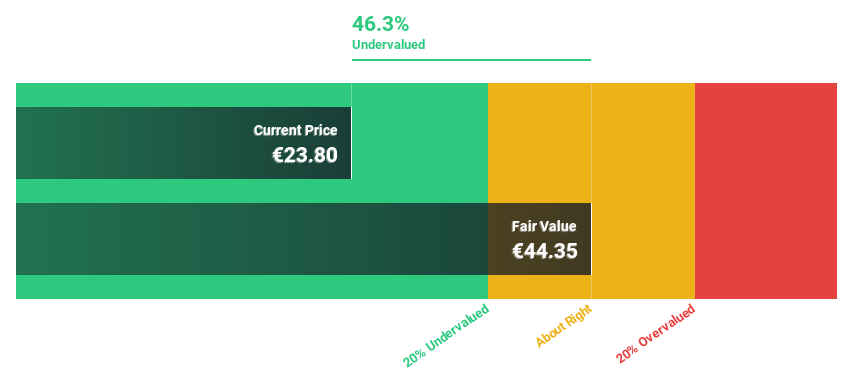

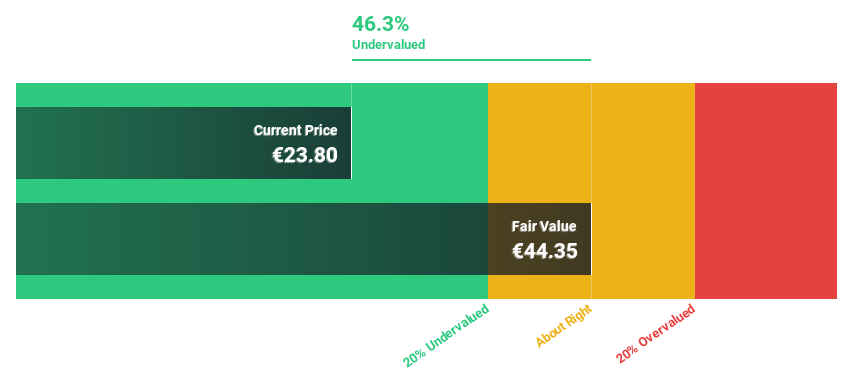

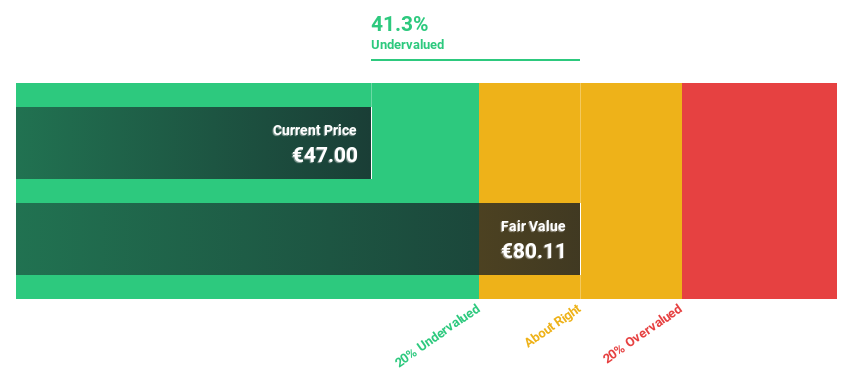

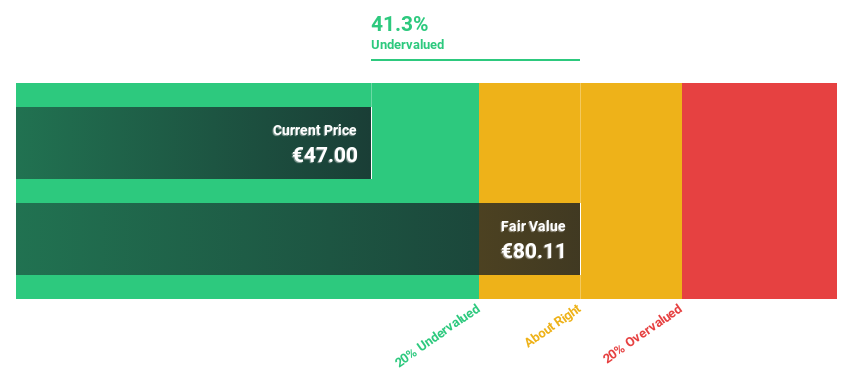

Estimated discount to fair value: 48%

Stratec SE currently trades at €42.50, well below its estimated fair value of €81.66, suggesting a possible undervaluation based on discounted cash flows. Despite a decline in net profit margin from 7.5% to 4.8% last year and debt not sufficiently covered by operating cash flow, the company’s earnings are expected to grow 21.9% annually, outperforming the German market’s forecast of 18.9%. Recent presentations at major conferences highlight ongoing strategic initiatives, despite a year-on-year decline in first-quarter sales and net profit.

Summarize everything

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include XTRA:BSL XTRA:CHGXTRA:SBS and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]