A look at the fair value of Oceania Healthcare Limited (NZSE:OCA)

Key findings

-

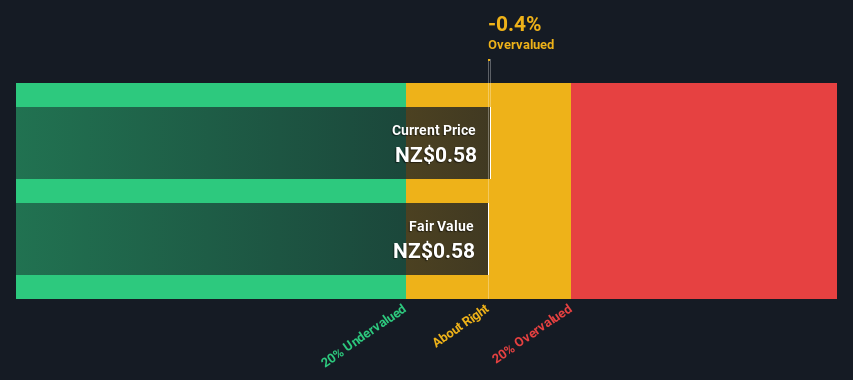

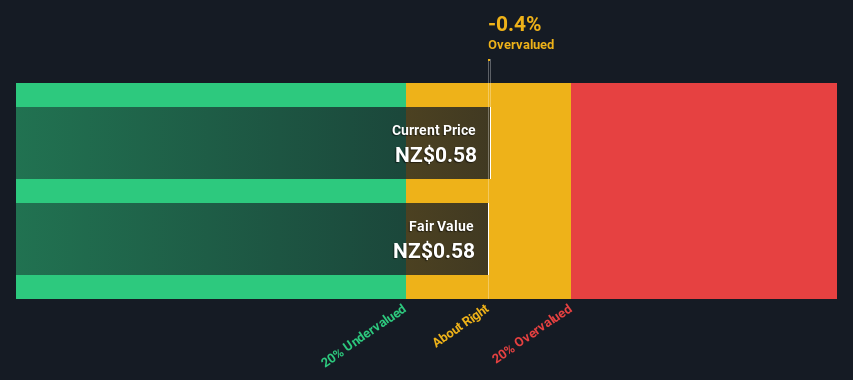

Using the dividend discount model, the fair value of Oceania Healthcare is NZ$0.58

-

Oceania Healthcare’s share price of NZD 0.58 suggests that the price is at a similar level to the estimated fair value.

-

Our fair value estimate is 38% below Oceania Healthcare’s analyst price target of NZ$0.94.

Does Oceania Healthcare Limited (NZSE:OCA)’s share price in July reflect its true value? Today we will estimate the stock’s intrinsic value by taking the expected future cash flows and discounting them to today’s value using the Discounted Cash Flow (DCF) model. Models like this may seem incomprehensible to a layperson, but they are relatively easy to follow.

However, keep in mind that there are many ways to estimate the value of a company, and a DCF is just one method. If you still have pressing questions about this type of valuation, take a look at Simply Wall St’s analysis model.

Check out our latest analysis on healthcare in Oceania

The calculation

We need to calculate Oceania Healthcare’s value a little differently than other stocks because it’s a healthcare company. Rather than using free cash flows, which are difficult to estimate and often unreported by analysts in this industry, we use dividend payments per share (DPS). This often understates a stock’s value, but can still be good as a comparison to competitors. We use the Gordon Growth Model, which assumes the dividend will grow at a sustainable rate over time. The dividend is expected to grow at an annual growth rate that matches the 5-year average 10-year government bond yield of 2.7%. We then discount that figure to today’s value at a cost of equity of 6.4%. Relative to the current share price of NZ$0.6, the company appears to be around fair value at the time of writing. However, valuations are imprecise tools, much like a telescope – move a few degrees and you end up in another galaxy. Keep this in mind.

Value per share = Expected dividend per share / (Discount rate – Perpetual growth rate)

= NZ$0.03 / (6.4% – 2.7%)

= 0.6NZ$

Important assumptions

The above calculation relies heavily on two assumptions. The first is the discount rate and the other is the cash flows. You don’t have to agree with these inputs, I recommend repeating the calculations yourself and playing with them. The DCF also doesn’t take into account the possible cyclicality of an industry or a company’s future capital needs and therefore doesn’t provide a complete picture of a company’s potential performance. Since we consider Oceania Healthcare as potential shareholders, the cost of equity is used as the discount rate rather than the cost of capital (or weighted average cost of capital, WACC) which takes debt into account. In this calculation, we used 6.4% which is based on a leveraged beta of 0.800. Beta is a measure of a stock’s volatility relative to the overall market. We get our beta from the industry average beta of globally comparable companies with an imposed limit of between 0.8 and 2.0 which is a reasonable range for a stable company.

SWOT Analysis for Healthcare in Oceania

Strength

weakness

Opportunity

Danger

Go on:

While a company’s valuation is important, it is only one of many factors you need to evaluate a company. The DCF model is not a perfect stock valuation tool. It is best to apply different cases and assumptions and see how they affect the company’s valuation. For example, changes in the company’s cost of equity or risk-free interest rate can significantly affect the valuation. For Oceania Healthcare, we have compiled three additional factors that you should examine in more detail:

-

Risks: For example, we found 2 warning signs for the healthcare system in Oceania (1 we don’t like so much!) that you need to consider before investing here.

-

Future income: How is the growth rate of OCA compared to competitors and the overall market? Learn more about analyst consensus numbers for the coming years by using our free chart of analyst growth expectations.

-

Other high-quality alternatives: Do you like a good all-rounder? Explore our interactive list of high-quality stocks to get an idea of what else you might be missing out on!

PS The Simply Wall St app runs a discounted cash flow valuation for every stock on the NZSE every day. If you want to find the calculation for other stocks, just search here.

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

Related Posts

Ken Baker tells his story in his book “Joy Goes With Us”; he wanted to become a preacher, but that didn’t work out

Seven dead, number of injured rises to 36