Disney will unlock significant value for shareholders

The Walt Disney Co. (NYSE:DIS) stock has performed poorly, down 30% over the past five years. Moreover, shares have fallen more than 50% since their peak in early 2021, raising some questions about why this happened and whether now is a good buying opportunity.

Among the factors that catalyzed this decline was the sharp decline in net income. In 2019, the entertainment company’s net income was $11 billion and in 2023 it will be $2.35 billion, which, combined with the changing outlook, caused the stock to decline and valuation multiples to return to much more reasonable levels.

If the company manages to return its profitability to historical levels and multiples are now at a more attractive level, a significant increase in value for shareholders is possible. However, this also comes with some challenges.

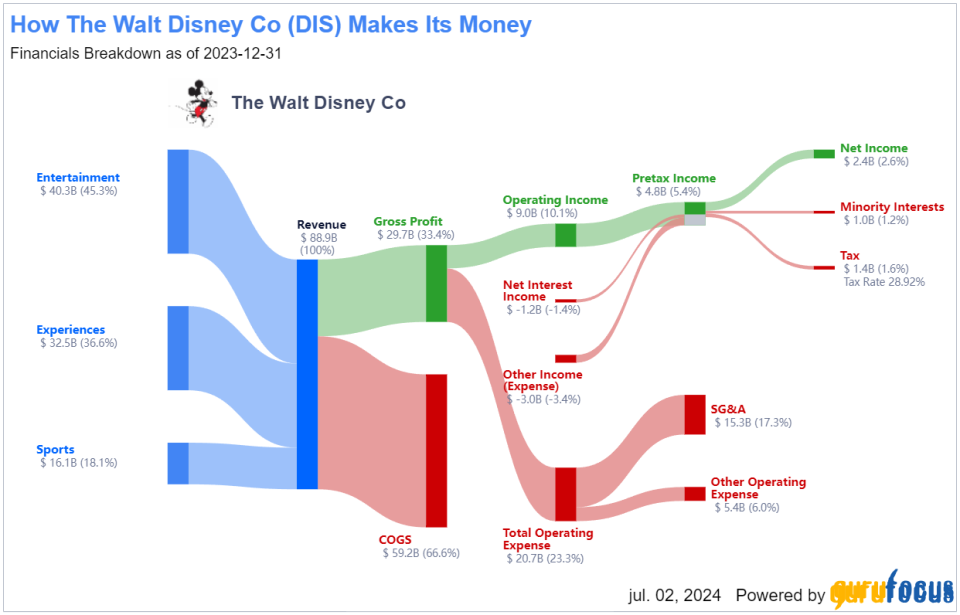

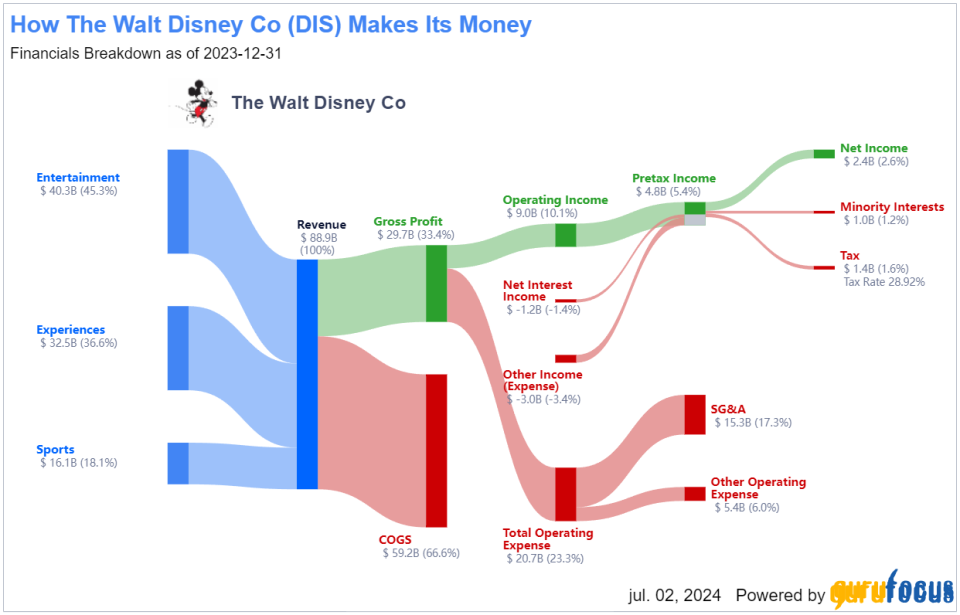

The company’s business is divided into three main categories: Entertainment, Experiences and Sports, which are in turn divided into various subcategories. Although the company has managed to grow revenues reasonably overall, this has been accompanied by a number of challenges that are directly reflected in the structure of the income statement below, which shows very low margins compared to the past.

Source: GuruFocus

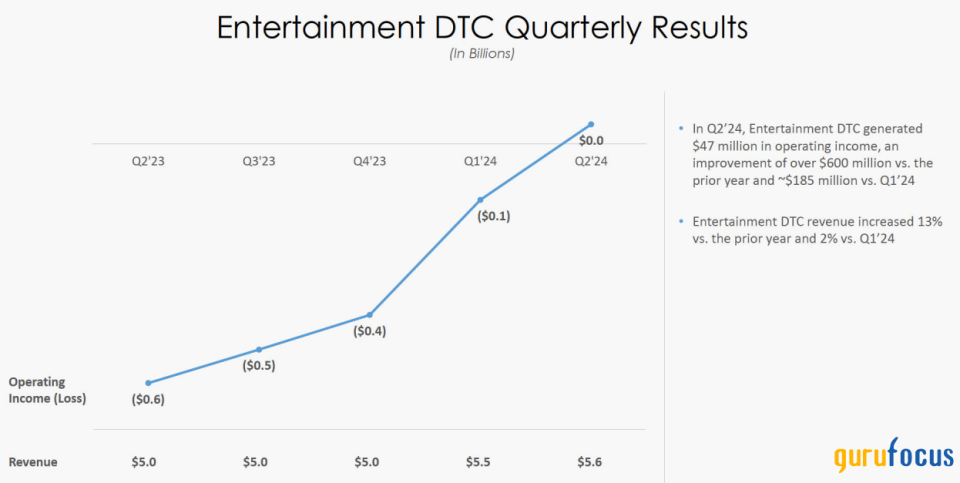

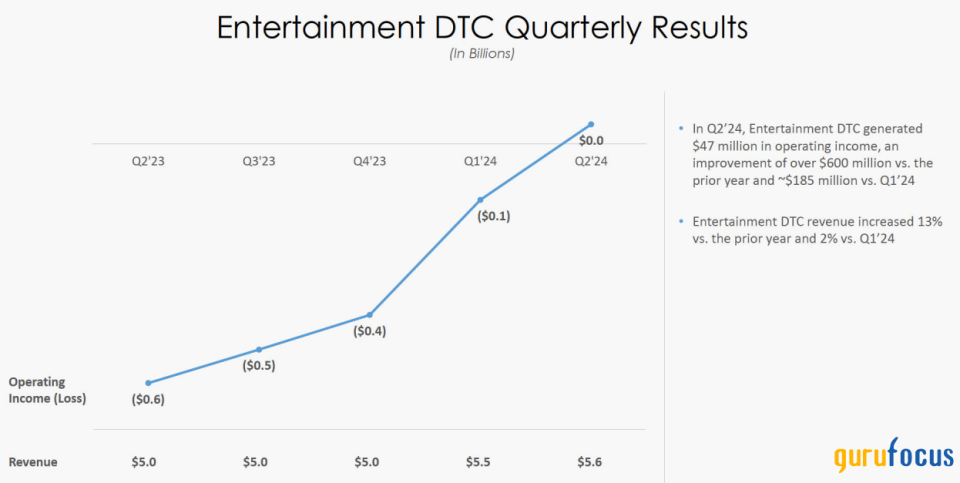

Let’s start with the entertainment segment. The biggest challenge that has affected profitability recently is the direct-to-consumer business. The company only achieved positive operating income in the last fiscal quarter because it needed a large number of subscribers (scale business) as well as price increases to achieve greater maturity of this business. In the linear networks, there was a decline of $0.2 billion in revenue and operating income in the last quarter, due to lower international results, fewer subscribers, price cuts and the non-renewal of transmission by an affiliate on the domestic side.

As if that wasn’t enough to complicate the outlook, Disney has suffered a series of flops in the film market over the past year, losing millions on films like The Marvels and Indiana Jones and the Dial of Destiny. Although these titles were later added to streaming channels (which could attract new subscribers), it’s very difficult to justify a $237 million loss like it did with The Marvels.

On the other hand, Experience remained solid in the second quarter, with growth in revenue and operating profit driven by higher ticket prices, cost-saving initiatives and growth at Disney Cruise and Hong Kong Disneyland. This underscores one of Disney’s moats, namely that even in a less favorable macroeconomic scenario, the company has managed to remain relevant in this business, which is more affected by economic cycles, while still improving the dynamics of its pricing.

Finally, the Sports segment reported mixed results in the second quarter, with slight revenue growth and stable operating profit, with the decline in Star India’s operating loss offsetting lower operating profit at ESPN Domestic, which was impacted by higher costs and lower affiliate revenues.

In short, Disney has faced revenue disruptions and cost pressures in recent quarters, but there are already signs of a turnaround, such as improved profitability in DTC and resilience in Experience, which make the prospects for value creation clearer.

While this scenario is not trivial and the outlook is bleak, Disney is still a company with many moats. These competitive advantages are based mainly on its iconic brand and world-renowned intellectual property. This means that its parks and other experiences continue to exist as resilient destinations even in difficult times. And with virtually irreplaceable characters, because even if possible competitors like Netflix (NLFX) announce theme parks in the coming years, it still seems unlikely that this will significantly affect the rush of visitors to Disneyland.

These IPs also facilitate the streaming business, which, despite strong competition, has good prospects as long as the company manages to increase its economies of scale, grow subscribers and improve cost and expense efficiency, apart from pricing power. It is worth noting that Disney still expects this segment to be one of its growth drivers in the future, as CEO Bob Iger stated during the second-quarter conference call.

“We have said all along that our path to profitability will not be a straight line. While we expect a weaker third quarter, largely due to the seasonality of our sports offerings in India, we firmly believe that streaming will be a growth driver for the company going forward and we have prioritized the necessary steps to achieve that goal,” Iger said.

This seems achievable to me. I believe that some companies will stand out in this streaming market, such as Netflix, which has already achieved a very high level of efficiency and a very solid business model. Disney also seems to be able to build something resilient, but with a higher level of differentiation as it targets different audiences and its own franchises, alongside other initiatives such as Hulu, Star and ESPN. There is an excellent trajectory to see in the chart below, and if this pace is maintained, we will see a positive impact of DTC on EPS growth in a few quarters.

Source: Disney second quarter earnings presentation

The Experiences division also has interesting initiatives, with some events planned for the second half of 2024, such as the Disney Treasure Cruise, as well as other strategies such as Disneyland Forward, the expansion plan for the Disneyland resort that has been provisionally approved by the Anaheim City Council.

Another trigger that I find interesting is the trend towards artificial intelligence. Disney is not an AI company, but could benefit from the technology as its films are currently very expensive to produce. As the software for producing animations, editing, special effects and the like advances, it is possible that the company will achieve higher productivity and require less time and capital to achieve the same level of film production. I see this as an interesting opportunity for the company.

While Disney has made some mistakes (mainly related to films that incurred significant losses), the company has also had some recent successes (such as Inside Out 2) that, combined with its strong competitive advantages, improve its prospects for a return to profitability in the coming years.

Disney’s net profit margin has fluctuated between -4% and 21.20% over the past decade, with the median at 15.60%. The margin for 2023 was around 2.60% and over the past 12 months it was 1.90%. This is a crucial point for the thesis because to believe in stronger shareholder value generation, one must assume that this margin will return to slightly better levels. It’s worth noting that Disney highlighted a 1 cent per share earnings loss in its presentation in the second quarter. However, excluding certain items (TFCF and Hulu amortization and restructuring and impairment changes), this number rises to $1.21, suggesting greater operational clarity for the bottom line when these items are no longer an issue.

Over the last 12 months, group revenue reached $89.20 billion, a very good level for a mature company. If the company returns to a median of 15% and keeps revenue stable, it would have a price-to-earnings ratio of 13.30, but it is impossible to predict exactly when this level will be reached again, if ever.

For the next 12 months, the market expects a price-to-earnings ratio of 19, which is close to an adjusted net margin of 10% and would result in net income of about $8.90 billion. The median ratio over the last 10 years was 20.50, a value close to the market estimate.

Another important factor is that Disney is targeting cash flow from operations of $14 billion (the market expects slightly less). After investing about $6 billion in parks, resorts and other properties, that will result in free cash flow of $8 billion for fiscal year 2024. Taking that amount into account alone already results in a price-to-FCF ratio of 22.

Given these multiples, Disney shares appear attractive as there is still pressure on some segments of the company that can unlock significant value for shareholders as profitability and scale increase, even under conservative assumptions.

Disney is far from a dying company. Its deep moats (most notably its intellectual property rights) set it apart from other media companies. Therefore, I interpret its current share price as attractive for those who like the sector and its business model, but a price that also reflects the challenges the company faces.

This scenario is unlikely to last forever, and at some point Disney will be able to resume producing more profitable films (and thus regain its footing in the market) and potentially make DTC profitable, which, combined with a very resilient experience segment, could unlock even more value.

This article first appeared on GuruFocus.

Related Posts

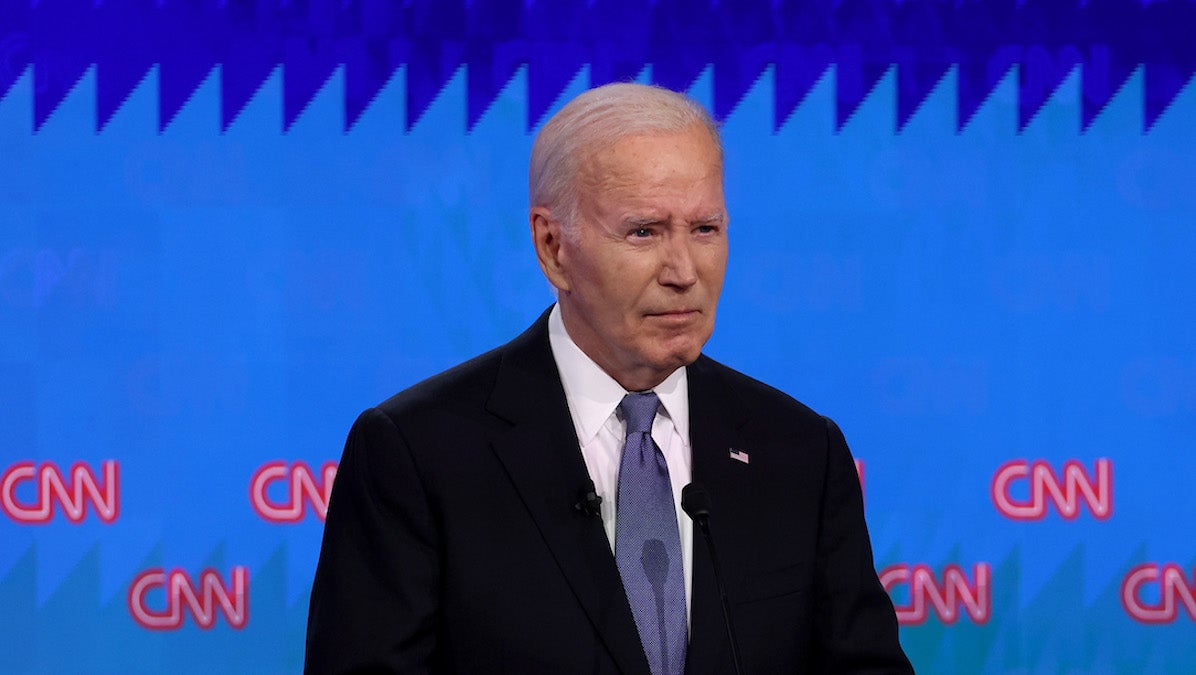

Biden’s harsh voice in the debate raises health concerns

Best Summer Books 2024: Environment