Avi Hasson: Despite war, the startup nation is a leader in cybersecurity

A new report from Startup Nation Central shows a rise in private funding for Israel, attributed to the country’s dominant cybersecurity field

Israel has managed to maintain its reputation as a startup nation even as the war in Gaza drags on. Israel’s tech sector in particular had a strong first half of 2024, according to a new report from Startup Nation Central, an organization dedicated to using innovative Israeli technology to solve global problems. The Media Line spoke with Avi Hasson, CEO of Startup Nation Central, about his analysis of the tech sector’s successes and challenges post-October 7.

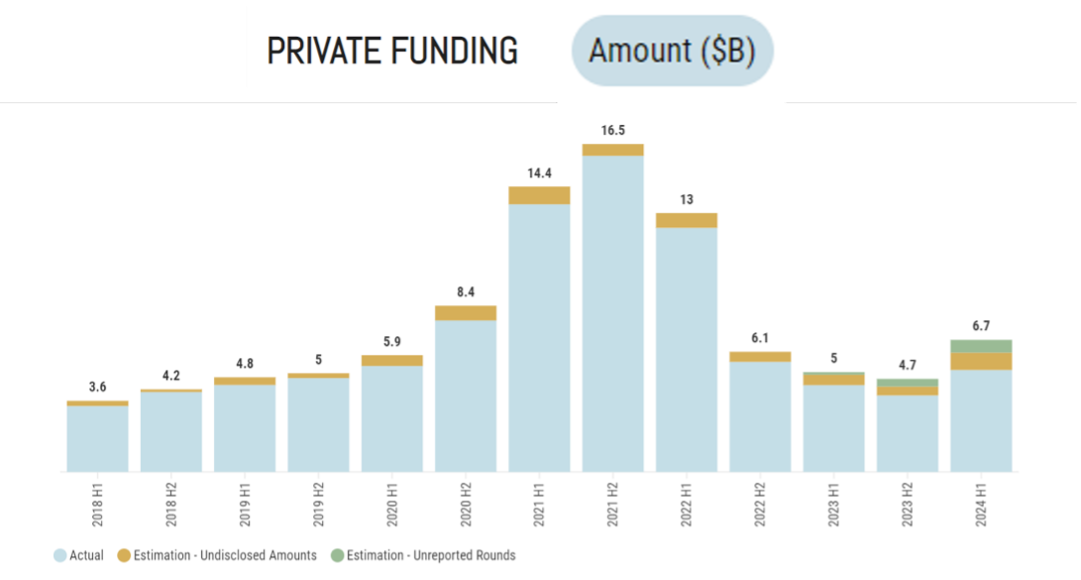

Startup Nation Central’s new report shows that private investment in Israel has continued to surge, growing 31% between the second half of 2023 and the first half of 2024. Private investment in Israel totaled $5.1 billion in the first six months of 2024, with more than half of that coming from 14 “mega rounds” of more than $100 million.

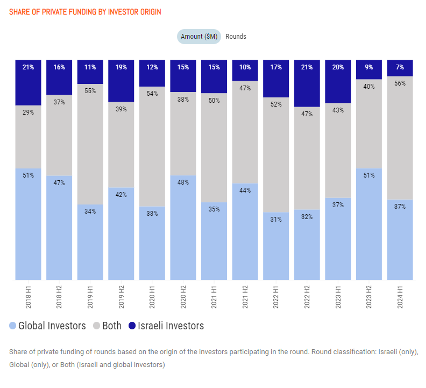

“We are seeing investors becoming increasingly reluctant to invest in Israel, and some are even withdrawing from Israel. At the same time, however, we are also seeing just as many, if not more, investors seizing the opportunity and increasing their activities, both locally and by investing in Israeli startups,” said Hasson.

(Courtesy of Startup Nation Central)

The report explained that young companies struggle to get funding, while star startups, especially in cybersecurity, have fewer problems. According to a recent report in the Wall Street Journal, Google’s parent company is looking to acquire Israeli cloud security company Wiz for $23 billion. That would be the largest acquisition of an Israeli company ever, Hasson said.

As many companies have moved their data from physical computers to the cloud, demand for cybersecurity solutions like those offered by Wiz has increased.

“Wiz was one of the first companies to truly support those organizations migrating to the cloud and facing the challenges and cybersecurity threats that come with that migration,” Hasson said.

Wiz reportedly had annual revenues of $350 million just five years after its founding.

Hasson called Wiz a “prime example” of the resilience of Israeli technology. “There is currently an arms race in cybersecurity among the largest companies, and Israel has an unusually high share of the world’s cybersecurity companies,” he said.

In the first half of 2024, more than half of Israel’s private funding went to cybersecurity. Leading Israeli cybersecurity companies include Wiz, Cyabra, Fireblocks, Cyera and Paragon.

Two Israeli cybersecurity companies, Check Point and CyberArk, have acquired other companies this year, Hasson said.

(Courtesy of Startup Nation Central)

Aside from Wiz, nine Israeli cybersecurity companies were involved in exits in the first quarter of 2024. These cybersecurity exit deals totaled $1.5 billion and accounted for 35% of the funds raised through exits in the first half of 2024.

Hasson explained that many large platforms are looking to acquire numerous cybersecurity companies in order to integrate those companies’ services rather than having to rely on many different vendors.

While Israel’s share of the global cybersecurity market increased, the U.S.’ share decreased, the new report found. In 2018, cybersecurity accounted for 20 percent of both countries’ funding ecosystems. Over time, that figure dropped to 13 percent for the U.S. and rose to 25 percent for Israel.

While that sounds like good news, Hasson said it also shows that the Israeli market is not sufficiently diversified.

“We focus too much on cyber, fintech and other subsectors, while in the US we are seeing growth in other emerging subsectors like health, food, agriculture, climate and others, which gives the sector a broader picture,” Hasson explained. “But if you are looking for cybersecurity companies, whether you are an investor or a large multinational, Israel is probably at least one of the main places where you can find the talent and even the business acumen.”

In addition, Europe is more economically diversified than Israel, said Hasson.

Since the war began, two major U.S. rating agencies have downgraded Israel’s rating. Hasson explained the discrepancy between those ratings and the positive outlook in his report by describing the factors taken into account by the rating agencies, including geopolitical risks, fiscal discipline and political stability.

“The Israeli government has not performed well in these aspects,” he said. “So the public sector has a big influence on the credit rating, while the private sector is almost entirely responsible for what we saw in our report.”

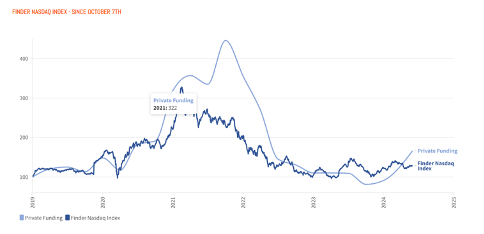

Overall, trends in the Israeli economy are positive, said Hasson. The country has got inflation under control and interest rates have fallen.

(Courtesy of Startup Nation Central)

One question about Israel’s economic future concerns the country’s ability to cooperate with its Arab neighbors, especially the Abraham Accords countries. Hasson said Startup Nation Central is actively involved in developing cooperation projects in the field of technology and innovation between Israel and Arab countries, including those that do not have formal relations with Israel.

“There is business activity, there is investment activity,” he said. “It’s happening under the radar.”

Both the private sector and governments of other countries have made it clear that they intend to continue to work with Israel, even if those opportunities are limited due to the ongoing war in Gaza, Hasson said.

“We are working within those boundaries to ensure that the relationship continues, thinking about a broader and longer-term future,” he said.