Exploring Swedish stocks with an intrinsic value discount of up to 48.6%

Against a backdrop of volatile global markets, the Swedish Stock Exchange offers a unique environment for value investors. With discounts to intrinsic value of up to 48.6%, certain Swedish stocks appear to be worth considering, particularly in a climate where spotting investment opportunities is critical due to mixed economic signals globally. In this context, identifying stocks that are undervalued relative to their intrinsic value could be particularly interesting, as they offer potential resilience or growth as market dynamics evolve.

The 10 most undervalued stocks in Sweden based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

RVRC Holding (OM:RVRC) |

46,00 SEK |

87.22 SEK |

47.3% |

|

Gränges (OM:GRNG) |

139,40 SEK |

258,76 SEK |

46.1% |

|

Afry (OM:AFRY) |

198,40 SEK |

382.28 SEK |

48.1% |

|

RaySearch Laboratories (OM:RAY B) |

143,40 SEK |

278,89 SEK |

48.6% |

|

Nolato (OM:NOLA B) |

60,45 SEK |

115,76 SEK |

47.8% |

|

Dometic Group (OM:DOM) |

70,40 SEK |

130.21 SEK |

45.9% |

|

Sinch (OM:SINCH) |

23.29 SEK |

43.46 SEK |

46.4% |

|

Flexion Mobile (OM:FLEXM) |

8.94 SEK |

16.31 SEK |

45.2% |

|

Nordisk Bergteknik (OM:NORB B) |

16,80 SEK |

30.78 SEK |

45.4% |

|

Image systems (OM:IS) |

1.47 SEK |

2.84 SEK |

48.3% |

Click here to see the full list of 49 stocks from our Undervalued Swedish Stocks Based on Cash Flows screener.

Let’s take a closer look at some of our favorites among the companies we reviewed.

Overview: Ependion AB, together with its subsidiaries, specializes in offering digital solutions for secure control, management, visualization and data communication and has a market capitalization of approximately SEK 3.46 billion.

Operations: The company specializes in digital solutions, with a focus on secure control, management, visualization and data communication.

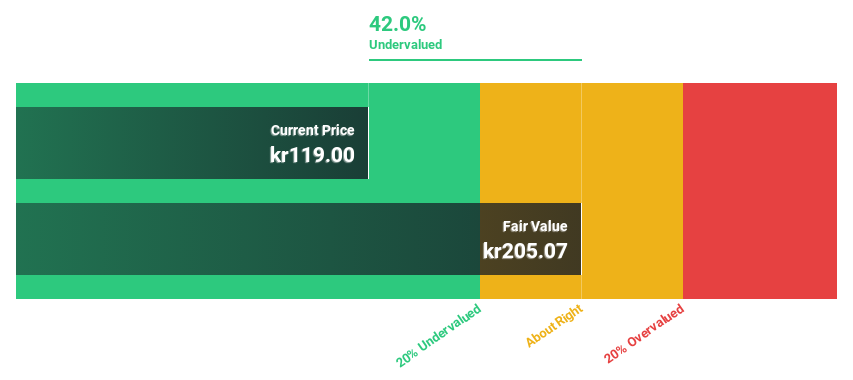

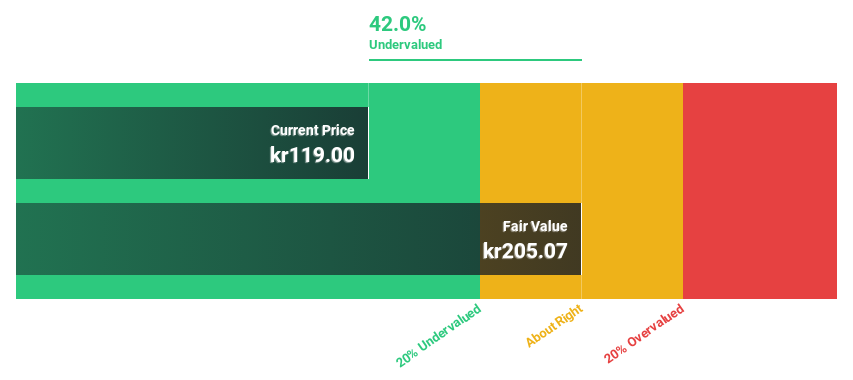

Estimated discount to fair value: 42%

Ependion trades at SEK 119, well below its fair value of SEK 205.07, and has a promising investment profile based on cash flows. Despite a high level of debt, above-average performance is expected. Forecast earnings growth is 22.8% annually over the next three years – higher than the Swedish market average. Current financials show a decline in revenue and net profit for the first half of 2024; however, strategic moves such as significant orders from Siemens for the Indian Railways point to potential revenue sources in the future.

Overview: Humble Group AB is active in the refinement, development and distribution of fast-moving consumer goods in Sweden and internationally and has a market capitalization of approximately SEK 4.29 billion.

Operations: The company generates its sales in four main segments: Future Snacking (SEK 935 million), Sustainable Care (SEK 2.24 billion), Quality Nutrition (SEK 1.51 billion) and Nordic Distribution (SEK 2.62 billion).

Estimated discount to fair value: 39.7%

Humble Group’s price of SEK 9.68 is well below the estimated fair value of SEK 16.06, suggesting a severe undervaluation based on cash flows. While the revenue growth forecast of 11% per year is robust compared to the 1.7% in the Swedish market, the forecast profitability and earnings growth are also promising, with earnings expected to increase significantly annually. However, a low forecast return on equity of 8.7% somewhat dampens this optimism. Recent credit line extensions totaling SEK 300 million could support further growth or operational flexibility.

Overview: RaySearch Laboratories AB is a medical technology company specializing in software solutions for cancer treatment in the Americas, Europe, Africa, Asia-Pacific and the Middle East, with a market capitalization of approximately SEK 4.92 billion.

Operations: The company generates its revenue primarily from healthcare software and totals SEK 1.05 billion.

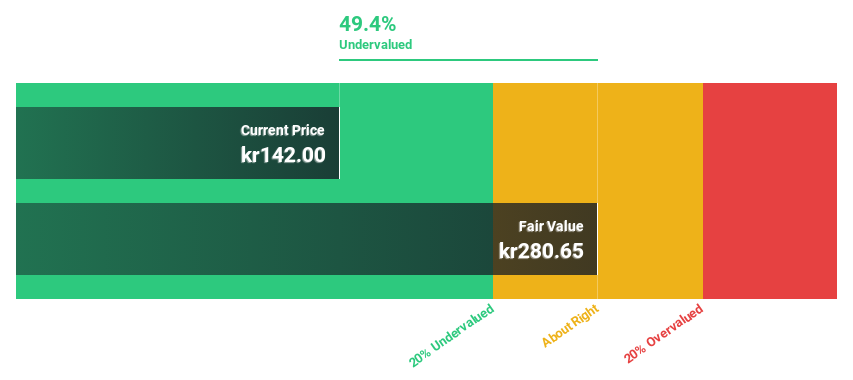

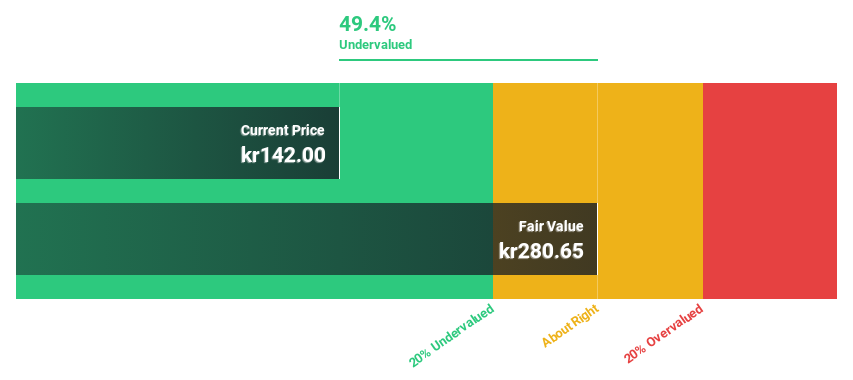

Estimated discount to fair value: 48.6%

RaySearch Laboratories is significantly undervalued at a current price of SEK 143.4 versus an estimated fair value of SEK 278.89, a discount of 48.6%. The company’s earnings have increased by 356.9% over the past year and are expected to grow by 33.62% annually, beating the Swedish market forecast of 15.2%. Recent innovations such as RayStation® 2024B improve clinical workflow automation and can increase potential future revenue streams, which are expected to grow by 10.6% annually.

Take advantage

Looking for other investments?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include OM:EPEN OM:RAY B and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]