Analysis of three Indian stocks with discounts to intrinsic value between 14.7% and 39.9%

The Indian stock market has shown robust growth, rising 1.1% last week and clocking a remarkable 45% gain over the past year, with earnings expected to continue growing at a 16% annual rate. In this thriving market environment, identifying stocks trading below their intrinsic value could present attractive opportunities for investors looking for potential gains.

Top 10 undervalued stocks in India based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

HEG (NSEI:HEG) |

2,096.15 € |

3,284.02 € |

36.2% |

|

IOL Chemicals and Pharmaceuticals (BSE:524164) |

417,60 € |

636,71 € |

34.4% |

|

Updater Services (NSEI:UDS) |

324,25 € |

538,89 € |

39.8% |

|

Vedanta (NSEI:VEDL) |

455,50 € |

744,79 € |

38.8% |

|

Rajesh Exports (NSEI:RAJESHEXPO) |

309,50 € |

507,53 € |

39% |

|

Strides Pharma Science (NSEI:STAR) |

942,55 € |

1,664.05 € |

43.4% |

|

Mahindra Logistics (NSEI:MAHLOG) |

534,50 € |

906,03 € |

41% |

|

Delhivery (NSEI:DELHIVERY) |

382,70 € |

741,32 € |

48.4% |

|

PVR INOX (NSEI:PVRINOX) |

1,438.30 € |

2,546.10 € |

43.5% |

|

Godrej Properties (NSEI:GODREJPROP) |

3381,40 € |

5621,73 € |

39.9% |

Click here to see the full list of 20 stocks from our Undervalued Indian Stocks Based on Cash Flows screener.

Here’s a quick look at some of the choices from the screener.

Overview: Godrej Properties Limited is engaged in real estate construction and development across India and has a market capitalization of approximately Rs. 939.83 billion.

Operations: The company generates its revenue primarily from real estate construction and development totaling approximately Rs 29.95 billion, with a smaller segment in the hospitality sector generating approximately Rs 0.41 billion.

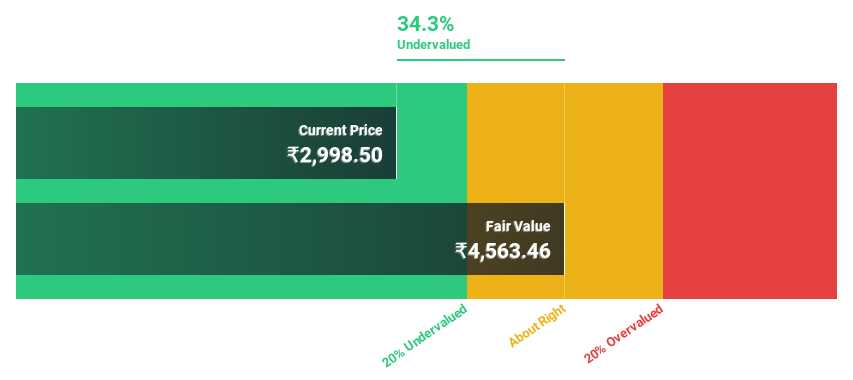

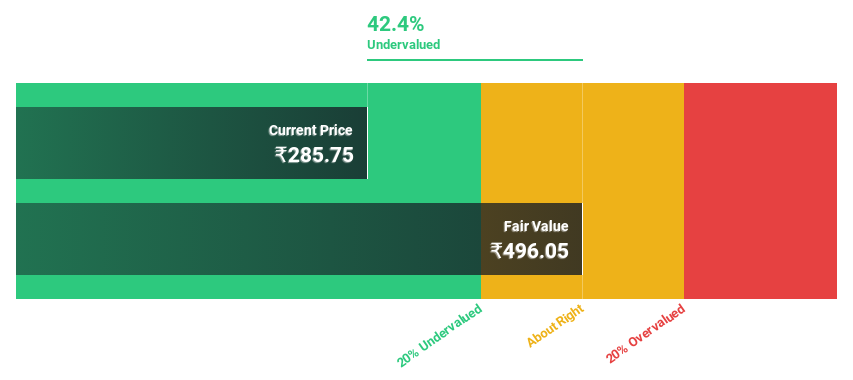

Estimated discount to fair value: 39.9%

Godrej Properties is significantly undervalued by 39.9% at ₹3381.4 million, with its fair value estimated at ₹5621.73 million. Recent acquisitions in Bengaluru and Pune demonstrate aggressive expansion and increase future revenue potential to around INR30 billion. Although earnings have grown at 28.7% annually over the past five years, debt concerns persist as it is barely covered by operating cash flow. However, robust forecast annual earnings growth of 36.2% and market-beating revenue growth projections suggest promising upside potential.

Overview: Quess Corp Limited is a business services provider operating in India, Southeast Asia, Middle East and North America with a market capitalization of approximately Rs 928.1 billion.

Operations: The company’s revenue is generated from Workforce Management (₹134.42 billion), Operating Asset Management (₹28.01 billion) and Global Technology Solutions (excluding Product Led Business) (₹23.40 billion).

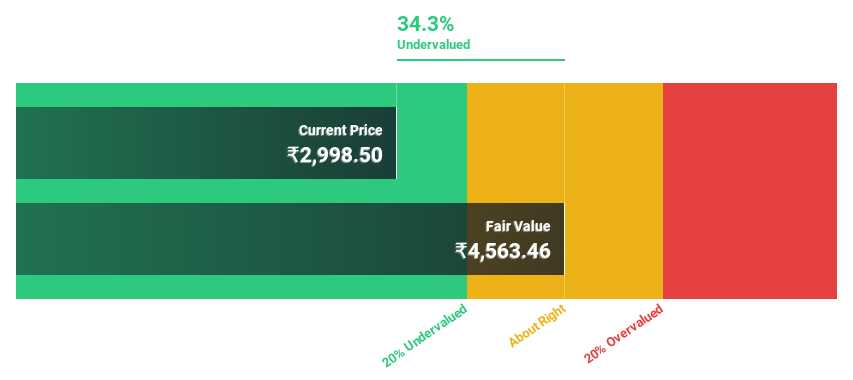

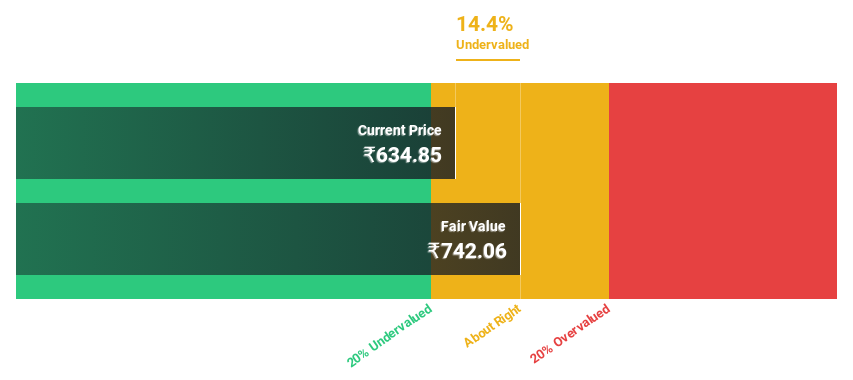

Estimated discount to fair value: 14.7%

Quess Corp. is trading at ₹625.6, below its estimated fair value of ₹733.22, reflecting potential undervaluation in the market. Despite a challenging dividend history and significant insider selling recently, Quess’s earnings have grown 23.8% in the past year, with forecasts suggesting robust annual growth of 27.61%. The recent strategic appointment of Mr. Gurmeet Chahal as CEO of Quess Global Technology Solutions could increase the company’s focus on lucrative sectors such as healthcare and financial services through advanced technologies such as AI and analytics.

Overview: Rajesh Exports Limited operates in India and is engaged in refining, manufacturing, wholesaling and retailing of gold and diamond jewellery and various gold products. Its market capitalization is around Rs 91.74 billion.

Operations: The company generates a turnover of Rs 28.09 billion from its gold products segment.

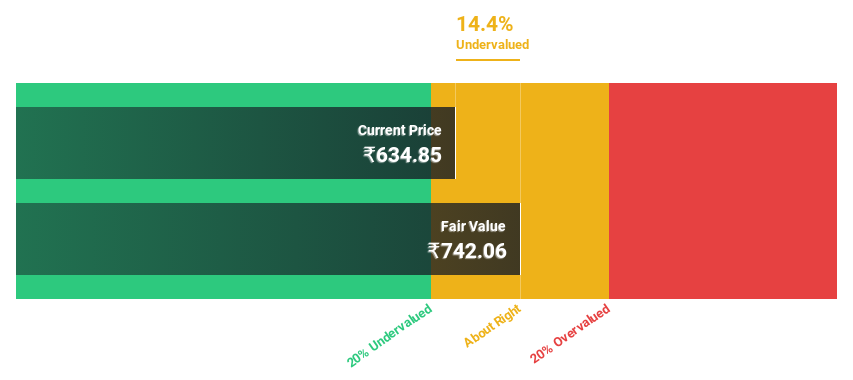

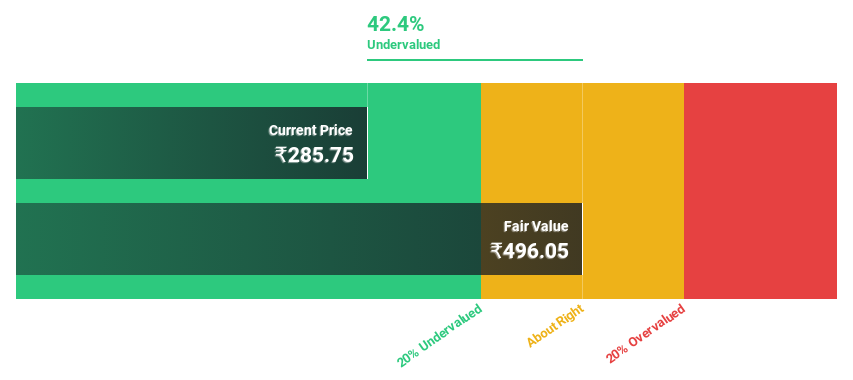

Estimated discount to fair value: 39%

Rajesh Exports is priced at ₹309.5 million, 39% below its fair value of ₹507.53 million, suggesting significant undervaluation based on cash flows. Despite a modest return on equity of 8.2%, the company’s earnings are expected to grow at an annual rate of 31.7% over the next three years, outpacing the Indian market’s growth rate of 15.9%. However, profit margins have fallen to just 0.1% from 0.4% last year, suggesting potential efficiency issues.

Summarize everything

Interested in other options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include NSEI:GODREJPROP, NSEI:QUESS and NSEI:RAJESHEXPO.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]