Top 3 stocks expected to be worth less than their true value in June 2024

As global markets continue to navigate a mix of political chaos in Europe and mixed economic signals from major economies, investors are keeping a close eye out for investment opportunities that may be undervalued in such a volatile environment. In this context, identifying stocks that are valued below their true worth could provide potential investment opportunities for those looking to invest in current market conditions.

The 10 most undervalued stocks based on cash flow

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Kuaishou Technology (SEHK:1024) | HK$49.35 | HK$98.60 | 49.9% |

| Noble (NYSE: NE) | 44.55 dollars | 88.41 US dollars | 49.6% |

| RaySearch Laboratories (OM:RAY B) | 140,00 SEK | 279,05 SEK | 49.8% |

| Component (HLSE:CTH1V) | 3,05 € | 6,07 € | 49.8% |

| Cloudia Research (BIT: AGAIN) | 2,90 € | 5,79 € | 49.9% |

| Guerbet (ENXTPA:GBT) | 36,10 € | 71,57 € | 49.6% |

| Interojo (KOSDAQ:A119610) | 24900,00 € | 49536,65 € | 49.7% |

| Musti Group Oyj (HLSE:MUSTI) | 25,40 € | 50,47 € | 49.7% |

| HeartCore Enterprises (NasdaqCM:HTCR) | 0.7092 US dollars | 1.40 euros | 49.5% |

| Deckchairs (AIM:LGRS) | 2,68 € | 5,33 € | 49.7% |

Click here to see the full list of 953 stocks from our Undervalued Stocks Based on Cash Flow screener.

Here’s a look at some of the choices from the screener

Overview: UPM-Kymmene Oyj operates worldwide in the forest-based bioindustry and has a market capitalization of approximately EUR 18.11 billion.

Operations: UPM-Kymmene Oyj’s sales are generated in several segments, including UPM Energy (EUR 0.68 billion), UPM Fibres (EUR 3.22 billion), UPM Plywood (EUR 0.40 billion), UPM Raflatac (EUR 1.50 billion), UPM Specialty Papers (EUR 1.48 billion) and UPM Communication Papers (EUR 3.32 billion).

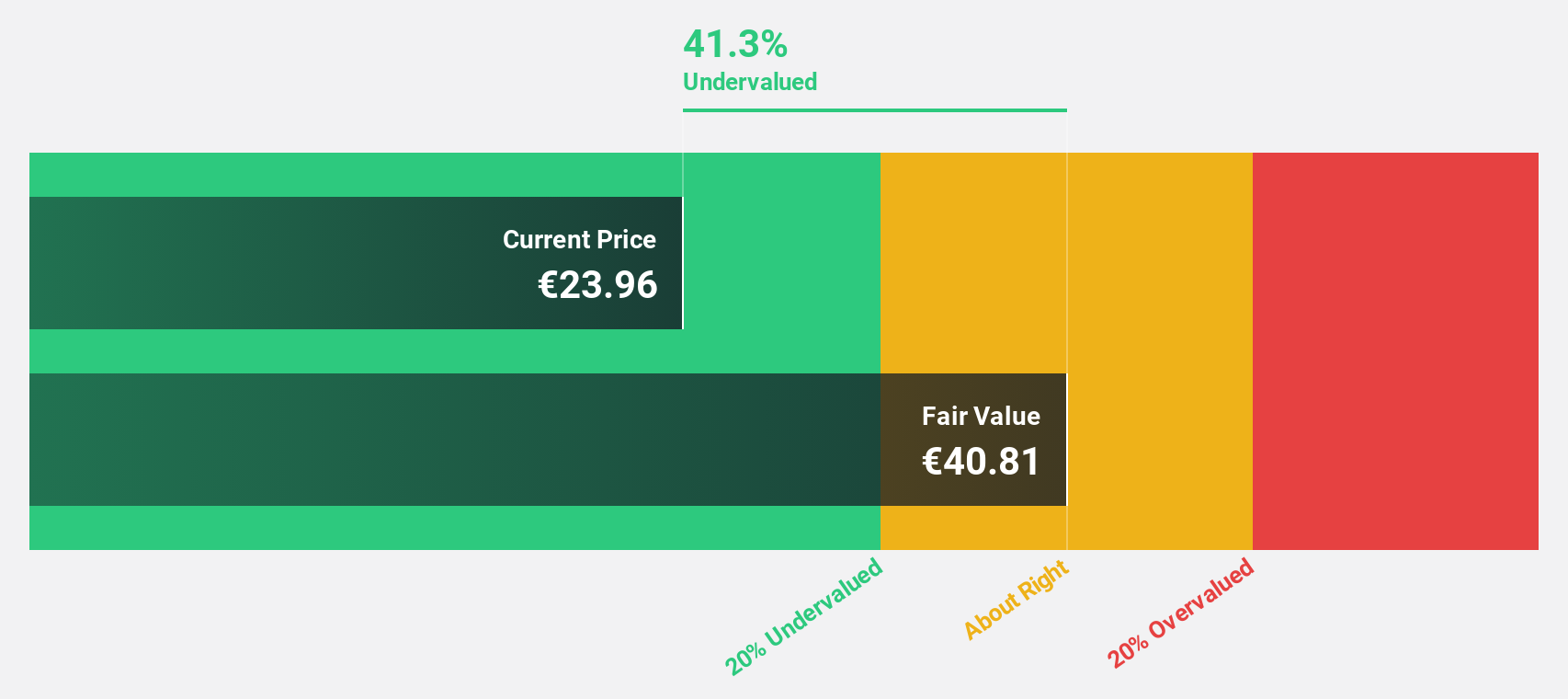

Estimated discount to fair value: 25.5%

UPM-Kymmene Oyj is considered undervalued at €33.95, with fair value estimated at €45.56 based on discounted cash flow analysis. Despite slower sales growth forecasts of 3.8% annually versus 3.1% in the Finnish market, UPM’s earnings are expected to grow 22.8% annually, outperforming the local market’s forecast of 14.8%. However, current dividend coverage is weak and profit margins have fallen to 4.7% from 13.1% last year. Recent leadership changes and a stable dividend policy may influence future performance dynamics.

Overview: AIA Group Limited, together with its subsidiaries, provides life insurance-based financial services and has a market capitalization of approximately HK$622.20 billion.

Operations: The company generates HK$19.76 billion from its life insurance business.

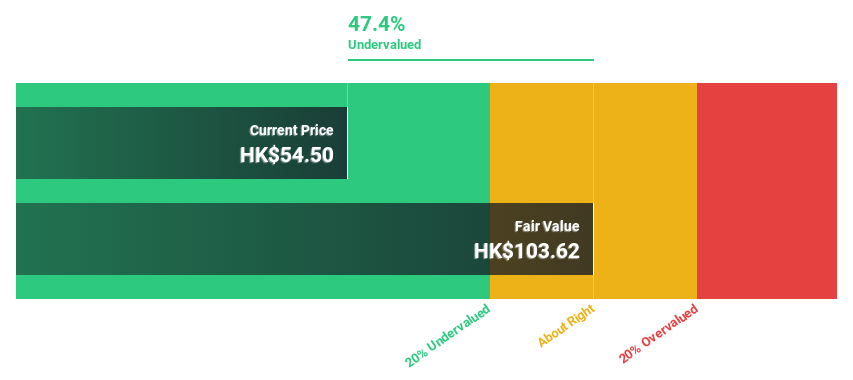

Estimated discount to fair value: 37.5%

AIA Group trades at HK$55.8, with a fair value of HK$89.35. On a discounted cash flow basis, the company is considered undervalued, with a potential for price appreciation of 69.1% according to analyst consensus. The company’s earnings are expected to grow at 17.1% annually, outpacing the Hong Kong market growth rate of 11.6%. Recent strategic share buybacks to increase shareholder value underscore the company’s proactive management approach, given robust revenue growth forecasts of 26.4% annually, significantly outperforming the local market forecast of 7.8%.

Overview: Dino Polska SA operates a network of medium-sized food supermarkets in Poland with a market capitalization of approximately PLN 39.88 billion.

Operations: The company’s main source of income is its retail network, which generates sales of PLN 26.79 billion.

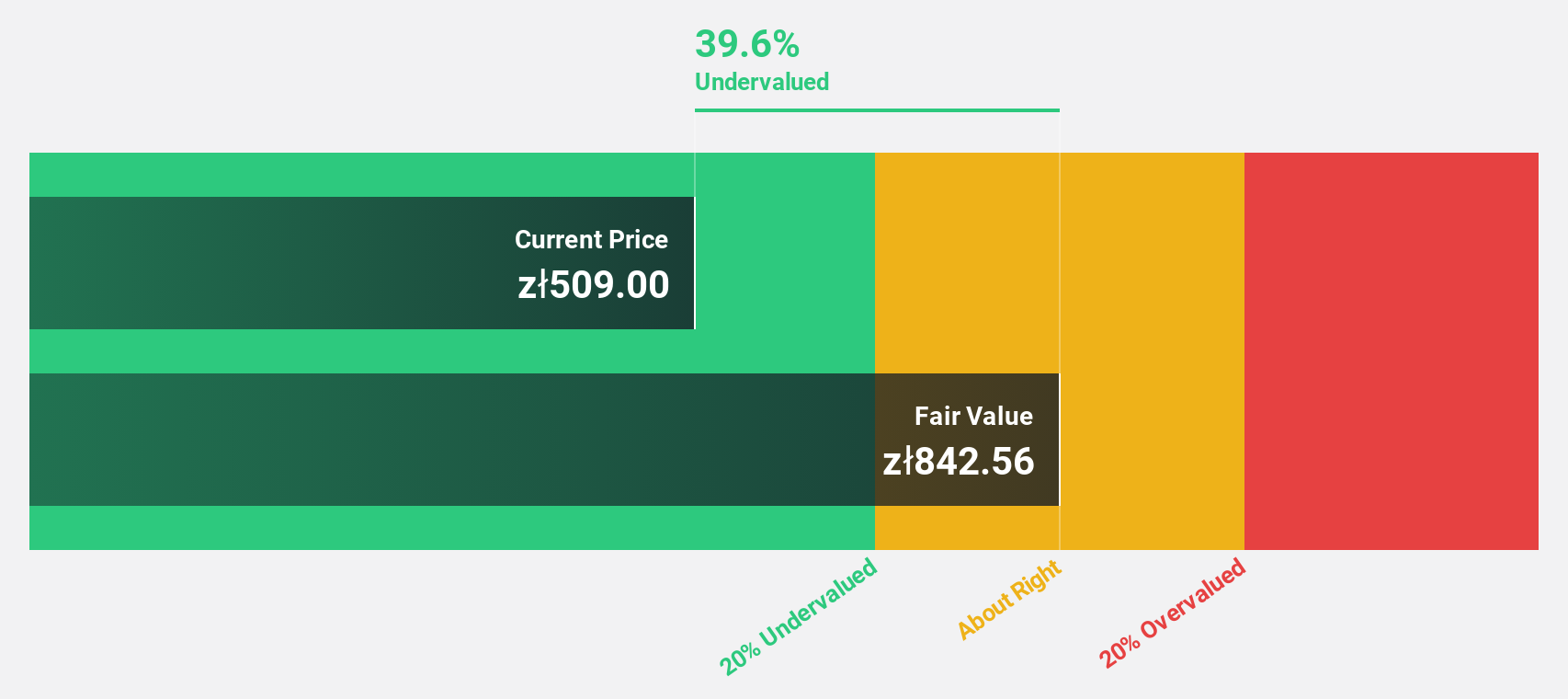

Estimated discount to fair value: 32.5%

Dino Polska SA is considered undervalued with a current trading price of PLN 406.8, trading 32.5% below its calculated fair value of PLN 602.38. This valuation comes against the backdrop of strong financial performance, including year-on-year net profit growth and significant store expansions, reflecting an aggressive growth strategy. The company’s earnings are expected to grow 18.72% annually, outperforming the forecast growth of the Polish market. Despite robust revenue and earnings growth rates that outperform the market average, Dino’s stock remains attractively valued based on cash flow analysis.

Make it happen

Are you thinking about other strategies?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if UPM-Kymmene Oyj may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]