Medy-Tox and two other stocks that may trade below estimated value

The South Korean market has shown modest growth of 6.5% over the past year, with a stable performance over the past week and expectations of significant earnings growth in the near future. In this context, identifying potentially undervalued stocks offers investors the opportunity to potentially profit from companies poised for appreciation amid these promising economic conditions.

The 10 most undervalued stocks in South Korea based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Ilyin Electric Ltd (KOSE:A103590) |

28400,00 € |

55805.48₩ |

49.1% |

|

Caregen (KOSDAQ:A214370) |

23,700.00 € |

44549,16 € |

46.8% |

|

Revu (KOSDAQ:A443250) |

10700,00 € |

20,682.89 € |

48.3% |

|

Anapass (KOSDAQ:A123860) |

27700,00 € |

48,758.49 € |

43.2% |

|

NEXTIN (KOSDAQ:A348210) |

63800,00 € |

109556,59 € |

41.8% |

|

KidariStudio (KOSE:A020120) |

4185,00 € |

7315,35 € |

42.8% |

|

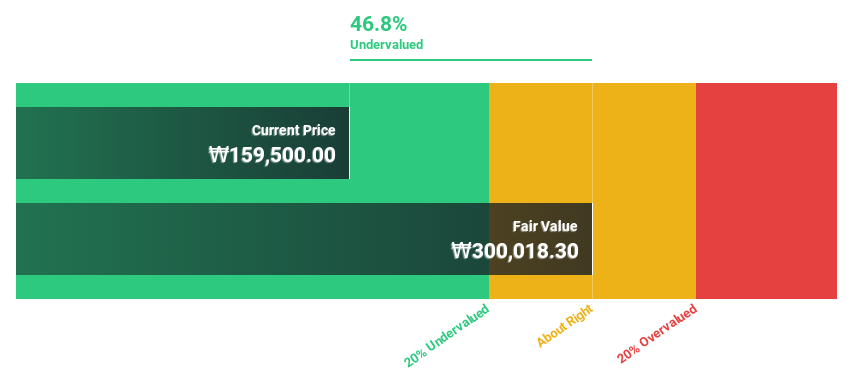

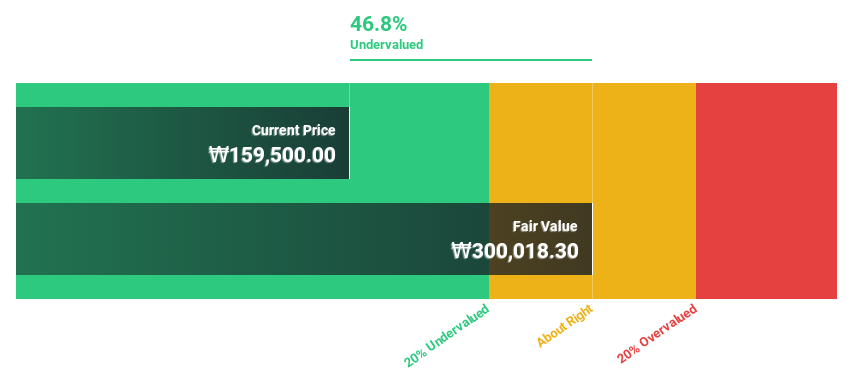

Medy-Tox (KOSDAQ:A086900) |

₩159500.00 |

300018,30 € |

46.8% |

|

Genomictree (KOSDAQ:A228760) |

22800,00 € |

38889,40 € |

41.4% |

|

Lutronic (KOSDAQ:A085370) |

36700,00 € |

63217,94 € |

41.9% |

|

SK Biopharmaceuticals (KOSE:A326030) |

83000,00 € |

149,772.41 € |

44.6% |

Click here to see the full list of 38 stocks from our Undervalued KRX Stocks Based on Cash Flows screener.

Here we highlight a subset of our favorite stocks from the screener.

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea with a market capitalization of approximately ₩1.07 billion.

Operations: The company, which specializes in biopharmaceuticals, is valued at around ₩1.07 billion.

Estimated discount to fair value: 46.8%

Medy-Tox currently trades at ₩159,500, well below its estimated fair value of ₩300,018.30. Despite recent financial setbacks with a shift from net profit to net loss as reported in the first quarter of 2024, the company is expected to deliver robust earnings growth of 68.3% annually over the next three years. Although revenue growth forecasts are modest at 12.4% per year and return on equity is expected to remain low at 11.7%, the stock’s significant discount suggests potential for re-rating if forecast earnings gains materialize.

Overview: ISC Co., Ltd. is a global company that designs, manufactures and sells semiconductor test sockets and has a market capitalization of approximately ₩1.23 billion.

Operations: The international company focuses on the development, production and distribution of test sockets for semiconductors.

Estimated discount to fair value: 22%

ISC Co., Ltd. reported a significant increase in net profit from KRW 11.04 billion last year to KRW 15.79 billion in Q1 2024, with revenue falling to KRW 873.51 million from KRW 2.20 billion. Despite lower profit margins and shareholder dilution last year, ISC trades at ₩60,200, well below its estimated fair value of ₩77,213. Analysts expect an impressive revenue growth rate of 22.7% annually and forecast earnings growth of 44% annually, outperforming the Korean market average.

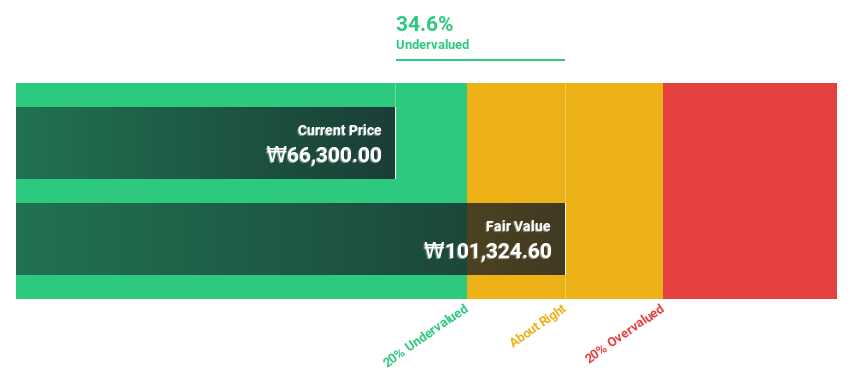

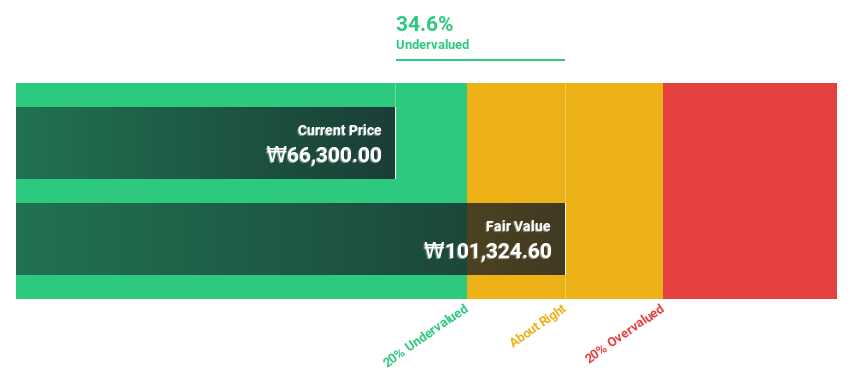

Overview: NEXTIN, Inc. is a South Korean company specializing in the manufacture of defect inspection and measurement systems for the semiconductor and display industries and has a market capitalization of approximately ₩654.92 billion.

Operations: The company generates sales of ₩103.59 billion from its semiconductor equipment and services business.

Estimated discount to fair value: 41.8%

NEXTIN, Inc. has a solid financial position following a recent private placement and share acquisition by KCGI Co., Ltd. As of the end of 2023, the company reported revenue of KRW 87.93 billion and net income of KRW 30.93 billion, representing high-quality results with significant non-cash components. Despite trading at ₩63,800 – 41.8% below its estimated fair value of ₩109,556.59 – NEXTIN is poised for significant growth with expected revenue increases exceeding the Korean market average and forecast earnings growth of over 20% annually over the next three years.

Turning ideas into action

-

Start your investing journey here with our pick of “38 Undervalued KRX Stocks Based on Cash Flows.”

-

Are you a shareholder in one or more of these companies? Make sure you’re never caught off guard by adding your portfolio to Simply Wall St and receive timely alerts about important stock developments.

-

Discover a world of investment opportunities and access unparalleled stock analysis across all markets with Simply Wall St.’s free app.

Looking for other investments?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include KOSDAQ:A086900KOSDAQ:A095340KOSDAQ:A348210.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]