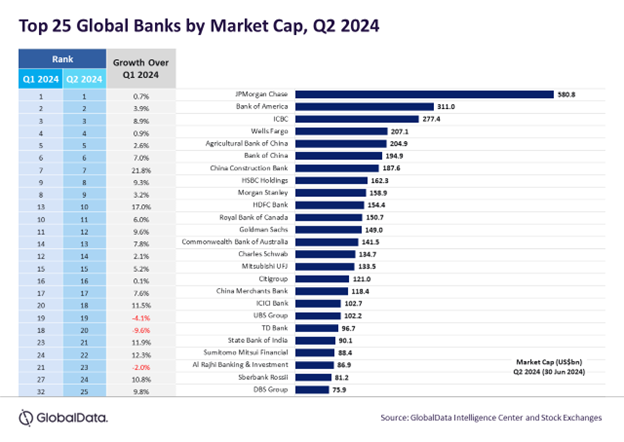

According to GlobalData, the 25 largest global banks will increase their market value by 5.4% in the second quarter of 2024

The aggregate market capitalization (MCap) of the top 25 global banks rose 5.4% quarter-on-quarter (QoQ) to $4.11 trillion in the second quarter (Q2) ended June 30, 2024, on favorable global economic signals. Shares of China Construction Bank and HDFC Bank posted growth of over 15%, while TD Bank saw a decline of nearly 10% in market value. JPMorgan Chase retained its position as the most valuable bank for the ninth consecutive quarter, reflecting robust performance in an evolving economic environment, according to GlobalData, publisher of RBI.

Murthy Grandhi, Company Profiles Analyst at GlobalData, commented, “The bullish sentiment among investors is driven by an expected rate cut by the Federal Reserve in September 2024. The US economy, on the other hand, has proven resilient, with real GDP growth increasing from 1.9% in 2022 to 2.5% in 2023. Growth is forecast to reach 2.1% in 2024, even after GDP declined from 3.4% in Q4 2023 to 1.4% in Q1 2024.

“The Federal Reserve’s forecast GDP growth of 2.1% for 2024 is due to a possible soft landing as inflation approaches the 2% target. Overall, investors remain optimistic about bank stocks as benchmark interest rates in the 5.25%-5.5% range stabilize deposit costs, thus easing pressure on net interest margins. A strong economy and an expected slight improvement in lending could provide banks with stable net interest income.”

China Construction Bank (CCB)

CCB’s share value rose 21.8% in the second quarter of 2024, driven by its solid capitalization and attractive valuations. This increase comes on the back of a solid first quarter of 2024, in which the bank reported a CNY1.17 trillion increase in gross loans and advances to customers from the previous fiscal year ended December 31, 2023. In addition, financial investments increased by CNY247.151 billion, while customer deposits increased by CNY1.71 trillion.

HDFC Bank

HDFC Bank’s market value increased by 17% to reach an MCap of $154.4 billion by the end of Q2 2024. Strong quarterly results that met investor expectations and increasing optimism about the bank’s future performance were the catalysts. HDFC Bank is expected to regain its industry-leading profitability, benefiting from an improved loan mix and normalized funding costs.

Grandhi continued, “JPMorgan Chase further cemented its status as the world’s leading bank with another quarter of strong results. The company reported a 9% increase in net revenue to $41.9 billion compared to the first quarter of 2023. This growth was primarily due to an 11% increase in net interest income, driven by the acquisition of First Republic, as well as a 7% increase in noninterest income, driven by higher asset management fees and lower net losses on securities investments in the Treasury and Chief Investment Office businesses.”

Access the most comprehensive company profiles on the market, powered by GlobalData. Save hours of research. Gain a competitive advantage.

Company profile – free sample

Thank you very much!

Your download email will arrive shortly

We are confident in the unique quality of our company profiles, but we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by filling out the form below.

By GlobalData

TD Bank

TD Bank’s MCap fell 9.6% quarter-on-quarter to $96.7 billion after it was investigated in the U.S. over alleged laundering of proceeds from illegal drug trafficking through its branches. TD has been under pressure to outline its next phase of growth after it ambitiously expanded into the U.S. retail business last year with the $1.3 billion acquisition of New York-based retailer Cowen Inc. The bank had also planned a $13.4 billion deal to acquire Tennessee-based First Horizon Corp., but that was abandoned after regulatory investigations into anti-money laundering violations delayed necessary approvals.

The “Big Four” Chinese banks

The market value of China’s four largest banks – ICBC, Bank of China, Agricultural Bank of China and China Construction Bank – recorded growth in the range of 3% to 22%. All of these banks recorded a decline in net interest margins in the quarter ended March 2024 due to various factors, including a cut in the benchmark interest rate and low market interest rates.

Grandhi concludes: “Global banks’ performance in the second half of 2024 will be shaped by several key factors, including economic conditions, monetary policy and inflation. Geopolitical factors, including trade tensions and conflicts, could affect international operations and market stability. Regulatory scrutiny, such as that seen at TD Bank, will also impact strategic initiatives and performance. Overall, while challenges remain, the combination of potential interest rate cuts, economic resilience and technological advances could benefit global banks.”