District council delays decision on tax exemption regulation for mobile homes

Kosciusko County Council members wanted to hear the public’s input on an ordinance to exempt mobile and manufactured homes from property taxes at their meeting Thursday, but only two people spoke.

After the public hearing, the council voted 4-2 not to take any action on it, instead deciding “to take no action until we have more numbers on costs and revenues for 2024. We will send a notice on this sheet to all entities (that received tax revenues from the mobile home tax in 2023) that we want to discuss this and want their input on it.”

The notices are sent by the Court of Auditors to the tax authorities.

The council members who voted to delay the ordinance without a definite timeline were Tony Ciriello, who made the motion, Dave Wolkins, Council President Mike Long and Vice President Kathy Groninger. Councilwomen Joni Truex and Kimberly Cates voted against. Councilwoman Sue Ann Mitchell was absent.

The regulation would exempt the assessment of personal property from mobile homes. Mobile homes assessed as real property would not be included.

County Assessor Gail Chapman and Treasurer Michelle Puckett first presented the ordinance to the council on April 4, but because Senate Bill 183 did not take effect until July 1, the council could not vote on it until after July 1. The two women presented it to the council again at their July 3 information meeting and said the ordinance would be up for adoption and there would be a public hearing on it at the next council meeting on Thursday. A legal notice was published about the public hearing.

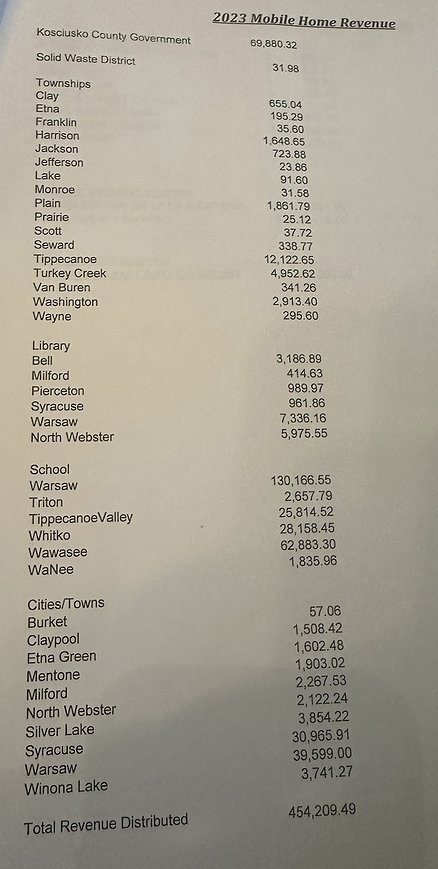

Shown is a list of 2023 mobile home revenues provided to all taxing authorities in Kosciusko County. Although the total is $454,209.49, it is estimated that 30-35% of mobile home owners do not pay their taxes on their mobile homes. Photo by David Slone, Times-Union

Shown is a list of 2023 mobile home revenues provided to all taxing authorities in Kosciusko County. Although the total is $454,209.49, it is estimated that 30-35% of mobile home owners do not pay their taxes on their mobile homes. Photo by David Slone, Times-UnionIn introducing Ordinance SEA 183, Puckett and Chapman provided council members with an information packet, including “a brief overview of all the steps that mobile home ownership goes through within the county, the various offices that are affected by it, and what we all do or don’t do with it depending on whether they (the taxes) are collected or not.” In the event that the taxes are not collected, they also provided the council with an extended time frame for the courts to certify collections and judgments.

The council was presented with data from 2023, the last complete data the county has on mobile homes. This data included tax dollars collected from mobile homes and the breakdown of how those dollars were distributed to taxing authorities.

“So for 2023, it’s $454,209.49,” Puckett said. “I would remind you that these amounts are not taken into account when setting tax rates or when the DLGF (Department of Local Government Finance) approves the budget. These revenues are not included because they are not a reliable source of revenue. You can’t rely on them, you never know how much you will collect and how much you won’t.”

Cates said: “So, fundamentally, the assessment costs us money, and that’s why we decided to do it. Isn’t that right, bottom line?”

Puckett said yes, and the state offered the opportunity to bring the exemption before the council later this year, but it has been discussed for years.

Ciriello asked which direction other counties would go with SEA 183. Puckett said the larger counties like Marion, St. Joe and Allen are “clearly opposed” because mobile homes bring them millions in tax revenue. The smaller counties will definitely adopt it, but Puckett said Kosciusko County is somewhere in between.

“We do generate some income, but it also costs us something, so I think our situation is a little more difficult. There’s no simple yes or no, so we’ve given you the information we have so you can consider all the aspects,” Puckett explained.

As for the county government’s revenue from mobile homes, she said they would “definitely pay double what we collect in revenue.” The revenue loss to the county is about .002%, she said, and the revenue is “just bonus dollars that you really can’t count on collecting.”

Cates asked Puckett for her opinion on the exemption. Puckett said she would agree because she understood the expenses and revenues.

Groninger asked if anyone had approached the schools about the issue. Puckett said no one had approached the schools specifically, but this was the third month they had been having the discussion about it, the media had covered it and no taxing agency had ever questioned the mobile home tax exemption proposal during tax time and since the council began discussing it.

Wolkins said that according to the Legislative Service Agency (LSA), Kosciusko County could lose $759,000 in 2025. He asked what that amount could be this year. Puckett explained that $454,000 is the amount of revenue the county actually took in from mobile homes in 2023. She wasn’t sure what numbers the LSA used for its estimates, but if the LSA looked at 100% of bills, only 65 to 70% of mobile home owners actually paid their tax bills. The $454,000 is also before the county’s expenses.

“Thirty to 35 percent don’t pay, and then the private ownership rights to mobile homes are included in the judgments and certified in court,” Puckett said. If it were easy to collect 100 percent, as LSA projects, the county would always collect 100 percent and then there would be no talks about the exemption.

In fiscal year 2023, there were 3,211 active mobile homes in the county, according to Chapman and Puckett data. Of those, 70% paid their taxes and 30% did not. There were 8,498 court-certified judgments and 17,976 active accounts in collection.

Wolkins said when people heard about the exemption, he hadn’t heard of anyone who thought it was a good idea. Given the possibility of taxing entities that lose revenue from the exemption, particularly schools, he said he’s not sure the county should do it.

According to information provided by Chapman and Puckett on the revenues school districts received from the mobile home tax in Kosciusko County in 2023, Warsaw received $130,166.55, Triton $2,657.79, Tippecanoe Valley $25,814.52, Whitko $28,158.45, Wawasee $62,883.30 and WaNee $1,835.96.

Chapman responded to Wolkins: “The commercial and industrial tax rates have gone up by – I would say – over $300 million in total, so some of that is being reduced by appeals. We have 107 appeals. But even if we settle some of those appeals, all of the tax rates on those major things will be higher, so the tax revenue coming into the county from those businesses alone will more than offset Warsaw’s losses on mobile home taxes.”

When the hearing opened to the public, no one spoke in favor of the exemption. Local businessman Don Zolman asked a question about including manufactured homes, and Chapman said the exemption would only apply to homes in mobile home parks, not manufactured homes, which would be taxed as real estate. Rachael Rhoades, Republican candidate for a seat on the county council, spoke against the exemption because it could mean a loss of revenue for schools.

After the hearing was closed to the public, Ciriello said he received phone calls, text messages and emails opposing the exemption. He said he, like Wolkins, could not support it.

At the July 3 meeting, Long had expressed a desire for anyone for or against the exemption to come to Thursday’s meeting and voice their opinion. On Thursday, he pointed out that only two had shown up, and he said that was disappointing.

“I personally haven’t had any emails, texts or conversations – except one at the Meijer store, but I found that out myself. … I find that disappointing,” Long said.

Cates said she respects the financial situation of all other agencies, but “financially, we have an obligation to our constituents in the district we serve. So when our elected officials, the department heads, say it’s not a good financial decision for us to continue like this, then I feel like we have to take that seriously.”

Long said the towns, schools and all other facilities are part of the county and that they would face a total revenue loss of more than $450,000.

Groninger suggested postponing the regulation to give people more opportunity to express their opinions.

Ciriello made the first motion to postpone the discussion until the first half of 2025 so that the 2024 data could be reviewed. Wolkins supported the motion.

Chapman commented, “That’s why I feel like you’re not listening to me at all. That annoys me. I listen to the other people, and I appreciate that, but you’re not listening to me. And so be aware that if we postpone this, I’ll have to hire another employee for the department below. So if you decide to postpone it until next year and then get rid of it, I’ll have to figure out something for another employee. I already have three employees and a plan for them.”

She said she didn’t have room for a fourth person in her office.

“So please think about the whole thing, not just the amount that will be lost. Think about the whole thing,” Chapman explained.

Truex asked if there would be a big difference between mobile home tax revenues in 2023 and 2024, and Chapman said no.

There was some discussion about whether Ciriello should amend his motion. He said if he were to amend it, his amendment would be to remove the exemption entirely and not reconsider it until the state requires the county to do so. However, he ultimately amended the motion as stated and the council approved it 4-2.