Is American Water Works Company, Inc. (NYSE:AWK) creating value for shareholders?

While some investors are already familiar with financial ratios (hats off to them), this article is for those who want to learn more about return on equity (ROE) and what it means. To keep the lesson practical, we’ll use ROE to better understand American Water Works Company, Inc. (NYSE:AWK).

Return on equity or ROE is an important factor for a shareholder to consider as it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio that measures the return on the capital provided by the company’s shareholders.

Check out our latest analysis for American Water Works Company

How do you calculate return on equity?

ROE can be calculated using the following formula:

Return on equity = Net profit (from continuing operations) ÷ Equity

Based on the above formula, the ROE for American Water Works Company is:

9.6% = $959 million ÷ $10 billion (based on the trailing twelve months ending March 2024).

The “return” is the profit over the last twelve months. You can also imagine it like this: for every dollar of equity, the company was able to generate $0.10 in profit.

Does American Water Works Company have a good return on equity (ROE)?

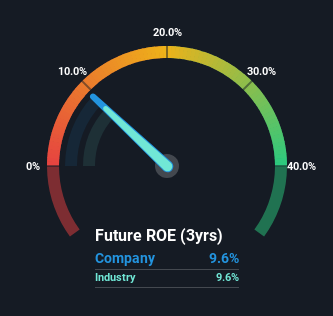

Perhaps the easiest way to determine a company’s return on equity is to compare it to the industry average. The limitation of this approach is that some companies are very different from others, even within the same industry. In the graph below, you can see that American Water Works Company’s return on equity is pretty close to the water utility industry average (9.6%).

That’s neither particularly good nor bad. While the return on equity is respectable compared to the industry, it’s worth checking whether the company’s return on equity is being helped by high levels of debt. If so, it’s more of an indication of risk than potential. You can see the two risks we’ve identified for American Water Works Company by checking out our Risk Dashboard free on our platform here.

Why you should consider debt when looking at ROE

Almost all companies need money to invest in their business and grow their profits. The money for investments can come from previous year’s profits (retained earnings), issuing new shares or borrowing. In the first and second options, the return on equity reflects this use of money for growth. In the latter case, the debt required for growth increases the return but has no impact on equity. Thus, the use of borrowing can improve the return on equity, but in the case of stormy weather, metaphorically speaking, with additional risk.

American Water Works Company’s debt and its return on equity of 9.6%

American Water Works Company actually takes on a high amount of debt to boost its returns. Its debt to equity ratio is 1.31. With a relatively low return on equity and significant leverage, it’s hard to get excited about this company right now. Investors should think carefully about how a company would perform if it could no longer borrow as easily, as credit markets change over time.

Summary

Return on equity is a useful indicator of a company’s ability to generate profits and distribute them to shareholders. A company that can generate a high return on equity without using debt can be considered a high-quality company. All other things being equal, a higher return on equity is better.

While return on equity is a useful indicator of a company’s quality, you need to consider a whole host of factors to determine the right price to buy a stock. It’s important to consider other factors too, such as future earnings growth – and how much investment is required in the future. You might want to take a look at this data-rich interactive chart showing forecasts for the company.

Naturally American Water Works Company may not be the best stock to buy. You may want to see this free Collection of other companies with high return on equity and low debt.

Valuation is complex, but we help simplify it.

Find out if American Waterworks Company may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if American Waterworks Company may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]