Verallia continues its commitment to value sharing and completes the 9th edition of its employee share ownership offer

PARIS, 21 June 2024–(BUSINESS WIRE)–Regulatory News:

Verallia (Paris:VRLA), the world’s 3rd-largest manufacturer of glass packaging for food and beverages, has opened its 9thth Employee share ownership offer. On June 20, 2024, over 3,800 employees, including 73% of French employees, signed up for this program, thus becoming partners in the development and performance of the Group. This program, which runs from May 2 to 17, 2024 in 9 countries, allows them to benefit from exclusive conditions for acquiring a stake in the Group’s capital – a 15% discount on the share price and a favorable matching contribution plan.

As in previous years, this yearth Issue confirms the success of the Group’s CSR strategy by involving its employees in the company’s development and performance. By close of business on June 20, 2024, more than 3,800 employees, or 41% of eligible employees in 9 countries, had invested in the Group, benefiting from an attractive subscription price of EUR 29.64 per unit.1Total employee investments (including the corresponding company contribution) amounted to over EUR 18.1 million.

At the close of trading, the Company had issued 611,445 new ordinary shares, representing 0.5% of the share capital and voting rights. As in previous years, the Company also reduced its capital by cancelling 611,445 treasury shares acquired under the share buyback program.2.

In just 9 years, these measures have already made almost 50% of the Group’s employees shareholders of Verallia, and more than 80% of French employees, both directly and through Verallia FCPE. Employees now own 4.5%3 of the company’s capital.

“The strong participation of our employees in this employee participation program reflects their confidence in Verallia’s strategy and strong CSR ambitions. We are very proud that in 9 years these measures have already enabled almost 50% of them to worldwide and more than 80% in France, who will become shareholders of the company directly and indirectly during this period by acquiring almost 4.5% of the capital. This operation once again demonstrates our firm commitment to sharing values.“, explained Patrice Lucas, CEO of Verallia.

About Verallia

At Verallia, our goal is to reinvent glass for a sustainable future. We want to redefine how glass is produced, reused and recycled to make it the most sustainable packaging material in the world. We work with our customers, suppliers and other partners along the value chain to develop new, useful and sustainable solutions for everyone.

With nearly 11,000 employees and 34 glass production sites in 12 countries, we are the European market leader and the third largest manufacturer of glass packaging for beverages and food worldwide. We offer innovative, tailor-made and environmentally friendly solutions to over 10,000 companies worldwide. Verallia produced more than 16 billion glass bottles and jars and achieved sales of 3.9 billion euros in 2023.

Verallia’s CSR strategy has been awarded the Ecovadis Platinum Medal, placing the Group in the top 1% of companies assessed by Ecovadis. Our objective of reducing CO2 emissions by -46% in Scopes 1 and 2 between 2019 and 2030 has been validated by the SBTI (Science Based Targets Initiative). It is in line with the objective set by the Paris Agreement to limit global warming to 1.5°C.

Verallia is listed on compartment A of the regulated market of Euronext Paris (ticker: VRLA – ISIN: FR0013447729) and is traded in the following indices: CAC SBT 1.5°, STOXX600, SBF 120, CAC Mid 60, CAC Mid & Small and CAC All-Tradable.

___________________________

1 i.e. a discount of 15% on the average Verallia share price on the Euronext Paris regulated market over the twenty trading days preceding April 30, 2024.

2 Capital increase with a nominal value of EUR 2,066,684.10, with a capital reserve of EUR 16,056,545.70. The 611,445 new ordinary shares are immediately entitled to dividends, have the same rights and obligations as shares already issued and participate in all distributable amounts without restriction or reservation. Capital reduction through cancellation of 611,445 treasury shares from the share buyback of November 3, 2021. The company’s share capital remains unchanged, with the number of shares issued corresponding to the number of shares canceled. It amounts to EUR 408,321,248.14 and consists of 120,805,103 ordinary shares with a nominal value of EUR 3.38 each.

3 After the 2024 employee share offer and after the capital increase and reduction

View original version on businesswire.com: https://www.businesswire.com/news/home/20240620949682/en/

contacts

Verallia Press

Annabel Fuder & Anne Mauvieux

[email protected] | +33 (0)1 46 34 60 60

Investor Relations at Verallia

David Placet | [email protected]

Related Posts

England vs USA: The incredible Chris Jordan scores an elusive hat-trick at the T20 World Cup. Watch | Cricket News

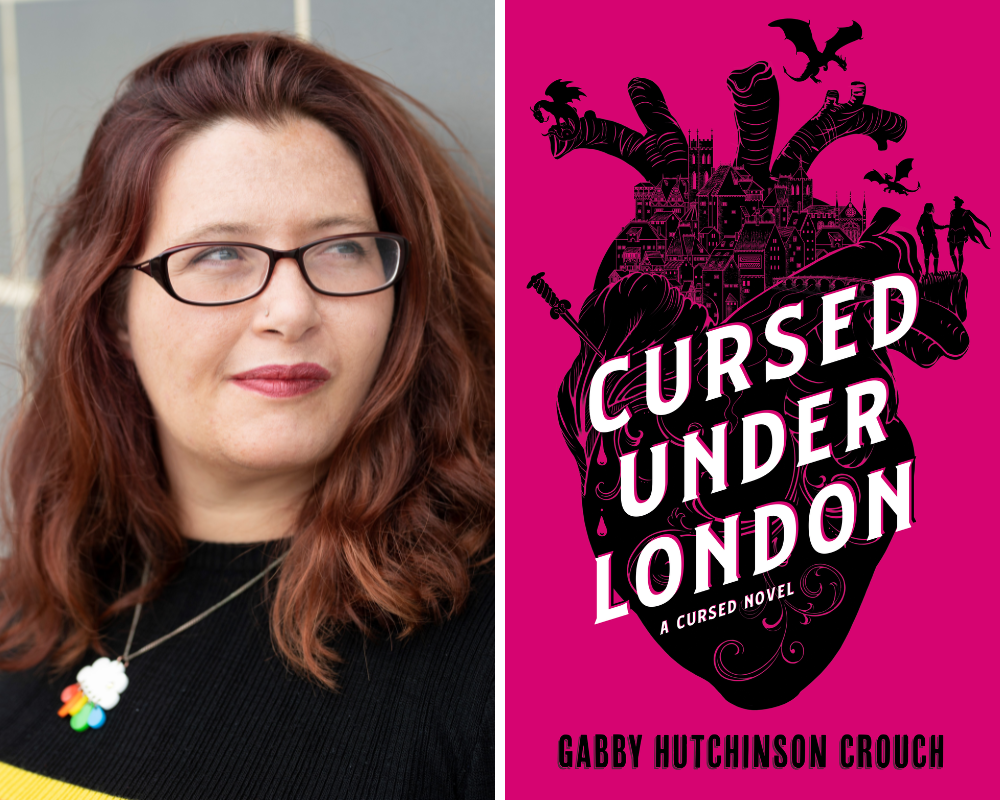

Gabby Hutchinson Crouch on her love for William Shakespeare as a fictional character