A deep dive into the … from Micron Technology

Insights into the fund’s recent portfolio adjustments and the performance of key stocks

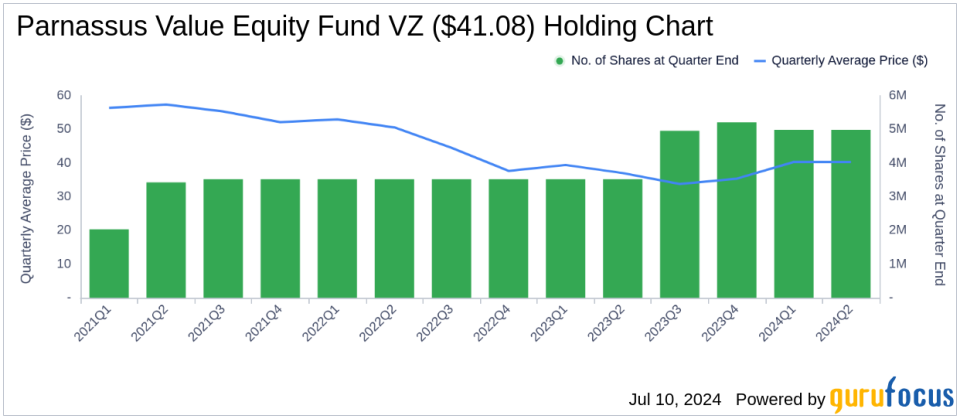

The Parnassus Value Equity Fund (Trades, Portfolio), managed by Parnassus Investments, recently submitted its N-PORT filing for the second quarter of 2024. Known for its commitment to fossil-fuel-free investing and positive work environments, the fund focuses on acquiring undervalued, out-of-favor stocks with potential for significant returns. Managed by Billy Hwan following the departure of Jerome Dodson (Trades, Portfolio) in 2020, the fund aims to outperform the S&P 500 by investing in high-quality U.S. large companies that meet strict ESG criteria.

New additions to the portfolio

The Parnassus Value Equity Fund (Trades, Portfolio) recorded a notable new addition in the second quarter of 2024:

-

The most significant new addition was Broadcom Inc (NASDAQ:AVGO) with 33,578 shares, representing 1.1% of the portfolio and a total value of $53.91 million.

Significant increases in existing positions

The fund also increased its holdings in several key stocks:

-

NICE Ltd (NASDAQ:NICE) saw an increase of 274,307 shares, bringing the total to 509,404 shares. This adjustment represents a 116.68% increase in share count and an impact of 0.96% to the current portfolio valued at $87.60 million.

-

Pfizer Inc (NYSE:PFE) increased its holdings by 1,047,972 shares, bringing its holdings to 4,233,811 shares, an increase of 32.89% and a total value of $118.46 million.

Complete outputs

The fund has completely liquidated its positions in the following areas:

-

Cisco Systems Inc (NASDAQ:CSCO) sold all 1,324,420 shares, impacting the portfolio by -1.27%.

Reduction of important investments

There were significant reductions in several investments:

-

Micron Technology Inc (NASDAQ:MU) saw a decline of 782,572 shares, a decrease of -43.56%, which impacted the portfolio by -1.76%. The stock traded at an average price of $126.02 during the quarter and has returned 11.65% over the past three months and 60.03% year-to-date.

-

American Express Co (NYSE:AXP) was reduced by 153,720 shares, a decrease of -29.38%, which impacted the portfolio by -0.67%. The stock traded at an average price of $231.59 during the quarter and has returned 10.15% over the past three months and 28.78% year-to-date.

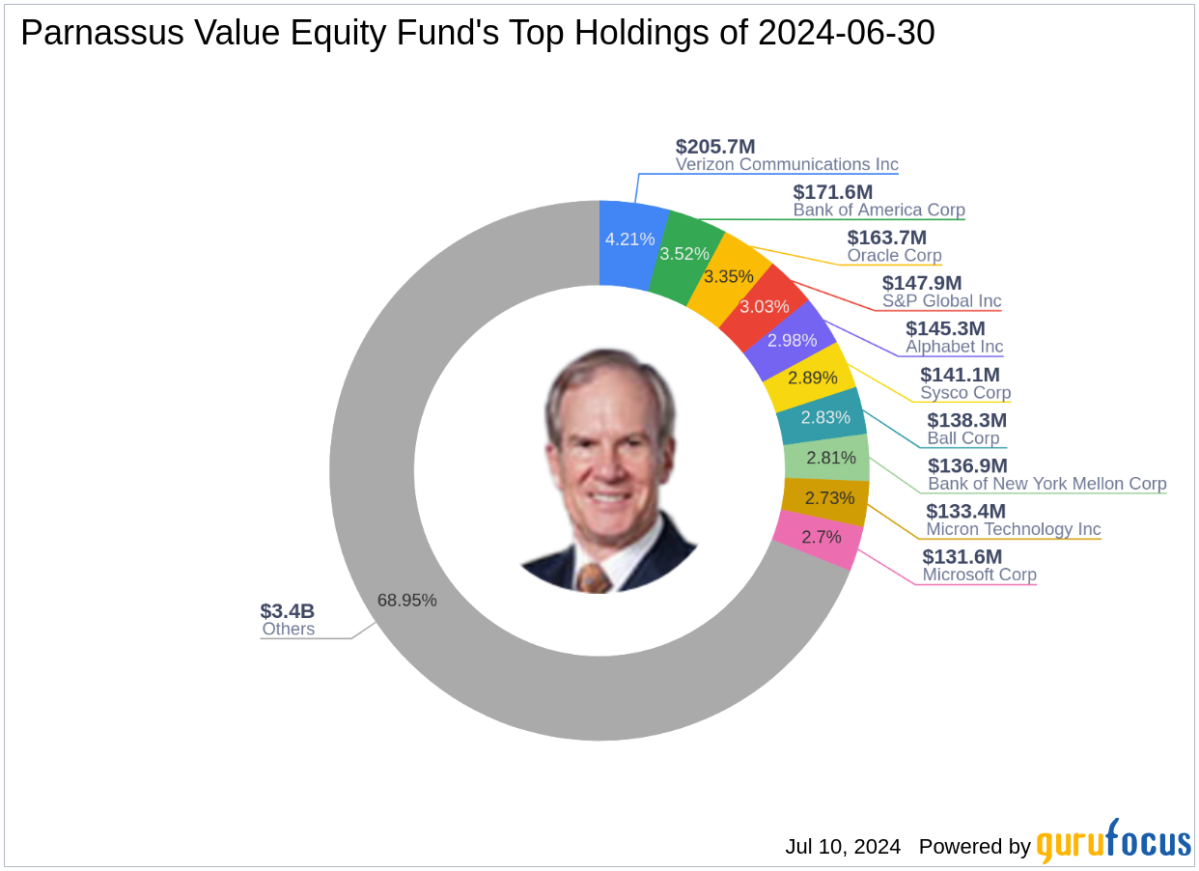

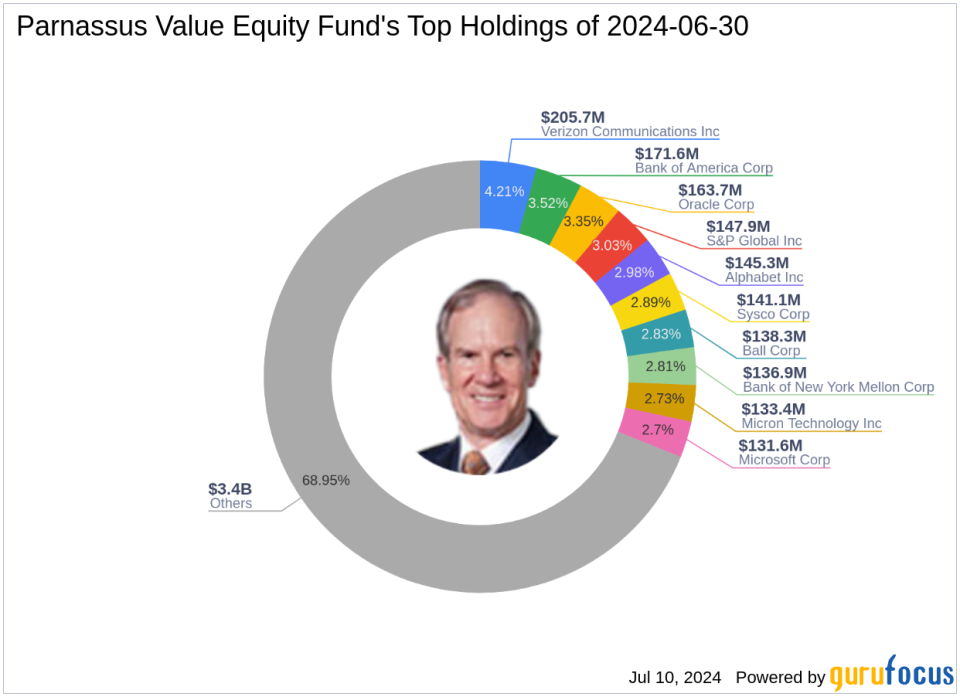

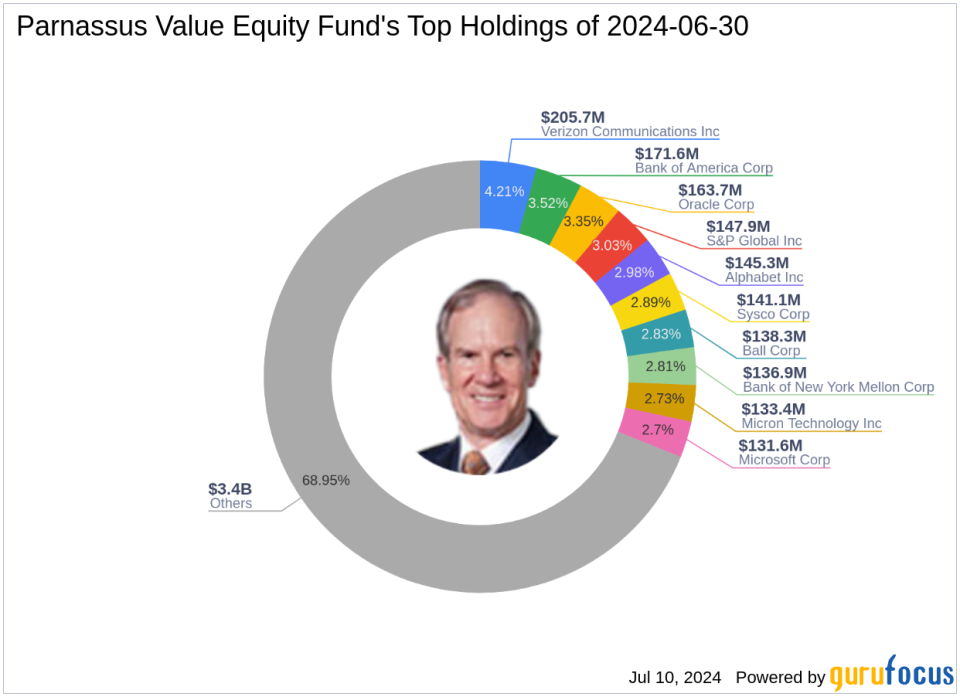

Portfolio overview

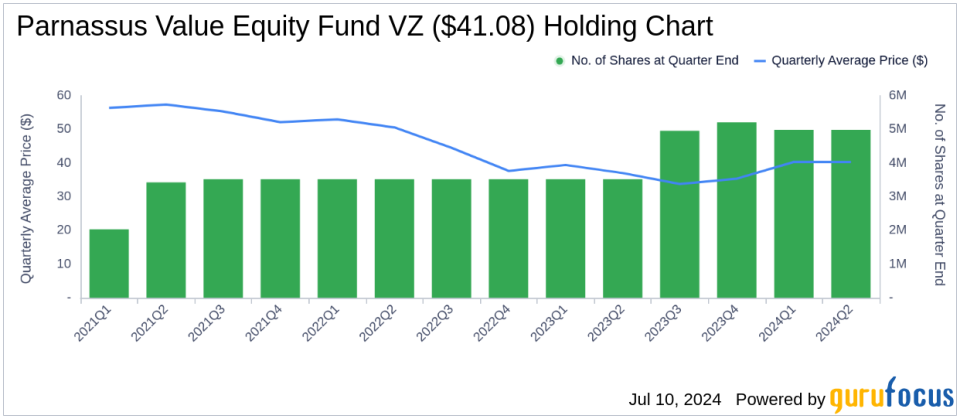

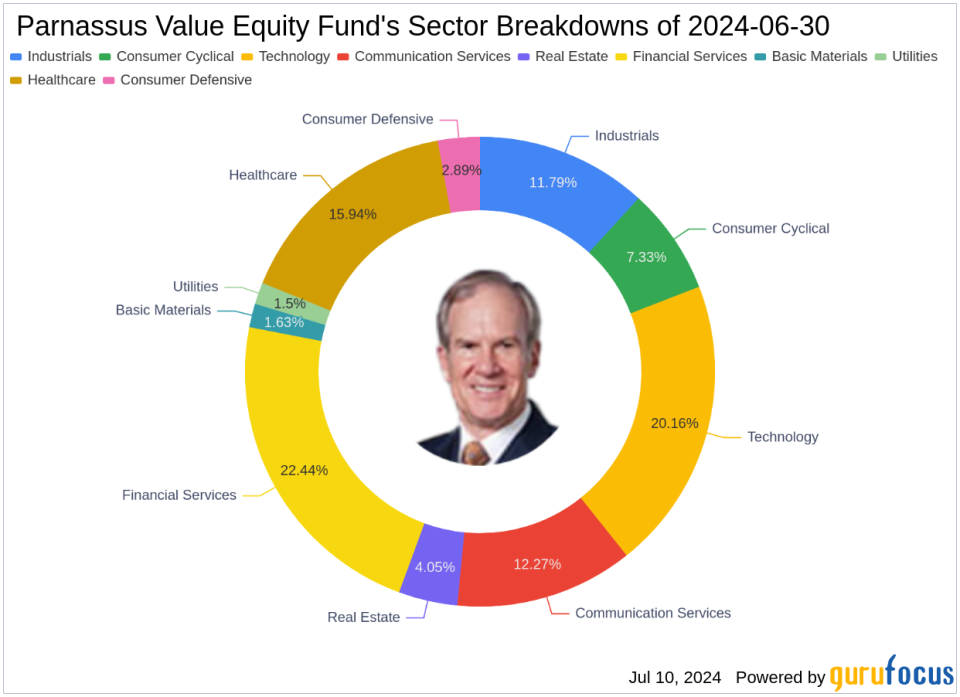

As of Q2 2024, the Parnassus Value Equity Fund (Trades, Portfolio) portfolio included 44 stocks. The largest holdings were 4.21% in Verizon Communications Inc (NYSE:VZ), 3.52% in Bank of America Corp (NYSE:BAC), 3.35% in Oracle Corp (NYSE:ORCL), 3.03% in S&P Global Inc (NYSE:SPGI), and 2.98% in Alphabet Inc (NASDAQ:GOOGL). The holdings are predominantly concentrated in 10 of the 11 industries, including financial services, technology, healthcare, and communication services.

This article created by GuruFocus is intended to provide general insights and does not constitute tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment advice. It does not contain a recommendation to buy or sell any stock and does not take into account any individual investment objectives or financial circumstances. Our goal is to provide long-term, fundamental, data-driven analysis. Note that our analysis may not include the most recent, price-sensitive company announcements or qualitative information. GuruFocus does not hold a position in the stocks mentioned here.

This article first appeared on GuruFocus.