Alnylam Pharmaceuticals and two other value stocks on the US stock exchange are expected to trade below their intrinsic value

As the S&P 500 and Nasdaq Composite continue to hit record highs, driven by strong tech performance and rate cut expectations, investors are closely watching the market for opportunities. In this environment, it could be particularly interesting to identify stocks that appear undervalued relative to their intrinsic value.

The 10 most undervalued stocks in the US based on their cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Hanover Bancorp (NasdaqGS:HNVR) |

$16.18 |

31,97 € |

49.4% |

|

Lazard (NYSE:LAZ) |

39,91 € |

$78.79 |

49.3% |

|

Victory Capital Holdings (NasdaqGS:VCTR) |

47,30 € |

$92.71 |

49% |

|

Array Technologies (NasdaqGM:ARRY) |

9,44 € |

18,59 € |

49.2% |

|

Daqo New Energy (NYSE:DQ) |

$15.48 |

$30.43 |

49.1% |

|

AppLovin (NasdaqGS:APP) |

$84.71 |

$165.42 |

48.8% |

|

Hexcel (NYSE: HXL) |

$64.11 |

$127.33 |

49.7% |

|

APi Group (NYSE:APG) |

$36.48 |

$71.48 |

49% |

|

Hecla Mining (NYSE:HL) |

$5.27 |

$10.53 |

49.9% |

|

Zillow Group (Nasdaq:ZG) |

$46.35 |

$92.65 |

50% |

Click here to see the full list of 180 stocks from our Undervalued U.S. Stocks Based on Cash Flow screener.

Below we present a selection of stocks that our filter has filtered out.

Overview: Alnylam Pharmaceuticals, Inc. is a biopharmaceutical company engaged in the discovery, development and commercialization of novel therapeutics based on ribonucleic acid interference and has a market capitalization of approximately $32.27 billion.

Operations: The company generates its revenue primarily through the discovery, development and commercialization of RNAi therapeutics; total revenues amount to approximately $2.00 billion.

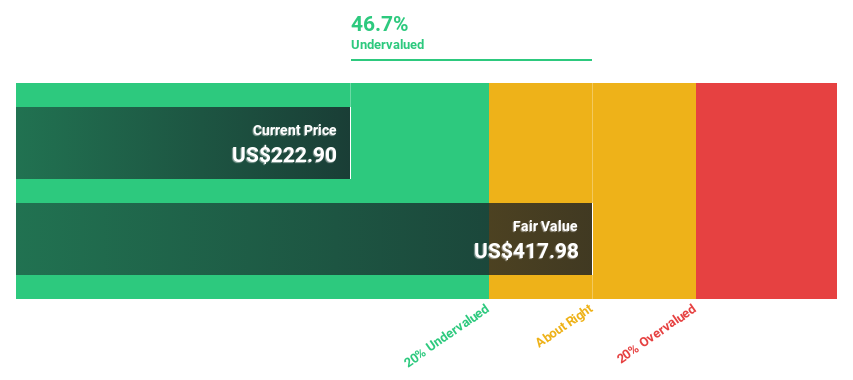

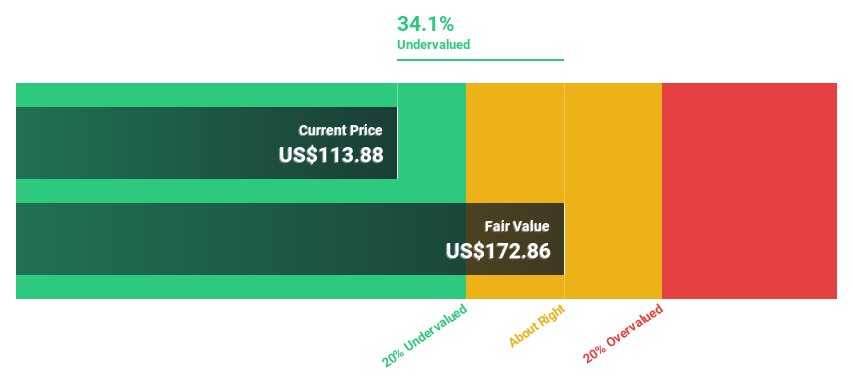

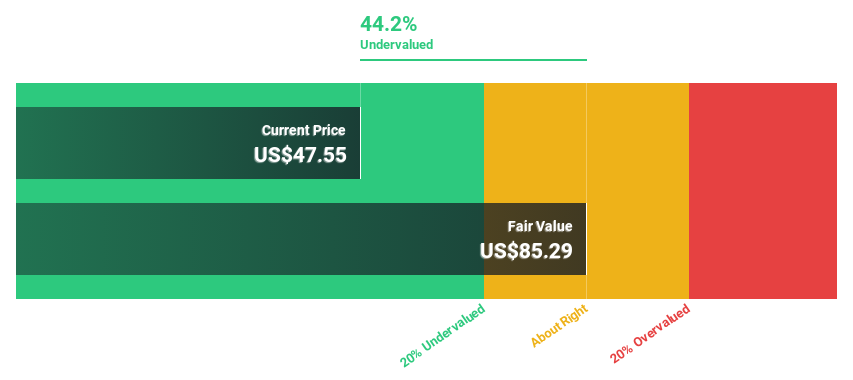

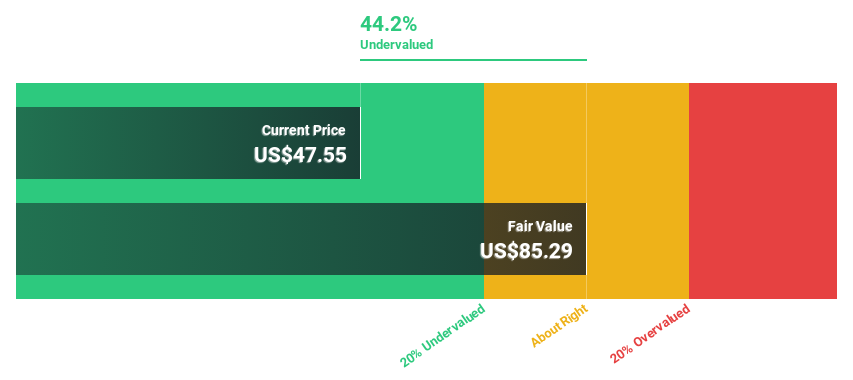

Estimated discount to fair value: 48%

Currently trading at $254.74, Alnylam Pharmaceuticals is significantly undervalued with an estimated fair value of $489.82 according to DCF analysis, meaning it is trading more than 20% below its fair value. Recent positive Phase 3 trial results for Vutrisiran suggest potential future revenue streams and market expansion, and underpin the high expected revenue growth rate of 19.5% per year compared to the market’s 8.7%. Despite this potential, the stock remains highly volatile and there has been significant insider selling recently.

Overview: DoorDash, Inc. operates a global commerce platform that connects merchants, consumers, and independent contractors, with a market capitalization of approximately $44.59 billion.

Operations: The company generates its revenue primarily from Internet information services; total revenue amounts to approximately 9.11 billion US dollars.

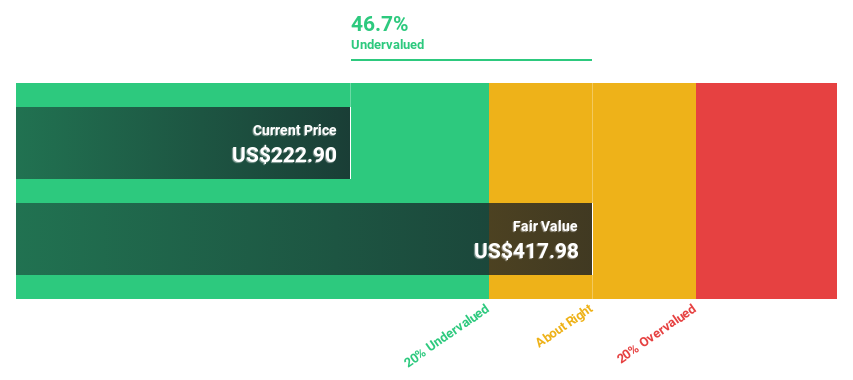

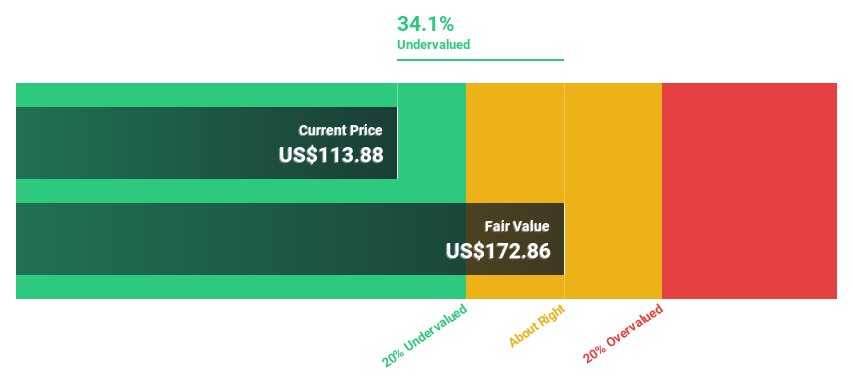

Estimated discount to fair value: 40.4%

DoorDash, currently trading at $108.95, appears undervalued with a DCF-based fair value estimate of $182.94, trading more than 20% below fair value. Recent index adjustments reflect mixed market perceptions, although inclusion in the Russell Top 200 suggests some positive sentiment. Despite challenges in closing acquisition deals such as Deliveroo, strategic partnerships with companies such as Academy Sports and Ulta Beauty are improving service offerings and market presence. Revenue is expected to grow 12.7% annually, outpacing the U.S. market forecast of 8.7%. However, significant insider selling over the past three months may indicate shareholder caution.

Overview: Zillow Group, Inc. operates a portfolio of real estate brands with a market capitalization of approximately $10.97 billion in the United States through mobile applications and websites.

Operations: The company generates revenue of approximately $2.01 billion from its Internet information services.

Estimated discount to fair value: 50%

Zillow Group trades at $46.35 and is significantly undervalued based on cash flows with an estimated fair value of $92.65. Despite a net loss in Q1 2024, revenue increased to $529 million from $469 million a year ago, demonstrating resilience and growth potential. The company’s strategic initiatives, such as the Fair Housing Classifier, underscore its commitment to innovation and market integrity. Projected annual revenue growth of 10.7% exceeds the U.S. market average of 8.7% and positions Zillow for improved profitability within three years.

Where to now?

Looking for other investments?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include NasdaqGS:ALNY, NasdaqGS:DASH, and NasdaqGS:ZG.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]