July 2024 Insight into three Chinese stocks whose estimates are below their intrinsic value

While global markets navigate mixed economic signals, China’s stock market has proven resilient despite challenges. Recent data points to a slowdown in manufacturing, but some sectors have still managed to post modest gains. In this context, identifying stocks that appear undervalued relative to their intrinsic value could present opportunities for sophisticated investors.

The 10 most undervalued stocks in China based on cash flows

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Ningbo Dechang Electrical Machinery Manufactured (SHSE:605555) | 17.60 CN¥ | CN¥33.82 | 48% |

| Shanghai Baolong Automotive (SHSE:603197) | 31.21 CN¥ | 57.25 CNY | 45.5% |

| Anhui Anli Material Technology (SZSE:300218) | 13.84 CNY | 26.54 CNY | 47.8% |

| Thunder Software Technology Ltd (SZSE:300496) | CN¥43.47 | 84.37 CNY | 48.5% |

| Eyebright Medical Technology (Beijing) (SHSE:688050) | 66.20 CN¥ | 121.63 CNY | 45.6% |

| INKON Life Technology (SZSE:300143) | 7.51 CNY | 14.64 CNY | 48.7% |

| China Film (SHSE:600977) | 10.54 CNY | 20.17 CN¥ | 47.8% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | 9.00 CN¥ | 17.58 CNY | 48.8% |

| Yonyou Network Technology Ltd (SHSE:600588) | 8.92 CNY | 16.93 CNY | 47.3% |

| MGI Tech (SHSE:688114) | 42.60 CN¥ | 78.26 CNY | 45.6% |

Click here to see the full list of 95 stocks from our Undervalued China Stocks Based on Cash Flows screener.

Let’s take a closer look at some of our favorites from the reviewed companies

Overview: Hubei Dinglong Co., Ltd. operates in various sectors including integrated circuit chip design, semiconductor materials and printing consumables, and has a market capitalization of approximately CNY 21.46 billion.

Operations: The company’s sales amount to around 2.80 billion Chinese yen (approximately 121 million euros) mainly in the areas of photoelectric image display and semiconductor process materials.

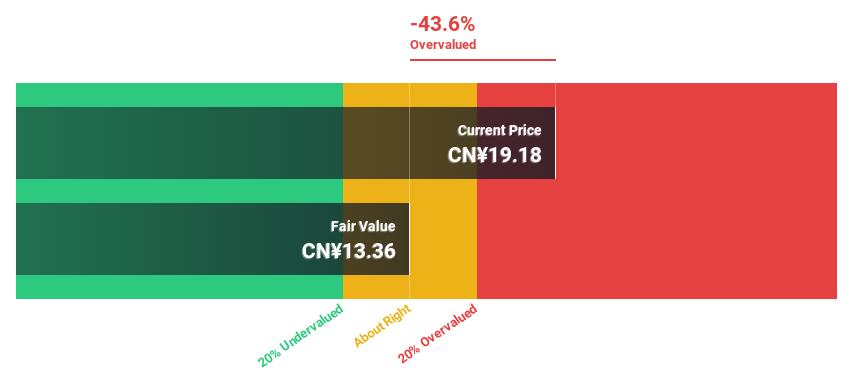

Estimated discount to fair value: 10.4%

Hubei Dinglong Ltd. is trading at CN¥22.87, below its estimated fair value of CN¥25.54, reflecting a slight undervaluation based on cash flows. Nevertheless, the company’s earnings are expected to grow at an annual rate of 36.39% over the next three years, outperforming the 22% growth rate forecast for the Chinese market. Recent financials show robust year-on-year gains, with first-quarter net profit rising sharply from CN¥34.73 million to CN¥81.58 million, supported by significant revenue growth from CN¥546.7 million to CN¥707.99 million.

Overview: Electric Connector Technology Co., Ltd. operates worldwide and specializes in the research, design, development, manufacture and sales of electronic connectors and related interconnection systems. The company has a market capitalization of 16.07 billion CNY.

Operations: The company generates sales of CNY 3.19 billion from its core business in the electronic connector industry.

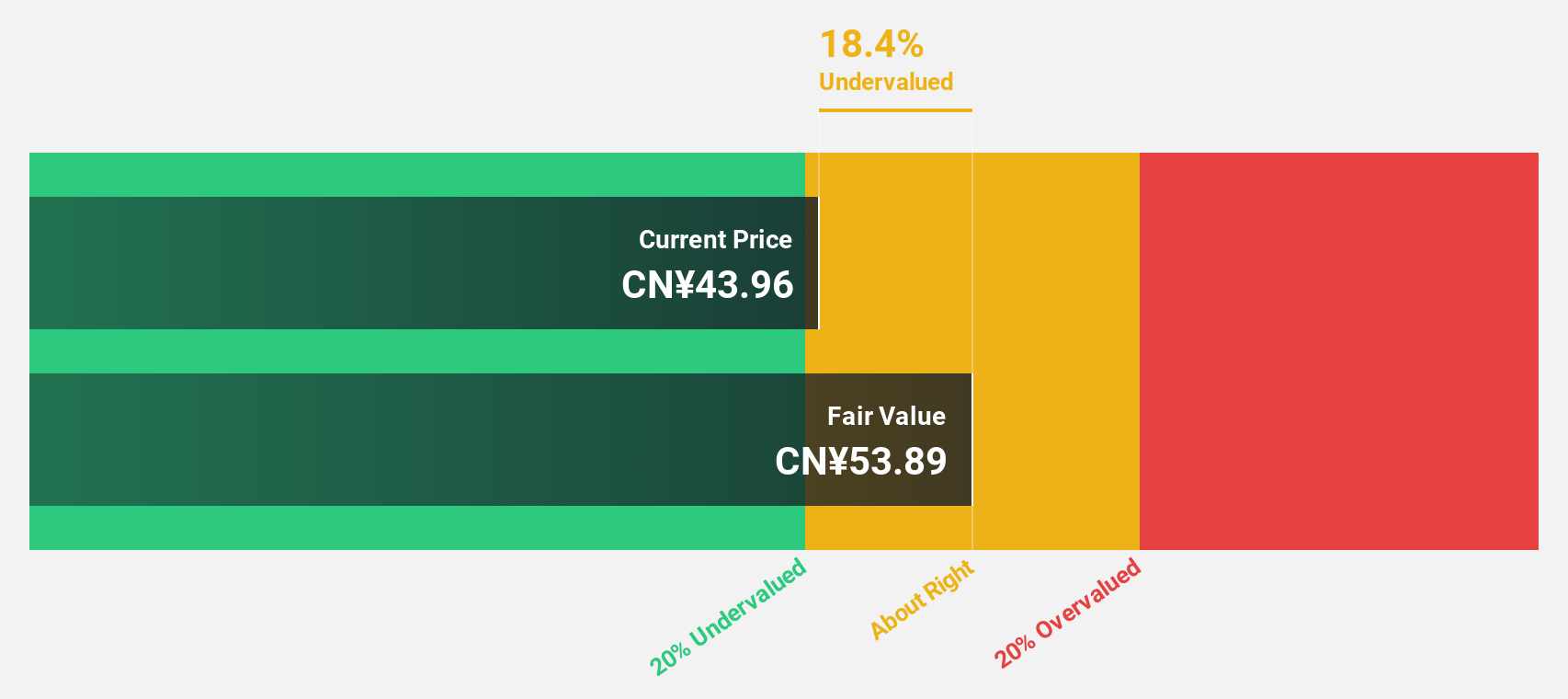

Estimated discount to fair value: 22.8%

Electric Connector Technology Co., Ltd. is trading at CNY38.36 below its estimated fair value of CNY49.66, indicating significant undervaluation based on cash flow analysis. Despite modest dividend coverage by cash flows, the company’s financial health is supported by robust forecast revenue and earnings growth rates of 26.5% and 29.8% per year, respectively – both well above the market average. Recent corporate actions include a dividend increase and continued share buybacks, underscoring confidence in the company’s financial performance.

Overview: Gambol Pet Group Co., Ltd. is a China-based company specializing in the research and development, production and sales of pet food products with a market capitalization of approximately 20.55 billion Chinese yen.

Operations: The company’s total sales from pet food and supplies are approximately 4.52 billion Chinese yen.

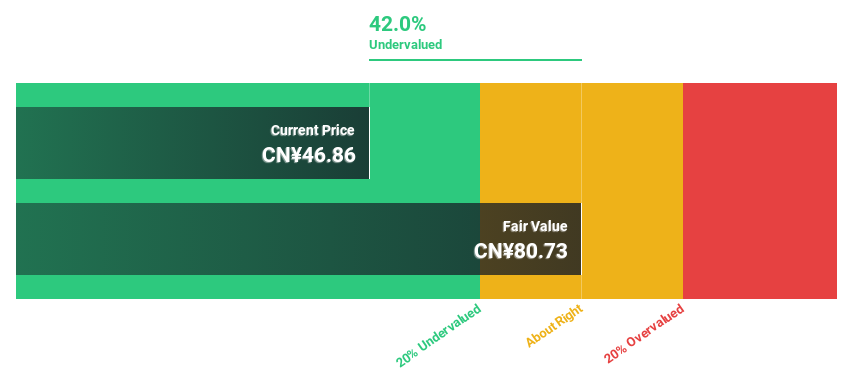

Estimated discount to fair value: 27.2%

Gambol Pet Group Co., Ltd. appears to be undervalued by more than 20% with a current trading price of CNY51.38 compared to its estimated fair value of CNY70.63 based on discounted cash flow analysis. Recent financials show robust first quarter earnings growth from CNY84.98 million to CNY148.29 million year-on-year, supporting the company’s strong earnings growth forecast of 22.6% annually over the next three years – outperforming broader forecasts for the China market. Despite these strengths, the forecast return on equity three years from now is relatively low at 15.4%. Recent company activities include dividend confirmations and index inclusion, indicating operational stability and market recognition.

Where to now?

Looking for a new perspective?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if Gambol Pet Group may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]