3 SEHK shares are expected to trade below their fair value

Against a backdrop of global economic volatility and mixed performance in major markets, the Hong Kong stock market has proven resilient, with the Hang Seng Index posting modest gains. This stability provides an interesting opportunity for investors to consider stocks that may be trading below their fair value and potentially offer attractive returns in a cautiously optimistic economic environment.

Top 10 undervalued stocks in Hong Kong based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Giant Biogene Holding (SEHK:2367) |

HK$40.70 |

HK$75.83 |

46.3% |

|

China Cinda Asset Management (SEHK:1359) |

HK$0.66 |

1.29HK$ |

48.8% |

|

Super Hi International Holding (SEHK:9658) |

HK$13.92 |

HK$26.04 |

46.5% |

|

Shanghai INT Medical Instruments (SEHK:1501) |

HK$26.45 |

HK$48.23 |

45.2% |

|

Zhaojin Mining Industry (SEHK:1818) |

14,98 € |

HK$29.86 |

49.8% |

|

BYD (SEHK:1211) |

HK$235.20 |

HK$464.83 |

49.4% |

|

AK Medical Holdings (SEHK:1789) |

HK$4.34 |

7,95 € |

45.4% |

|

Vobile Group (SEHK:3738) |

HK$1.20 |

HK$2.31 |

48.1% |

|

MicroPort Scientific (SEHK:853) |

HK$5.16 |

HK$9.48 |

45.6% |

|

Q Technology (Group) (SEHK:1478) |

HK$4.05 |

HK$7.45 |

45.7% |

Click here to see the full list of 42 stocks from our Undervalued SEHK Stocks Based on Cash Flows screener.

Let’s take a closer look at some of our favorites from the reviewed companies

Overview: Pacific Textiles Holdings Limited is a company that manufactures and trades textile products. Its market capitalization is approximately HK$2.34 billion.

Operations: The company generates its revenue mainly from the manufacture and trading of textile products; total sales amount to approximately HK$4.67 billion.

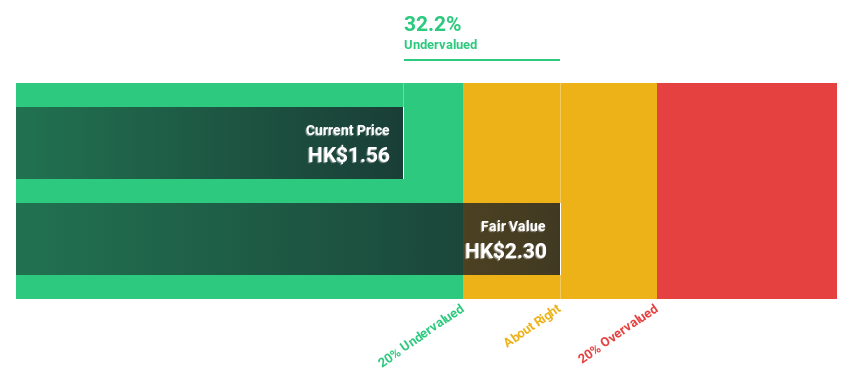

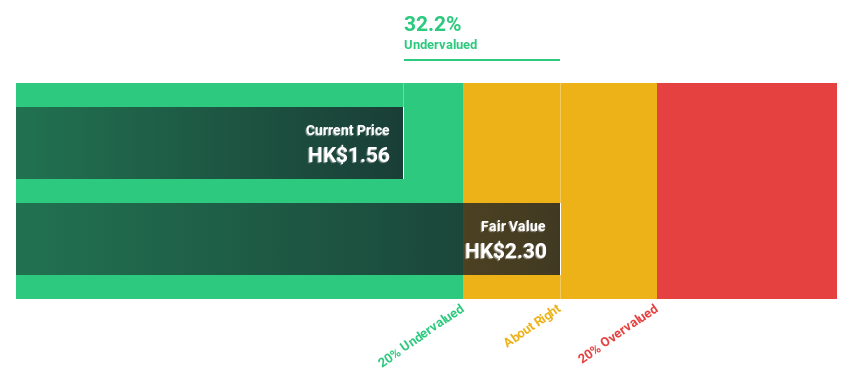

Estimated discount to fair value: 38.3%

Pacific Textiles Holdings currently trades 38.3% below its fair value at HK$1.67, against an estimated fair value of HK$2.71, highlighting the potential undervaluation based on cash flows. Despite a significant decline in net profit and a decline in revenue from HK$5.02 billion to HK$4.67 billion year-on-year, the company’s earnings are expected to grow 37.7% annually, outperforming the Hong Kong market’s average growth of 11.3%. However, profit margins have been declining and recent management updates are aimed at aligning with new regulatory standards.

Overview: Shanghai INT Medical Instruments Co., Ltd. operates in the healthcare sector and focuses on the development and manufacture of medical instruments. The company has a market capitalization of approximately HK$4.63 billion.

Operations: Shanghai INT Medical Instruments generates its revenue primarily from its cardiovascular intervention business and totals CNY 641.32 million.

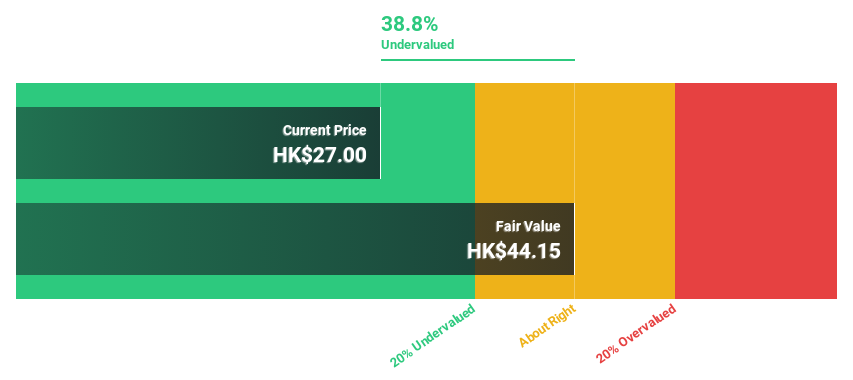

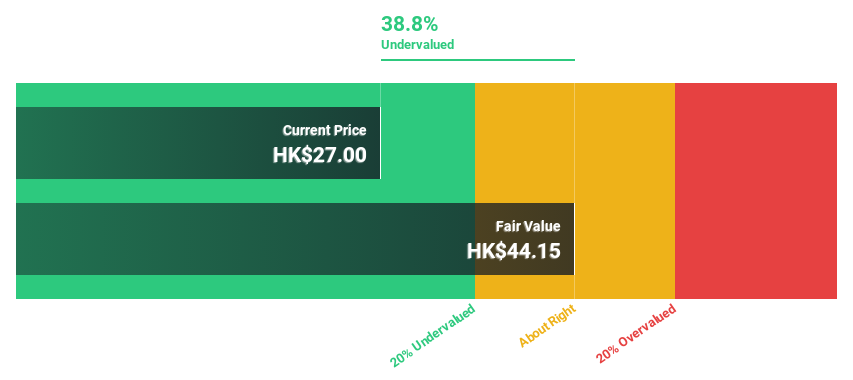

Estimated discount to fair value: 45.2%

Shanghai INT Medical Instruments is significantly undervalued according to DCF. The current price of HK$26.45 is well below the estimated fair value of HK$48.23. The company’s revenue and earnings are expected to grow by 26% and 25.4% per year, respectively, significantly outperforming the Hong Kong market average. Despite past shareholder dilution, recent dividend increases reflect a positive cash flow forecast and further underscore the company’s potential as an undervalued stock in the Hong Kong market.

Overview: China International Capital Corporation Limited is a financial services provider in mainland China and globally with a market capitalization of approximately HK$101.29 billion.

Operations: The company generates its revenue from various financial services both in mainland China and internationally.

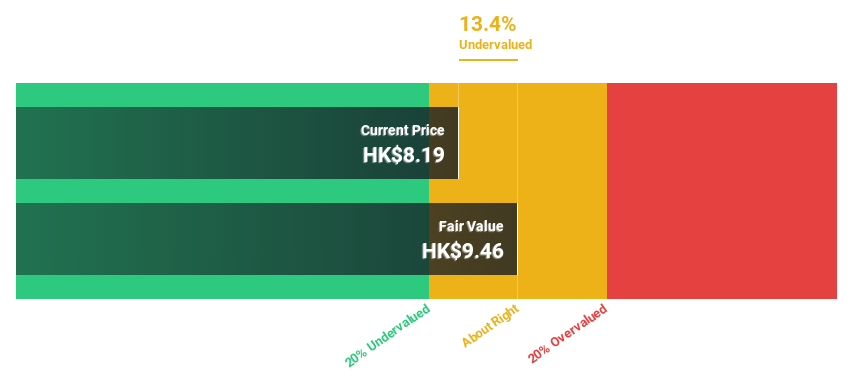

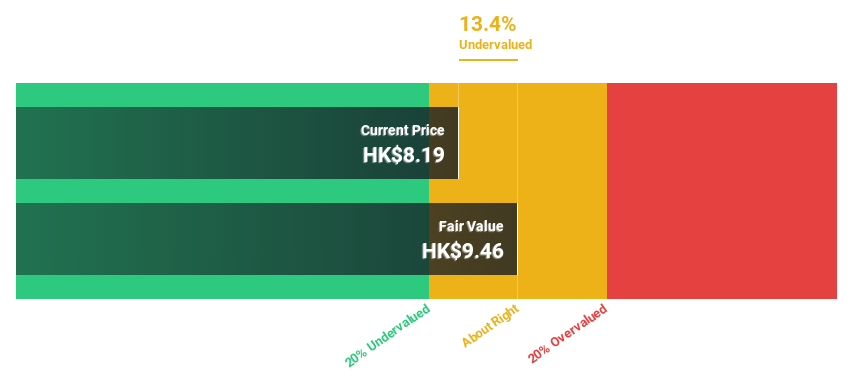

Estimated discount to fair value: 13.4%

China International Capital Corporation Limited trades at HK$8.19, below the estimated fair value of HK$9.46, suggesting slight undervaluation based on discounted cash flow analysis. The company’s revenue and earnings growth forecasts of 8.4% and 20.35% annually, respectively, are expected to outperform the Hong Kong market average of 7.6% and 11.3%, respectively. However, the forecast three-year return on equity of 6.9% remains low, indicating potential concerns over profitability efficiency despite positive growth numbers.

Turning ideas into action

Looking for other investments?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

The companies discussed in this article include SEHK:1382 SEHK:3908 and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]