Exploring undervalued stocks on KRX with discounts to intrinsic value between 12.7% and 46.1%

The South Korean stock market has shown robust performance, rising 2.0% last week and reaching 11% gains over the past year, with earnings expected to grow 30% annually. In such a thriving market, identifying stocks trading below their intrinsic value could present potential opportunities for investors looking for growth at a reasonable price.

The 10 most undervalued stocks in South Korea based on cash flows

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Caregen (KOSDAQ:A214370) | 23,000.00 € | 44549,16 € | 48.4% |

| Revu (KOSDAQ:A443250) | ₩10990.00 | 20646,79 € | 46.8% |

| Anapass (KOSDAQ:A123860) | 27800,00 € | 48807,34 € | 43% |

| KidariStudio (KOSE:A020120) | 4145,00 € | 7289,16 € | 43.1% |

| Genomictree (KOSDAQ:A228760) | 22600,00 € | 39335,03 € | 42.5% |

| Hancom Lifecare (KOSE:A372910) | 4885,00 € | 9749,34 € | 49.9% |

| Lutronic (KOSDAQ:A085370) | 36700,00 € | 63217,94 € | 41.9% |

| Shinsung E&GL Ltd (KOSE:A011930) | 2045,00 € | 4025,01 € | 49.2% |

| SK Biopharmaceuticals (KOSE:A326030) | 80,700.00 € | 149,728.31 € | 46.1% |

| Beam (KOSDAQ:A228670) | ₩12430.00 | 20942,05 € | 40.6% |

Click here to see the full list of 38 stocks from our Undervalued KRX Stocks Based on Cash Flows screener.

Let’s dive into some of the best options from the screener

Overview: TSE Co., Ltd specializes in providing semiconductor testing solutions domestically and internationally and has a market capitalization of approximately ₩573.81 billion.

Operations: The company is primarily engaged in semiconductor test solutions and serves markets both in South Korea and worldwide.

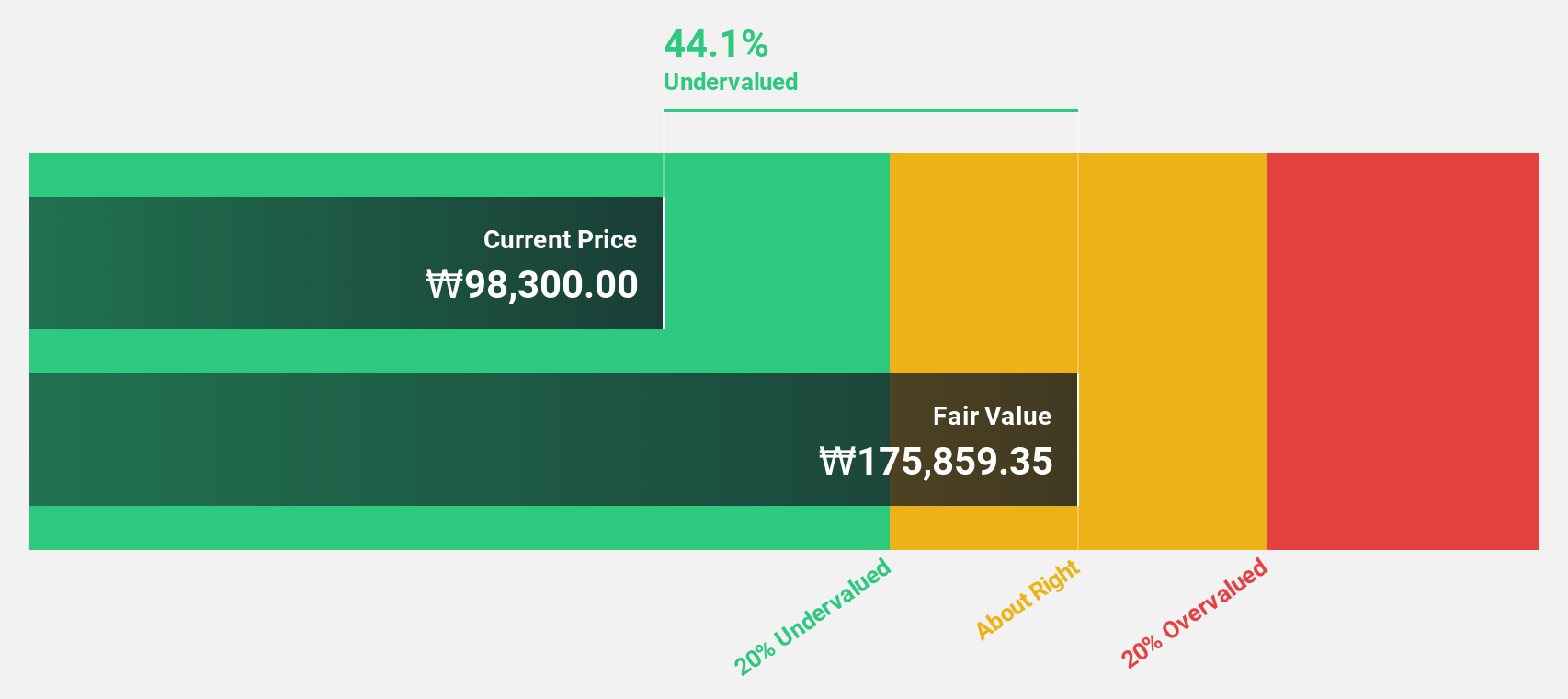

Estimated discount to fair value: 34.8%

TSE currently trades at ₩53,700, well below our fair value estimate of ₩82,398.34, meaning the company is undervalued by more than 20%. Despite a highly volatile share price recently and lower profit margins this year (1.2%) compared to last year (9.4%), TSE’s financial outlook appears solid. Earnings are expected to grow 63.75% annually over the next three years – a rate that beats the South Korean market average. However, the projected return on equity in three years is relatively low at 10.6%.

Overview: Hanall Biopharma Co., Ltd. is a South Korean pharmaceutical company engaged in the manufacture and international distribution of pharmaceuticals and has a market capitalization of approximately ₩1.60 billion.

Operations: The company generates its revenue from the manufacture and international distribution of pharmaceutical products.

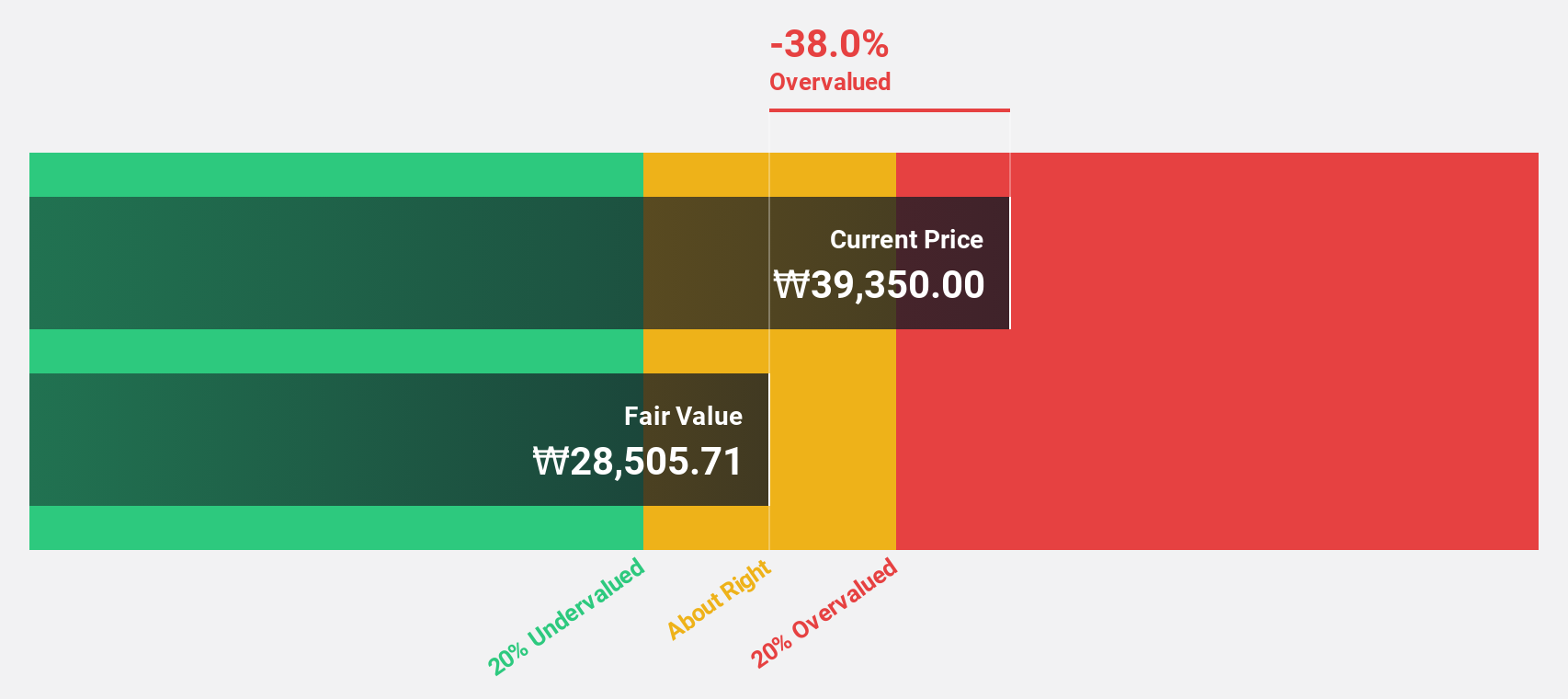

Estimated discount to fair value: 12.7%

Hanall Biopharma trades at ₩33,700, below its calculated fair value of ₩38.62 billion, suggesting undervaluation. The company recently turned profitable and expects robust revenue growth of 14.9% annually, outperforming the South Korean market average. While earnings are expected to grow at a respectable 69.57% annually, return on equity is expected to remain modest at 11%. Recent developments include the advancement of a Phase III trial for tanfanercept to treat dry eyes, with results expected in mid-2025.

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on developing drugs for central nervous system diseases with a market capitalization of approximately ₩6.32 billion.

Operations: The company focuses on the development of drugs for diseases of the central nervous system and generates its revenues primarily from its drug research and development activities.

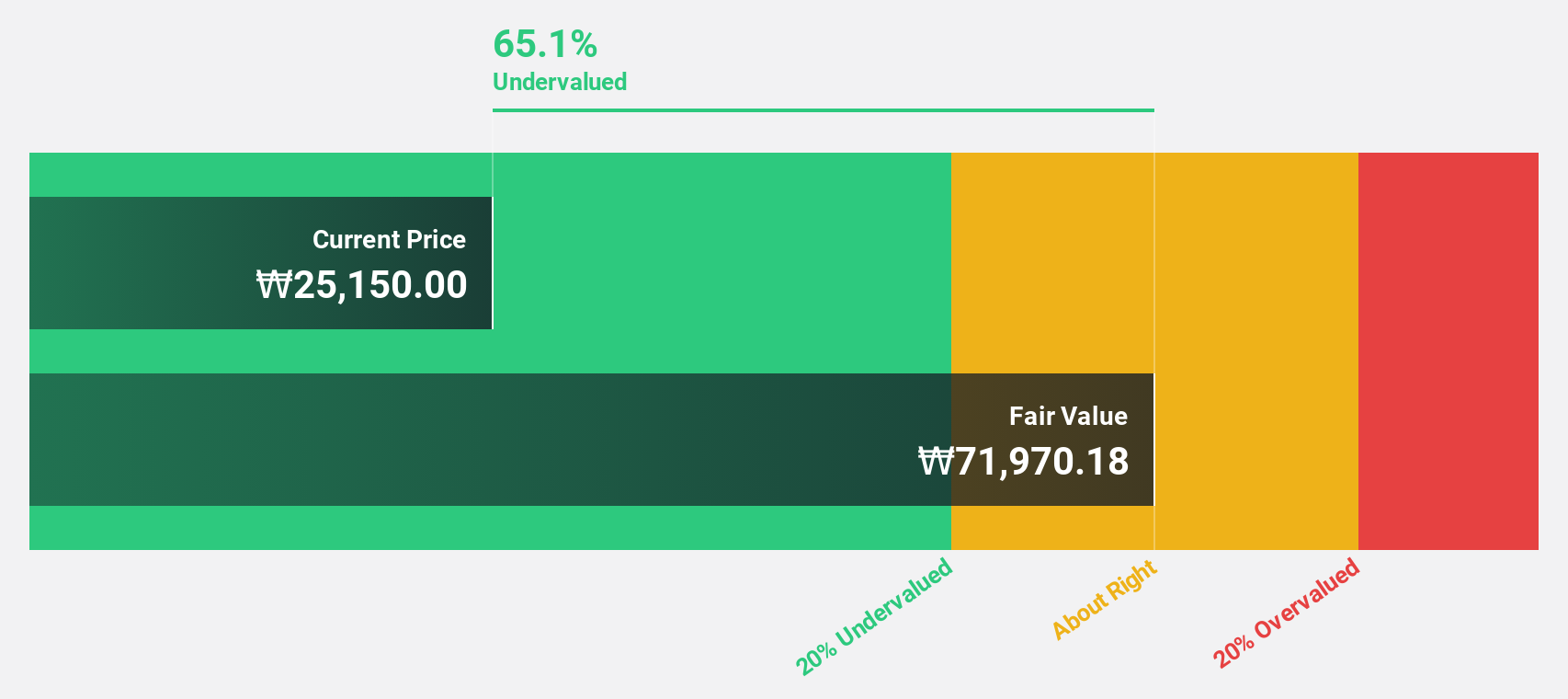

Estimated discount to fair value: 46.1%

SK Biopharmaceuticals is trading at ₩80,700, well below its estimated fair value of ₩149.73 billion. This undervaluation is due to the company being expected to become profitable within three years, with earnings growth expected to reach 84.97% annually and revenue growth expected to reach 22.2% annually – both above the market average. In addition, a robust projected return on equity of 33.6% underscores the company’s potential financial efficiency, although recent earnings calls confirmed these positive trends for the first quarter of 2024.

Summarize everything

Ready for a different approach?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if SK Biopharmaceuticals may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]