Thales leads the trio of stocks on Euronext Paris valued below their intrinsic value

Against a backdrop of political changes and economic uncertainty, the French market has proven resilient, with the CAC 40 index rising 2.62%. In such an environment, identifying potentially undervalued stocks is crucial for investors seeking to capitalize on the discrepancy between market prices and intrinsic value.

The 10 most undervalued stocks in France based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Antin Infrastructure Partners SAS (ENXTPA:ANTIN) |

12,10 € |

15,50 € |

21.9% |

|

Wavestone (ENXTPA:WAVE) |

57,00 € |

92,78 € |

38.6% |

|

Thales (ENXTPA:HO) |

153,85 € |

266,77 € |

42.3% |

|

Tikehau Capital (ENXTPA:TKO) |

22,55 € |

32,66 € |

31% |

|

ENENSYS Technologies (ENXTPA:ALNN6) |

0,55 € |

1,09 € |

49.3% |

|

Vivendi (ENXTPA:VIV) |

10,09 € |

16,11 € |

37.4% |

|

Lectra (ENXTPA:LSS) |

30,70 € |

44,28 € |

30.7% |

|

Figeac Aero Societe Anonyme (ENXTPA:FGA) |

5,88 € |

10,10 € |

41.8% |

|

Airwell Group Societe Anonyme (ENXTPA:ALAIR) |

3,88 € |

6,28 € |

38.2% |

|

Esker (ENXTPA:ALESK) |

183,80 € |

259,66 € |

29.2% |

Click here to see the full list of 14 stocks from our Undervalued Euronext Paris Stocks Based on Cash Flows screener.

Below we present a selection of stocks that have been filtered from our screen

Overview: Thales SA is a global company offering a range of solutions in the defense, aerospace, digital identity and security, and transportation sectors and has a market capitalization of approximately €31.80 billion.

Operations: The company generates revenues in three main segments: EUR 10.18 billion in defense and security (excluding digital identity and security), EUR 5.34 billion in aerospace and EUR 3.42 billion in digital identity and security.

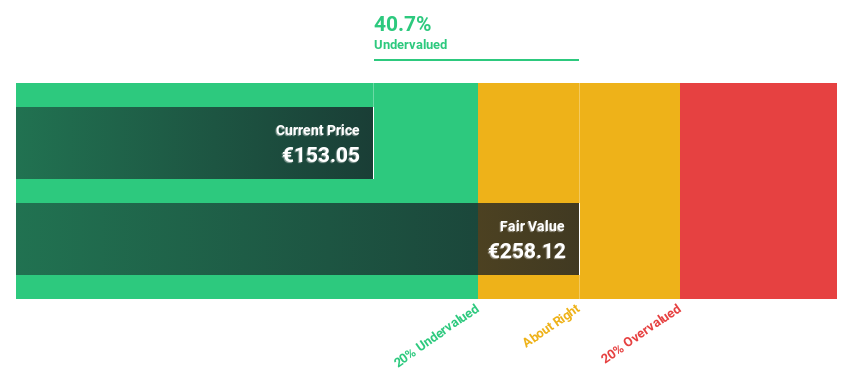

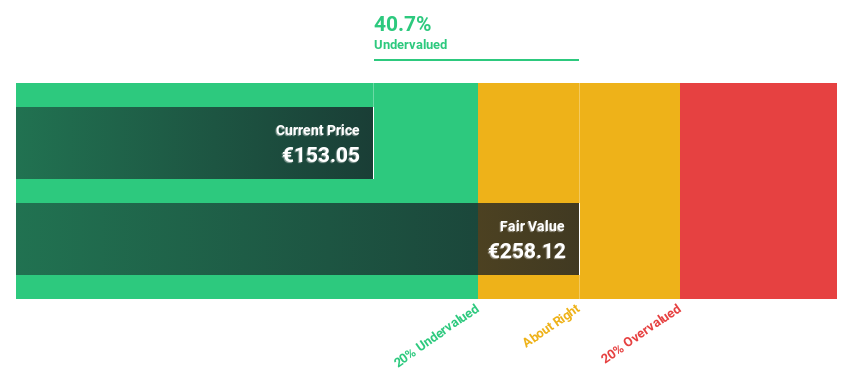

Estimated discount to fair value: 42.3%

Thales is currently undervalued by 42.3% at €153.85 compared to an estimated fair value of €266.77, suggesting potential for investors focused on cash flow metrics. Despite an unstable dividend history and significant one-off items impacting earnings, Thales is promising with forecast revenue growth of 6.3% per year, outperforming the French market at 5.7%. Recent strategic alliances and product launches in cybersecurity and digital services could strengthen the company’s market position, although high debt levels require caution.

Overview: Tikehau Capital is a private equity and venture capital firm offering a diverse portfolio of financing products such as senior secured debt, equity and mezzanine capital and has a market capitalization of approximately EUR 3.90 billion.

Operations: The company generates its revenue in two main segments: investment activities, which generated EUR 179.19 million, and asset management activities, which contributed EUR 322.32 million.

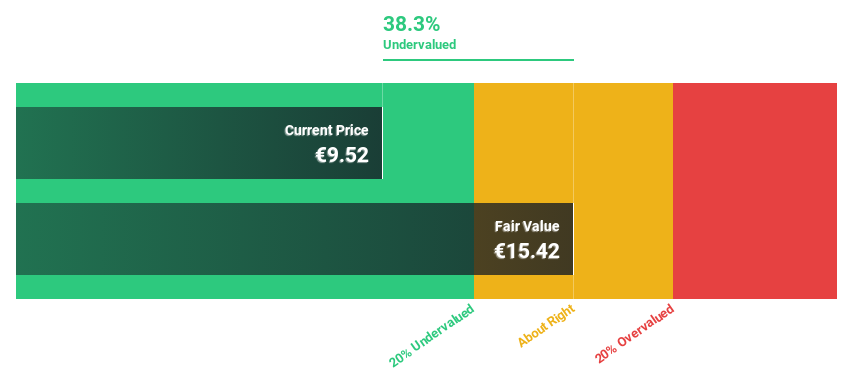

Estimated discount to fair value: 31%

Tikehau Capital trades at €22.55, significantly undervalued by more than 30% compared to its estimated fair value of €32.66. With forecast earnings growth of 30.9% per year, it outperformes the French market at 10.9%. However, dividend coverage by cash flows remains weak. Recent strategic developments include a partnership with Nikko Asset Management aimed at improving sales and investment capabilities in Asia, signaling potential growth opportunities despite current pressure on last year’s profit margins.

Overview: With a market capitalization of EUR 10.34 billion, Vivendi SE is a diversified entertainment, media and communications company operating in France, Europe, the Americas, Asia/Oceania and Africa.

Operations: The company’s turnover is mainly generated by the Canal + Group with 6.06 billion euros, followed by the Havas Group with 2.87 billion euros, Lagardère with 0.67 billion euros, Gameloft with 0.31 billion euros, Prisma Media with 0.31 billion euros, Vivendi Village with 0.18 billion euros and New Initiatives with 0.15 billion euros.

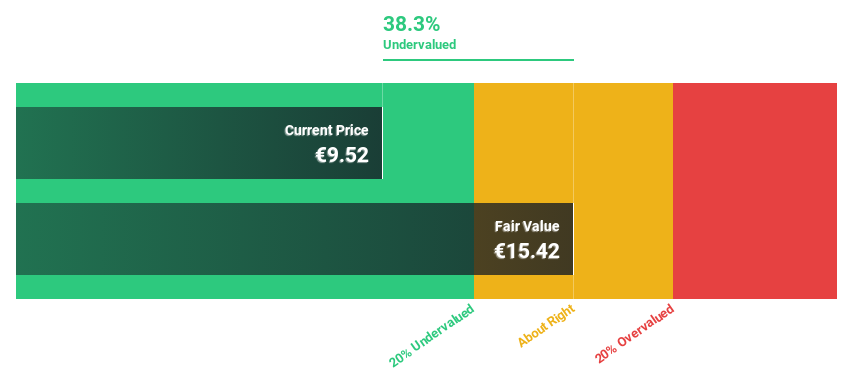

Estimated discount to fair value: 37.4%

Vivendi is trading at €10.09, well below its estimated fair value of €16.11, representing a significant undervaluation. The company’s earnings are expected to grow 29.26% annually, beating the French market’s forecast of 10.9%. Despite recent revenue growth to €4.275 billion in Q1 2024 from €2.290 billion last year and a forecast annual revenue increase of 18.5%, concerns remain over the low forecast return on equity of 5.9% and the unstable dividend history, with a €0.25 per share payout recently confirmed for FY 2023.

Make it happen

Looking for a new perspective?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ENXTPA:HOENXTPA:TKOENXTPA:VIV and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]