Dometic Group and two other stocks are expected to trade below value on the Swedish stock exchange

Amid volatile global markets, the Swedish Stock Exchange offers unique opportunities for value investors. With various indices showing mixed signals, identifying stocks trading below their intrinsic value could offer potential benefits in the current economic environment. In this context, companies like Dometic Group stand out as potentially undervalued assets worth considering.

The 10 most undervalued stocks in Sweden based on cash flow

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| RVRC Holding (OM:RVRC) | 45.14 SEK | 87,70 SEK | 48.5% |

| Truecaller (OM:TRUE B) | 35,60 SEK | 70,98 SEK | 49.8% |

| Nordic Waterproofing Holding (OM:NWG) | 161,00 SEK | 308.52 SEK | 47.8% |

| Lindab International (OM:LIAB) | 228,20 SEK | 426.51 SEK | 46.5% |

| Silence (OM:STYLE) | 202,00 SEK | 395,43 SEK | 48.9% |

| Biotage (OM:BIOT) | 167,60 SEK | 319.03 SEK | 47.5% |

| Flexion Mobile (OM:FLEXM) | 8.12 SEK | 16.01 SEK | 49.3% |

| Hexatronic Group (OM:HTRO) | 54.24 SEK | 106.25 SEK | 49% |

| Nordisk Bergteknik (OM:NORB B) | 17.02 SEK | 32.12 SEK | 47% |

| Image systems (OM:IS) | 1.52 SEK | 2.86 SEK | 46.8% |

Click here to see the full list of 45 stocks from our Undervalued Swedish Stocks Based on Cash Flows screener.

Below we present a selection of stocks that have been filtered from our screen

Overview: Dometic Group AB specializes in solutions for mobile living, including food and beverage storage, air conditioning and power solutions, and has a market capitalization of approximately SEK 22.06 billion.

Operations: Dometic’s sales are generated in several geographical segments: Europe, Middle East and Africa (EMEA) contributes SEK 8.14 billion, Marine SEK 6.56 billion, Americas SEK 5.05 billion, Asia Pacific (APAC) SEK 4.70 billion and worldwide operations SEK 5.92 billion.

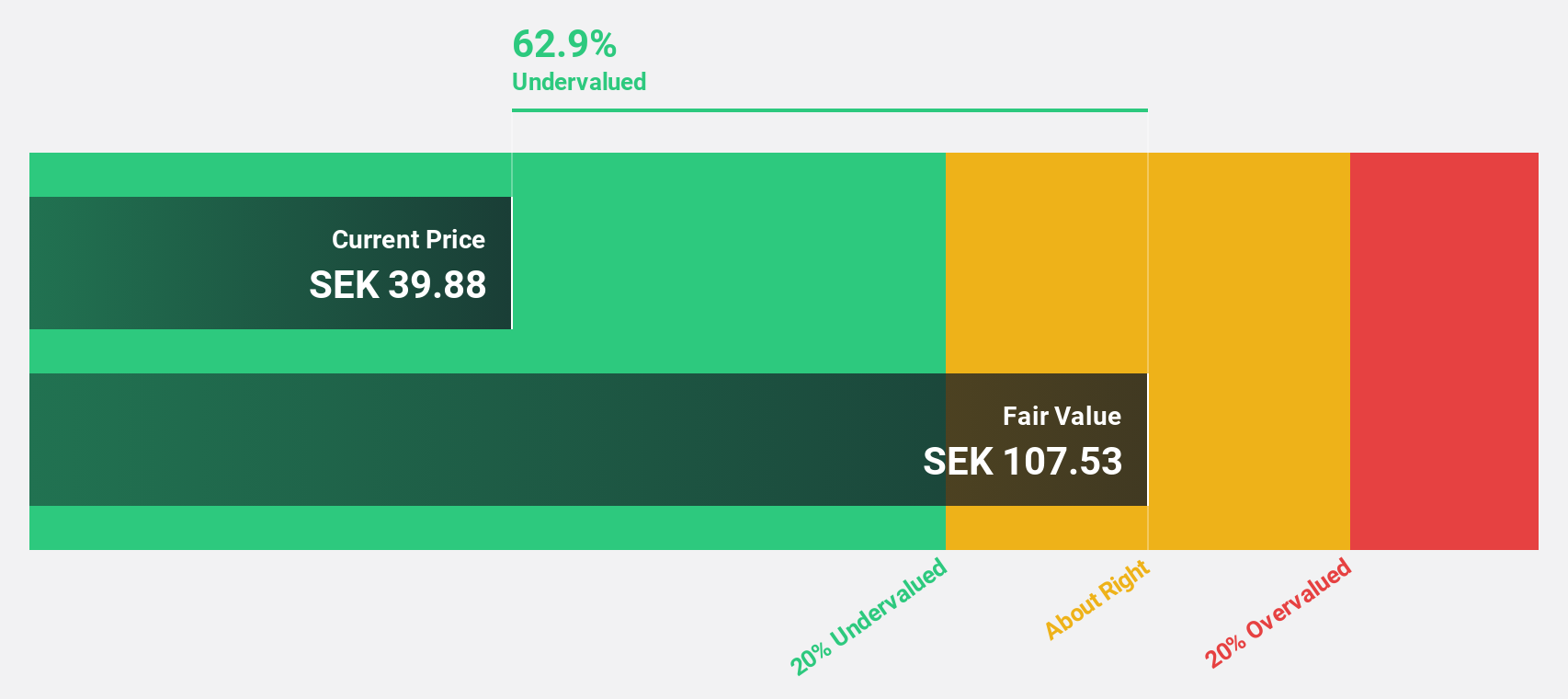

Estimated discount to fair value: 40.5%

Dometic Group remains a promising undervalued stock due to its cash flows, despite its recent revenue decline from SEK 7.29 billion to SEK 6.53 billion. The current price is SEK 69.05, well below the estimated fair value of SEK 116.06. Despite high debt and unstable dividend history, there is a significant undervaluation opportunity. The company’s earnings are expected to grow by 21.78% annually, outperforming the Swedish market’s forecast of 14.4%, indicating potential for tangible financial improvement over the next three years.

Overview: Lindab International AB, a Europe-based company, specializes in the manufacture and sale of products and solutions for ventilation systems and has a market capitalization of approximately SEK 17.54 billion.

Operations: The company generates its sales primarily in two business areas: Profile Systems with SEK 3.30 billion and Ventilation Systems with SEK 9.78 billion.

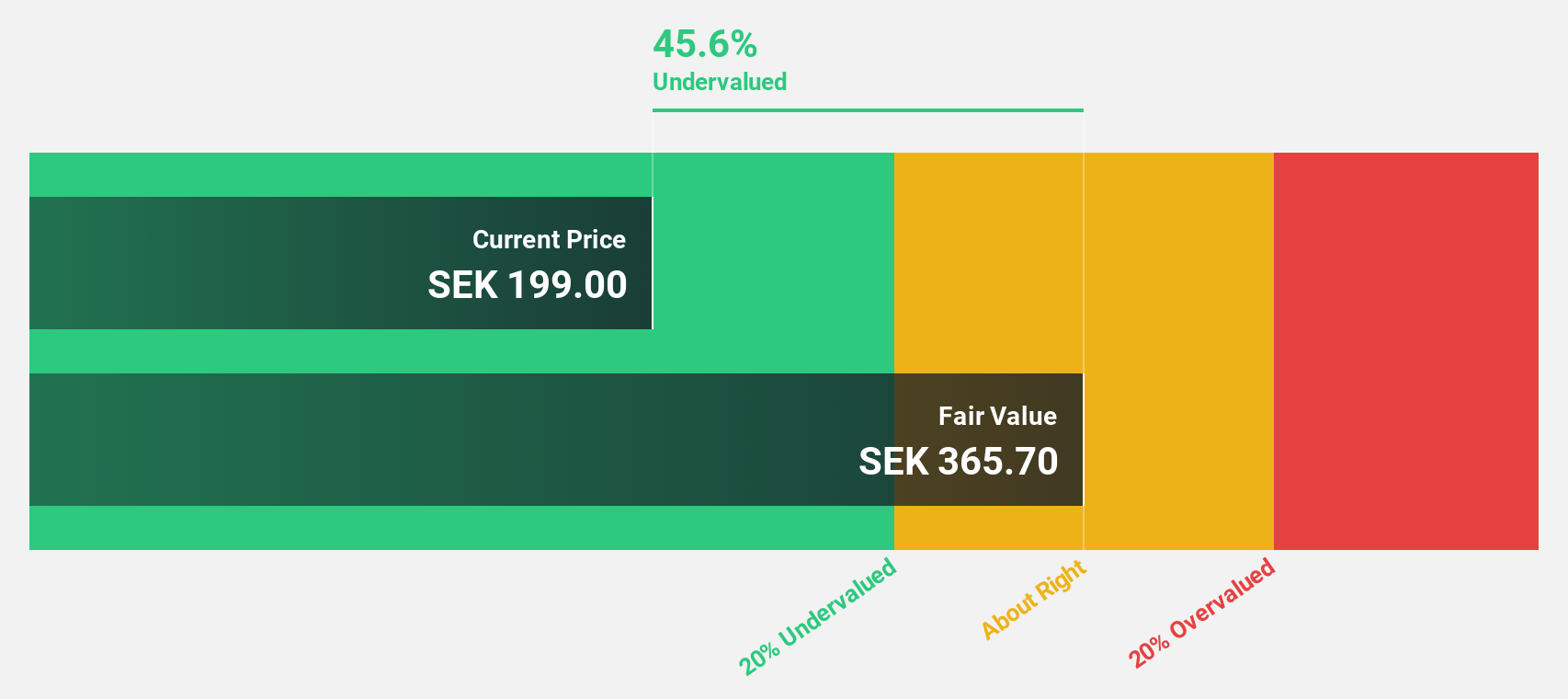

Estimated discount to fair value: 46.5%

Lindab International currently trades at SEK 228.2, well below its estimated fair value of SEK 426.51, reflecting a significant undervaluation based on discounted cash flows. Despite a recent decline in quarterly net profit from SEK 180 million to SEK 117 million and unstable dividends, the company’s earnings are expected to grow by over 20% annually over the next three years, outperforming the average growth rate of the Swedish market. This robust earnings growth forecast, together with a moderate increase in sales, suggests potential for a valuation correction.

Overview: RVRC Holding AB (publ) specializes in active lifestyle clothing and operates in Sweden, Germany, Finland and other international markets with a market capitalization of SEK 5.08 billion.

Operations: The company’s sales amount to SEK 1.80 billion (approximately EUR 1.8 billion) and are mainly generated through online retail.

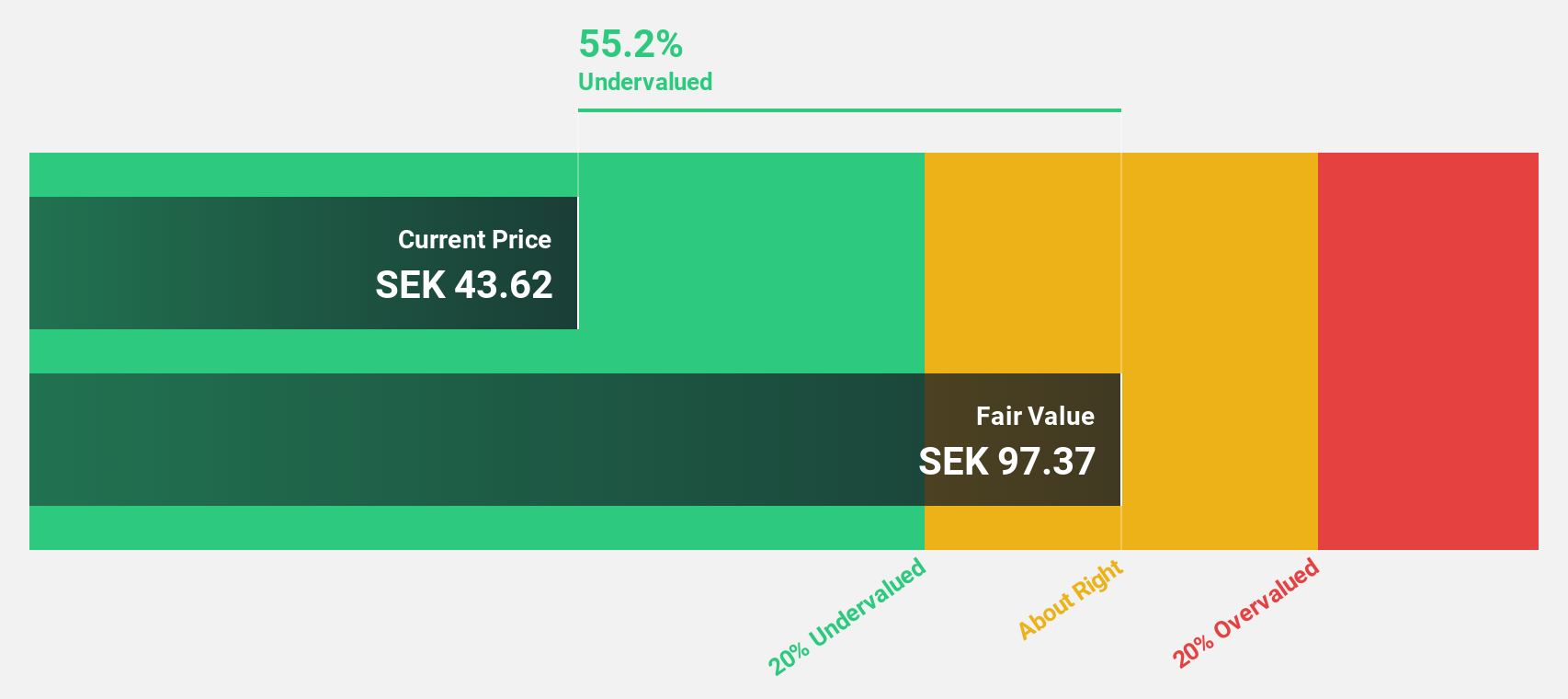

Estimated discount to fair value: 48.5%

RVRC Holding is considered to be significantly undervalued at SEK 45.14, with a fair value estimate of SEK 87.7, and is trading at a discount of 48.5%. Despite an unstable dividend history and revenue growth forecasts below significant levels (16.6% per year), earnings growth of 16.19% per year is expected, outperforming the Swedish market average (14.4%). Recent management changes and plans to sell shares could affect market dynamics, but reflect ongoing strategic adjustments within the company.

Take advantage

Looking for other investments?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if Lindab International may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

:max_bytes(150000):strip_icc():focal(734x388:736x390)/dr-ruth-071524-f946fe1038a348418eb2235d2624c411.jpg)