MTU Aero Engines and two other value stocks on the German stock exchange for your consideration

With modest gains in major European equity indices (the German DAX index recently rose 1.32%), investors are carefully looking for opportunities that could buck broader market trends. In such a context, identifying undervalued stocks is particularly appealing as they offer significant value potential in a market characterized by cautious optimism.

The 10 most undervalued stocks in Germany based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Stabilus (XTRA:STM) |

45,75 € |

81,22 € |

43.7% |

|

technotrans (XTRA:TTR1) |

18,55 € |

29,77 € |

37.7% |

|

Novem Group (XTRA:NVM) |

5,20 € |

10,19 € |

49% |

|

PSI Software (XTRA:PSAN) |

22,80 € |

43,49 € |

47.6% |

|

Stratec (XTRA:SBS) |

46,45 € |

82,42 € |

43.6% |

|

SBF (DB:CY1K) |

3,42 € |

5,83 € |

41.3% |

|

CHAPTERS Group (XTRA:CHG) |

24,00 € |

46,63 € |

48.5% |

|

MTU Aero Engines (XTRA:MTX) |

252,80 € |

421,34 € |

40% |

|

Your family entertainment (DB:RTV) |

2,46 € |

4,51 € |

45.5% |

|

Redcare Pharmacy (XTRA:RDC) |

134,60 € |

215,36 € |

37.5% |

Click here to see the full list of 29 stocks from our Undervalued German Stocks Based on Cash Flows screener.

Here’s a look at some of the choices from the screener

Overview: MTU Aero Engines AG is active worldwide in the development, production, marketing and maintenance of civil and military aircraft engines as well as industrial gas turbines and has a market capitalization of around 13.61 billion euros.

Operations: MTU Aero Engines generates its sales primarily in two business areas: the commercial maintenance business (MRO) with 4.35 billion euros and the commercial and military engine business (OEM) with 1.27 billion euros.

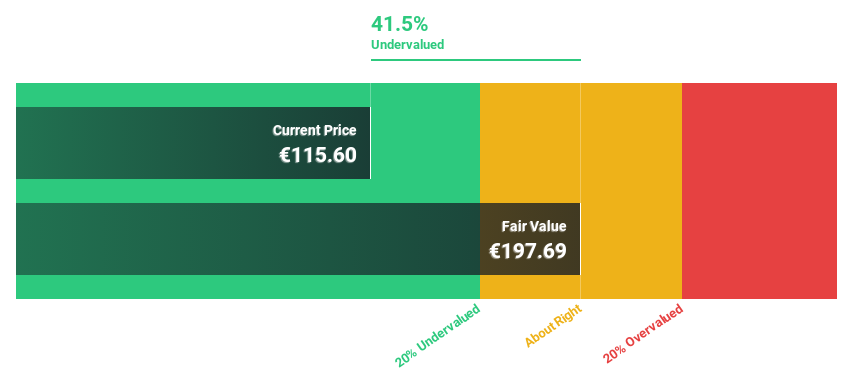

Estimated discount to fair value: 40%

MTU Aero Engines AG is trading well below its estimated fair value, making it an interesting proposition for investors focused on cash flow-based valuations. Despite a slight decline in net income and earnings per share as reported in the first quarter of 2024, the company is poised for significant growth, with earnings expected to grow by 35.51% annually. In addition, MTU’s revenue growth forecast of 12.2% annually exceeds the German market average, justifying the classification as undervalued on a discounted cash flow basis.

Overview: Redcare Pharmacy NV is an online pharmacy operating in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria and France with a market capitalization of around EUR 2.74 billion.

Operations: The company generates its revenue primarily through its DACH segment, which generated EUR 1.62 billion, and its international activities, which contributed EUR 369.34 million.

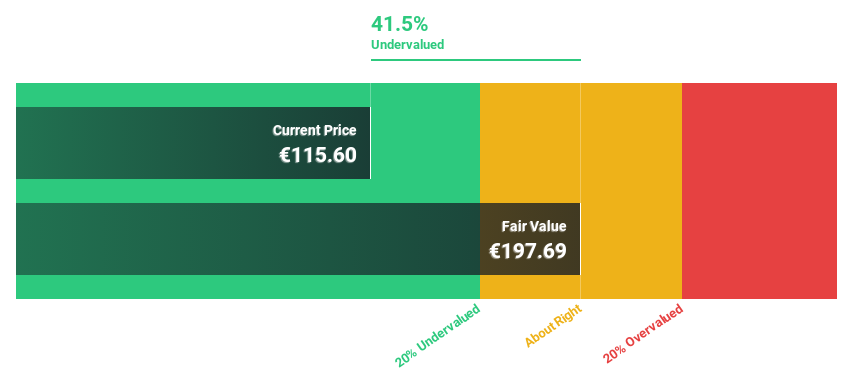

Estimated discount to fair value: 37.5%

Redcare Pharmacy, with a current trading price of €134.6 against an estimated fair value of €215.36, underlines its undervalued status in the German market based on cash flows. Despite significant share price volatility recently, the company reported a significant increase in revenue from €372.05 million to €560.22 million year-on-year from Q1 2024 and reduced its net loss from €10.22 million to €7.81 million. The forecast revenue growth of 17.1% annually outperforms the German market’s 5.2%, coupled with an expected turnaround to profitability within three years and forecast earnings growth of 47.38% per year, although concerns about shareholder dilution and low expected return on equity (7.5%) dampen the outlook.

Overview: Kontron AG specializes in the provision of Internet of Things (IoT) solutions in the Austrian and global market and has a market capitalization of around 1.24 billion euros.

Operations: Kontron AG’s sales are generated primarily in three segments: Europe (€971.03 million), Global (€269.17 million) and Software + Solutions (€306.81 million).

Estimated discount to fair value: 34.3%

Kontron AG’s share price of €20.08 is below the calculated fair value of €30.55, suggesting an undervaluation based on cash flows. Nevertheless, the revenue growth forecast of 13.2% per year is modest compared to the industry giants, but still outperforms the overall German market at 5.2%. Recent product launches such as the VX6096 underline the company’s innovation lead and potential market expansion. However, a low forecast return on equity of 17.2% in three years and an unstable dividend trend underscore the financial warning signs amid the growth story.

Turning ideas into action

Curious about other options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include XTRA:MTX XTRA:RDCXTRA:SANT and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]