Exploring undervalued small caps with Insider Action in Australia, July 2024

Amid a week of mixed results in the Australian market, which saw the ASX200 post a slight decline and sectors such as healthcare post gains, small-cap stocks continue to attract attention due to their potential growth opportunities. In these conditions, identifying undervalued small caps through insider information can be particularly compelling, as they can offer unique advantages in navigating current market dynamics.

Top 10 undervalued small caps with insider buying in Australia

|

Surname |

SPORTS |

PS |

Discount to fair value |

Value assessment |

|---|---|---|---|---|

|

Business travel management |

17.9x |

2.7x |

46.32% |

★★★★★★ |

|

Nick Scali |

13.5x |

2.5x |

46.23% |

★★★★★★ |

|

Tabcorp Holdings |

N/A |

0.6x |

21.37% |

★★★★★☆ |

|

RAM Essential Services Ownership Fund |

N/A |

5.7x |

40.80% |

★★★★★☆ |

|

Heilius |

N/A |

0.6x |

42.35% |

★★★★★☆ |

|

Oldest |

20.9x |

0.4x |

48.29% |

★★★★☆☆ |

|

Thick Data |

21.7x |

0.8x |

1.36% |

★★★★☆☆ |

|

Car dealership Eagers |

9.4x |

0.3x |

35.05% |

★★★★☆☆ |

|

Codan |

28.8x |

4.2x |

27.78% |

★★★★☆☆ |

|

Coventry Group |

283.1x |

0.4x |

-16.19% |

★★★☆☆☆ |

Click here to see the full list of 28 stocks from our Undervalued ASX Small Caps with Insider Buying screener.

Here’s a quick look at some of the choices from the screener.

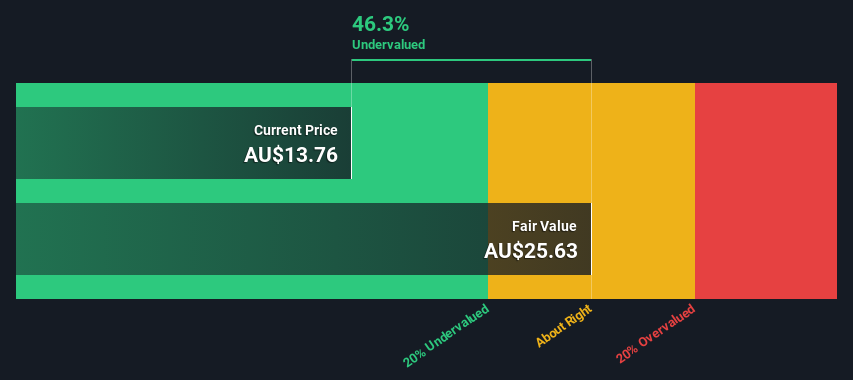

Simply Wall St Value Rating: ★★★★★★

Overview: Corporate Travel Management is a provider of travel management services to the corporate sector with offices in Asia, Europe, North America and Australia and New Zealand.

Operations: From 2013 to 2024, the company showed a fluctuating but generally increasing trend in gross profit margin, starting at about 39.94% and reaching about 41.60% at the end of the period. Net profit also grew during these years, despite some fluctuations, with notable increases especially in later years when revenue increased from A$80.47 million to A$724 million.

SPORTS: 17.9x

Corporate Travel Management, which is undergoing a leadership change with the recent appointment of Anita Salvatore as CEO for North America, reflects a strategic direction designed to strengthen its market position. With annual earnings growth expected at 12%, this reflects not only resilience but also potential underestimated by the market. Insider confidence is underlined by recent purchases, which signal strong confidence in the company’s trajectory. This mix of quality leadership momentum and promising financial forecasts positions the company in an interesting way for those looking for hidden gems in the Australian market.

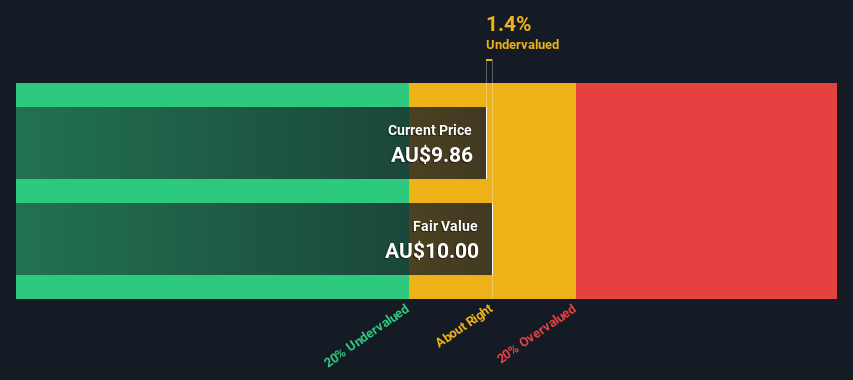

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dicker Data is a distributor of computer peripherals and related products with a market capitalization of approximately A$2.27 billion.

Operations: Gross profit margin in the wholesale computer peripherals sector has seen a significant increase, from 8.48% at the end of 2013 to 14.23% at the end of 2023, reflecting improved efficiency in managing costs relative to revenue over the decade. This sector generated revenue of A$2.27 billion at the latest data point, highlighting its significant contribution to the company’s overall performance.

SPORTS: 21.7x

Dicker Data, a prominent player in the technology distribution sector, recently demonstrated insider confidence through significant share purchases by its executives, signaling a strong belief in the company’s future prospects. Despite its reliance on external debt – a riskier method of financing – Dicker Data is poised for growth and expects earnings to grow at an annual rate of 8%. Their strategic financial maneuvers are complemented by a recently announced dividend payment of A$0.11 per share, underscoring their commitment to shareholder returns despite the company’s expansion.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an Australian company that provides a range of services and products, wholesale products, and feed and processing services through its store network and has a market capitalisation of approximately A$1.50 billion.

Operations: The store network generates the largest revenue at A$2.54 billion, supplemented by wholesale products and feed and processing services, which contribute A$341.19 million and A$120.14 million respectively. The company’s gross profit margin shows a fluctuating trend and was last at 19.41%.

SPORTS: 20.9x

Navigating a challenging financial environment with a significant year-on-year decline in net profit from A$48.85 million to A$11.59 million, Elders Limited is still showing promising results as insiders have recently bought shares, signaling their confidence in the company’s value prospects. Despite a high level of debt and reliance on external borrowings as its sole source of funding – which is considered higher risk – the company has reiterated its earnings guidance for 2024, forecasting EBIT between A$120 million and A$140 million. This financial outlook is supported by expected annual earnings growth of 22.8%, underpinning the potential for future value creation.

Make it happen

Looking for a new perspective?

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ASX:CTD ASX:DDR and ASX:ELD.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]