Top 3 Japanese stocks will be undervalued in July 2024

Against a backdrop of global economic volatility, Japan’s equity markets have shown robust performance recently, with major indices such as the Nikkei 225 and the TOPIX hitting all-time highs. This upswing is particularly interesting for value investors, as certain stocks may still be undervalued relative to their intrinsic value in this buoyant market environment.

The 10 most undervalued stocks in Japan based on cash flows

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Plus Alpha Consulting Ltd (TSE:4071) | ¥1848.00 | 3693.33 ¥ | 50% |

| Connection and Motivation (TSE:2170) | 475.00 ¥ | 925.64 ¥ | 48.7% |

| Hibino (TSE:2469) | 2623.00 ¥ | ¥5188.98 | 49.5% |

| Fujibo Holdings (TSE:3104) | 4780.00 ¥ | 9437.07 ¥ | 49.3% |

| Hamee (TSE:3134) | 1123.00 ¥ | 2152.15 ¥ | 47.8% |

| S-Pool (TSE:2471) | 324.00 ¥ | ¥622.58 | 48% |

| Macromill (TSE:3978) | 858.00 ¥ | 1671.10 ¥ | 48.7% |

| Yoko (TSE:6800) | 2023.00 ¥ | 3906.35 ¥ | 48.2% |

| DKS (TSE:4461) | 3820.00 ¥ | ¥7269.35 | 47.5% |

| Forward money (TSE:3994) | ¥5315.00 | 10377,77 ¥ | 48.8% |

Click here to see the full list of 92 stocks from our Undervalued Japanese Stocks Based on Cash Flow screener.

Here’s a look at some of the choices from the screener

Overview: Rorze Corporation specializes in the development of automation systems for semiconductor and flat panel display manufacturing. The company operates worldwide and has a market capitalization of approximately 570.41 billion yen.

Operations: The company generates its revenue primarily from its Life Science business, which generated 1.22 billion yen, and its Semiconductor/FPD Equipment business, which generated 92.04 billion yen.

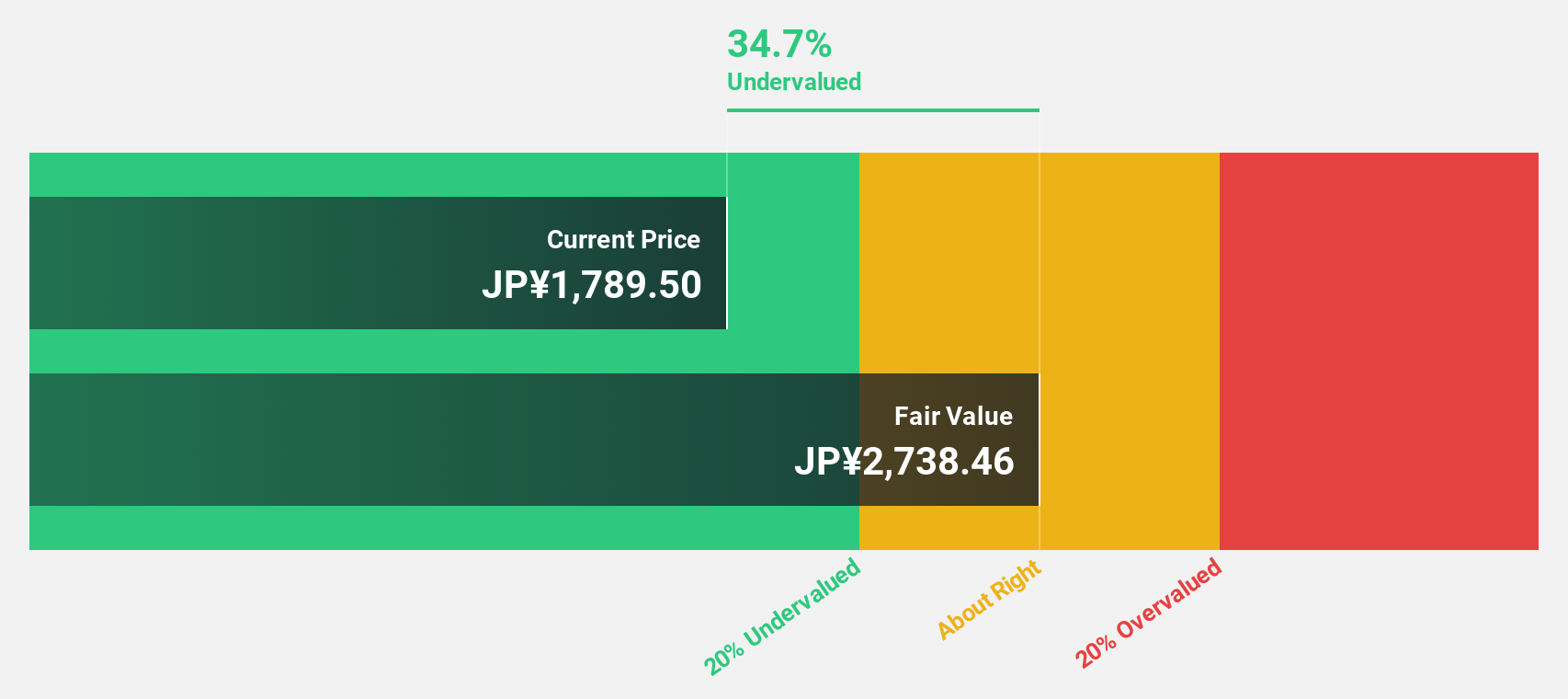

Estimated discount to fair value: 33.2%

Japanese company Rorze appears to be undervalued based on its cash flows. It is trading at 32,400 yen, well below its estimated fair value of 48,512.25 yen. The company’s revenues and earnings are expected to grow 13.9% annually, outperforming the Japanese market average of 4.3% and 8.9%, respectively. However, its share price has been very volatile recently. In addition, Rorze has been actively contributing to shareholder returns with recent share buybacks totaling 438.31 million yen and regular dividend payments.

Overview: Micronics Japan Co., Ltd. specializes in the development, manufacture and worldwide sales of test and measurement equipment for semiconductors and LCD systems and has a market capitalization of approximately 268.13 billion yen.

Operations: The company’s revenue comes primarily from worldwide sales of test and measurement equipment for semiconductors and LCDs.

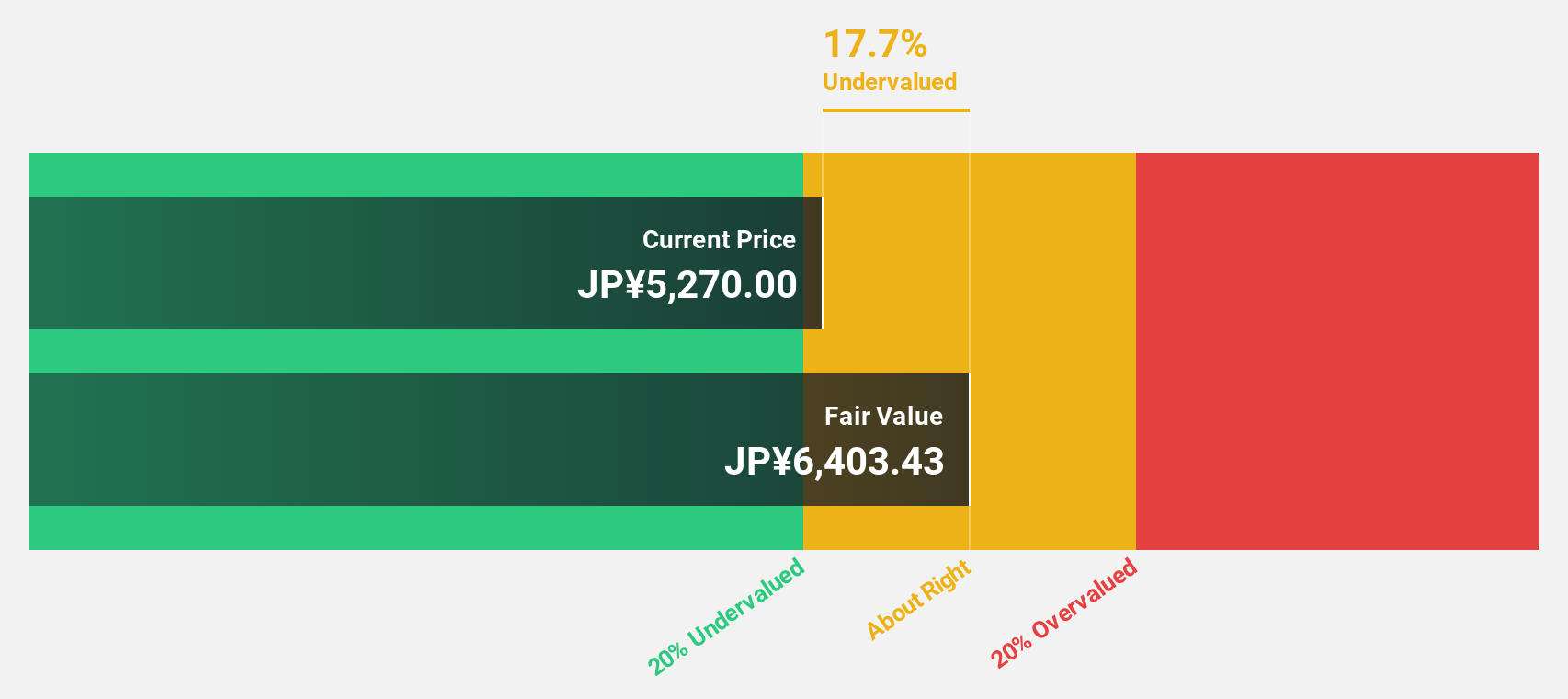

Estimated discount to fair value: 40.5%

Micronics Japan is currently considered undervalued in the market, with the trading price at 6950 yen, which is significantly below the calculated fair value of 11687.42 yen. The company’s earnings are expected to grow 39.78% annually, significantly outperforming the Japanese market’s forecast of 8.9%. Despite this promising growth trajectory and a high expected return on equity of 26.8%, the company’s profit margins have fallen to 10.6% from 16.7% last year, reflecting some operational challenges in the wake of rapid expansion.

Overview: Aozora Bank, Ltd. offers a range of banking products and services both in Japan and internationally and has a market capitalization of approximately 352.31 billion yen.

Operations: Aozora Bank’s revenues are generated from various segments, with the Structured Finance Group contributing 41.57 billion yen, followed by the International Business Group with 19.53 billion yen, the Institutional Banking Group with 16.29 billion yen, and the Customer Relations Group generating 7.83 billion yen.

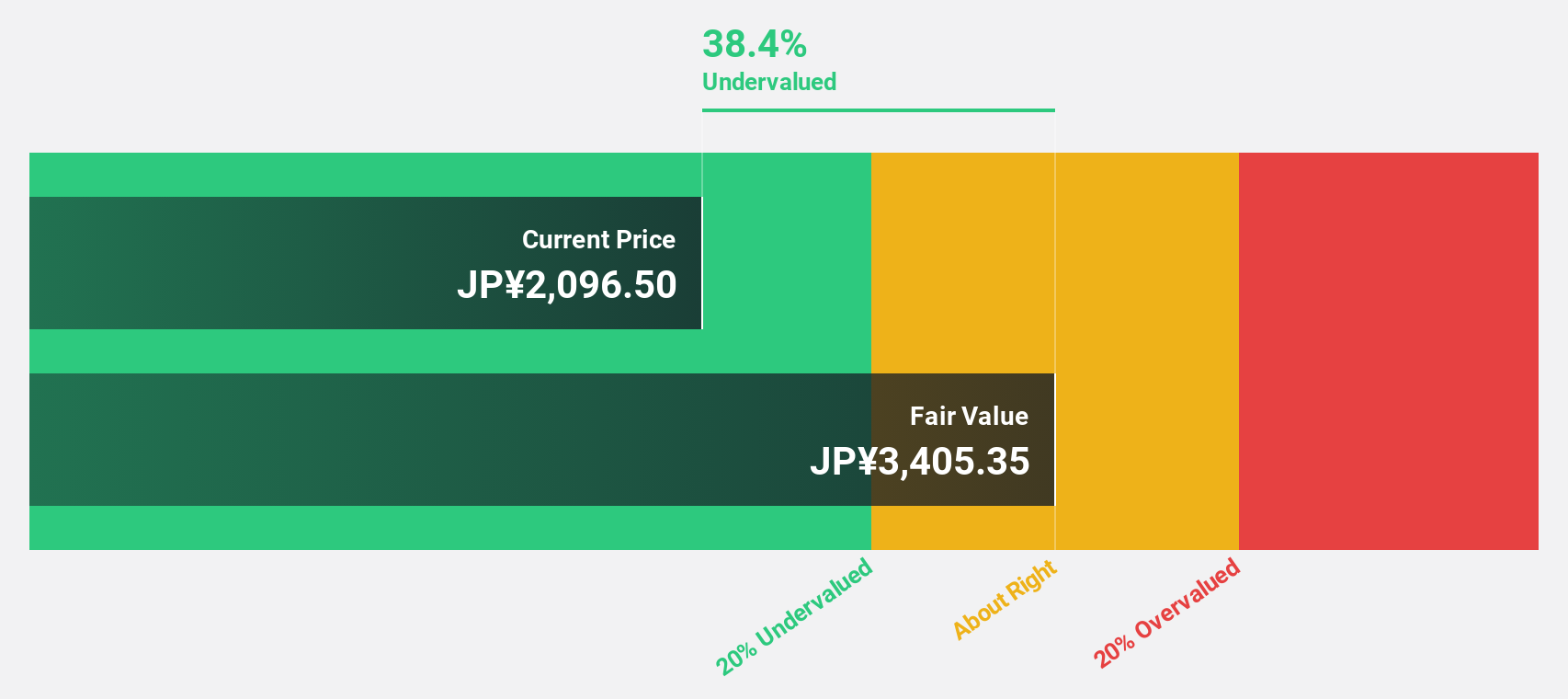

Estimated discount to fair value: 10.1%

Aozora Bank’s recent strategic alliance with Daiwa Securities and a series of private placements underscore its proactive approach to increasing shareholder value through diversified business models. Trading at 2547 yen, 10.1% below the estimated fair value of 2834.4 yen, the bank shows potential as an undervalued asset based on its cash flows. However, challenges such as a high bad loan ratio of 3.2% and a low bad loan provision of 67% point to areas of financial risk that need to be carefully managed. The bank’s revenue growth forecast of 9.3% annually is robust compared to the broader Japanese market of 4.3% and positions it for potential profitability improvements within three years.

Make it happen

Looking for a new perspective?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if Aozora Bank may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]