Class Action Lawsuit against Enphase Energy, Inc. (NASDAQ:ENPH)

A class action lawsuit has been filed against Enphase Energy, Inc. (NASDAQ:ENPH) on May 29, 2024. The plaintiffs (shareholders) alleged that they purchased ENPH shares at artificially inflated prices between February 7, 2023 and April 25, 2023 (the lawsuit period) and are now seeking compensation for their financial losses. Investors who purchased Enphase Energy shares during this period can click here to learn more about participating in the lawsuit.

Enphase Energy is a global energy management company that provides technology solutions for solar energy generation, storage and energy management. It designs, develops and manufactures microinverter-based solar and storage systems. The company markets its solutions to solar distributors, large installers, original equipment manufacturers, strategic partners and homeowners.

Misleading claims by Enphase Energy

Plaintiffs allege that Enphase Energy and two of its executive officers (Individual Defendants) deceived investors by repeatedly making false and misleading public statements about the Company’s business practices and prospects during the Class Period.

According to the complaint, ENPH stated in the press release announcing fourth-quarter and full-year 2022 results that it was adding additional microinverter manufacturing capacity in the United States due to solid demand for its offerings. The company also wanted to take advantage of the Inflation Reduction Act (IRA) incentives that encourage domestic production.

The company added that it plans to start domestic production with a new partner in the second quarter of fiscal 2023 and also with two existing contract manufacturing partners in the second half of 2023. In addition, the CEO stated in the related conference call that the company plans to start production at the Flex factory in Romania to easily serve European customers and increase its production. With the combined increase in production capacity in both the US and Europe, the company hoped to increase its total global quarterly capacity from 5 million in the fourth quarter of fiscal 2022 to over 6 million microinverters in the first quarter of 2023.

This is how the truth came to light

The lawsuit alleges that the defendants omitted truthful information in SEC filings and similar materials about several important matters, including, but not limited to, a decline in battery shipments to Europe and California. Accordingly, the defendants caused Enphase Energy’s stock to trade at artificially inflated prices during the period in question.

The information became clear on April 25, 2023, when the company reported its results for the first quarter of fiscal 2023. The company noted that U.S. sales declined 9% quarter-over-quarter due to seasonality and macroeconomic conditions. In addition, the company forecast disappointing second-quarter revenues in the range of $700 million to $750 million.

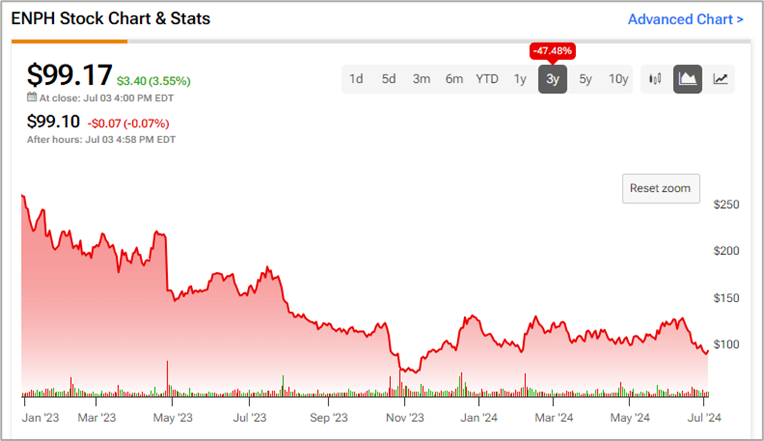

Enphase Energy shares have lost over 62% since January 2023, resulting in massive losses in shareholder returns.

Disclaimer