Using fundamentals to identify value opportunities – The importance of growth

Market commentators like to divide stocks into value and growth categories. Even academics like to use this language. When Eugene Fama and Ken French wrote their seminal paper on their three-factor model, they called the stocks with high price-to-book ratios “growth stocks.” But their method did not measure the actual earnings growth of these stocks. They inferred from the fact that they are expensive that they are growing fast. If investors are paying so much to own these types of stocks, surely they must expect them to grow fast in the future.

It is true that stocks with high price-to-book ratios will grow faster than the market average in the short term, but this effect is relatively short-lived. In fact, the earnings of the average “value” stocks will grow in line with the market average over time, as will those of the average “growth” stocks. The only difference is how much an investor pays to own those stocks and the rate of return they receive while waiting for the mean to revert. Growth stocks should be valued higher than value stocks to reflect better short-term growth. The problem is that investors often expect them to grow at the same rate over a longer period of time and overpay for such companies. It might have been better for everyone involved if Fama and French had called these “cheap” and “expensive” stocks rather than “value” and “growth” stocks.

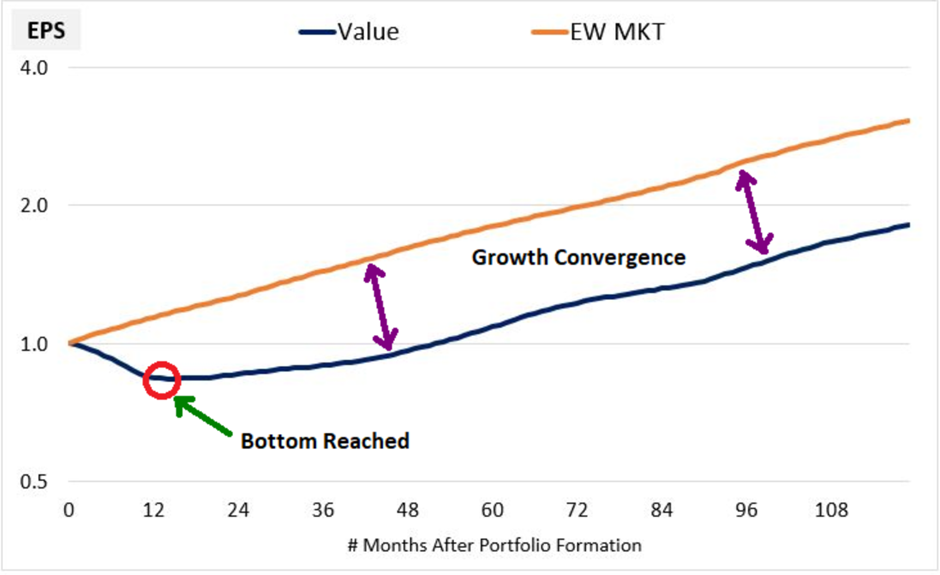

Far from being unimportant when investing in value stocks, growth is a fundamental component of the returns this strategy generates. One of my favorite charts from Factors From Scratch shows this:

Likewise, valuation is an important aspect of being a successful growth investor. Understanding these principles has led to the rise of GARP investing – growth at a reasonable price. The cornerstone of this approach is the price-earnings-growth ratio:

Price-earnings growth (PEG) = price-earnings ratio / earnings growth rate

You can find these here in the Stockopedia StockReport:

It was originally developed by Mario Farina and presented in his book in 1969. A beginner’s guide to successful stock market investing, but the legendary Peter Lynch made it popular. With this ratio, smaller is better as it means earnings are growing faster than the P/E ratio. There are a few different versions of the ratio, and Stockopedia offers the ability to search for…

Already have an account?

Login here