Yoong Onn Corporation Berhad (KLSE:YOCB) needs to do more to multiply its value in the future

There are a few key trends to look out for when identifying the next multibagger. In a perfect world, we would like to see a company invest more capital into its business and ideally the returns generated from that capital also increase. Basically, this means that a company has profitable initiatives that it can continue to reinvest in, which is a characteristic of a compounding machine. So we took a quick look Yoong Onn Corporation Berhad’s (KLSE:YOCB) ROCE trend, we were pretty pleased with what we saw.

What is return on capital employed (ROCE)?

Just to clarify in case you aren’t sure, ROCE is a ratio that evaluates how much pre-tax profit (as a percentage) a company generates on the capital invested in its business. The formula for this calculation at Yoong Onn Corporation Berhad is:

Return on capital = earnings before interest and taxes (EBIT) ÷ (total assets – current liabilities)

0.11 = 40 million RM ÷ (396 million RM – 44 million RM) (Based on the last twelve months to March 2024).

Therefore, Yoong Onn Corporation Berhad has a ROCE of 11%. This is a normal return in itself, but it is much better than the 5.6% achieved in retail.

Check out our latest analysis for Yoong Onn Corporation Berhad

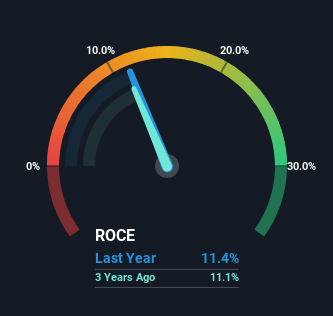

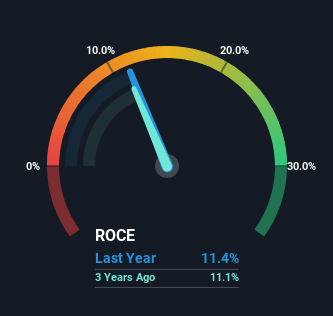

Historical performance is a good place to start when analyzing a stock. Above you can see Yoong Onn Corporation Berhad’s ROCE compared to past earnings. If you want to delve into historical earnings, check out these free Charts with detailed information on sales and cash flow development of Yoong Onn Corporation Berhad.

What can we learn from Yoong Onn Corporation Berhad’s ROCE trend?

While current returns on capital are decent, they have changed little. The company has consistently returned 11% over the last five years, and capital employed in the company has grown by 52% in that time. 11% is a fairly normal return, and it is somewhat reassuring to know that Yoong Onn Corporation Berhad has consistently returned that amount. Stable returns of this magnitude may not be particularly exciting, but if they can be sustained over the long term, they often provide nice returns for shareholders.

The conclusion on the ROCE of Yoong Onn Corporation Berhad

Most importantly, it’s important to remember that Yoong Onn Corporation Berhad has demonstrated its ability to consistently reinvest while generating respectable returns. And long-term investors would be delighted with the 154% return it has generated over the past five years. While the positive underlying trends can be attributed to investors, we still think this stock is worth a closer look.

If you want to know more about the risks facing Yoong Onn Corporation Berhad, we have found 2 warning signs that you should know.

While Yoong Onn Corporation Berhad may not have the highest returns right now, we have compiled a list of companies that currently have a return on equity of over 25%. Check it out free List here.

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]