July 2024 Insights into Japanese stocks valued below their intrinsic value

In a week of notable gains in Japanese equity markets, with the Nikkei 225 and TOPIX indices rising sharply on the back of a historically weak yen that boosted export-heavy industries, investors are closely monitoring opportunities in this buoyant market landscape. In such an environment, it could be particularly tempting to identify stocks that appear undervalued relative to their intrinsic value and offer potential to sophisticated investors.

The 10 most undervalued stocks in Japan based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Connection and Motivation (TSE:2170) |

479.00 ¥ |

923.53 ¥ |

48.1% |

|

Mimaki Engineering (TSE:6638) |

¥1962.00 |

3878.93 ¥ |

49.4% |

|

Hamee (TSE:3134) |

¥1125.00 |

2156.24 ¥ |

47.8% |

|

Cyber Security Cloud (TSE:4493) |

2300.00 ¥ |

4355.24 ¥ |

47.2% |

|

Sumco (TSE:3436) |

2462.00 ¥ |

4590.57 ¥ |

46.4% |

|

S-Pool (TSE:2471) |

322.00 ¥ |

¥623.96 |

48.4% |

|

Macromill (TSE:3978) |

872.00 ¥ |

1679.80 ¥ |

48.1% |

|

Bushiroad (TSE:7803) |

387.00 ¥ |

¥720.91 |

46.3% |

|

Forward money (TSE:3994) |

5212.00 ¥ |

¥10,435.23 |

50.1% |

|

Liberta Ltd (TSE:4935) |

¥514.00 |

985.57 ¥ |

47.8% |

Click here to see the full list of 94 stocks from our Undervalued Japanese Stocks Based on Cash Flow screener.

Below we present some of our favorites from our exclusive screener

Overview: Sumco Corporation, with a market capitalization of 860.93 billion yen, is engaged in the global manufacture and sale of silicon wafers for the semiconductor industry in Japan, the United States, China, Taiwan and Korea.

Operations: The company generates its revenue from the manufacture and sale of silicon wafers and primarily supplies the semiconductor industry in various global markets, including Japan, the United States, China, Taiwan and Korea.

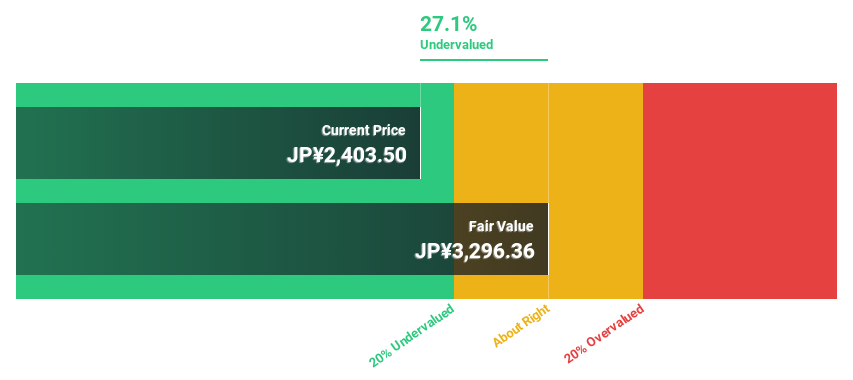

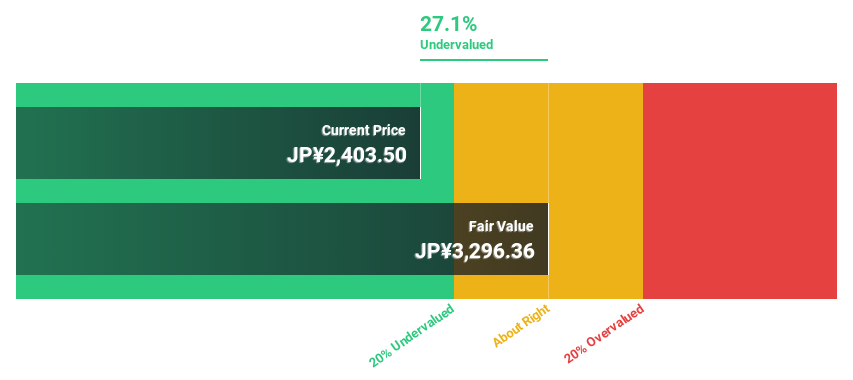

Estimated discount to fair value: 46.4%

Sumco currently trades at 2462 yen, significantly undervalued by over 20% compared to an estimated fair value of 4546.04 yen. Despite a recent dividend cut to 10 yen per share and an uncertain dividend forecast for the end of 2024, Sumco’s earnings are expected to grow at a robust 24.2% annually. However, profit margins have fallen to 7.6% from 20.6% last year, and dividends are not well supported by cash flows, suggesting potential financial stress or strategic changes in capital allocation.

Overview: Tokuyama Corporation, operating in Japan, is engaged in the manufacture and sale of a wide range of chemical products and has a market capitalization of approximately 214.98 billion yen.

Operations: The company operates primarily in the chemical sector and focuses on the manufacture and distribution of a wide range of chemical products.

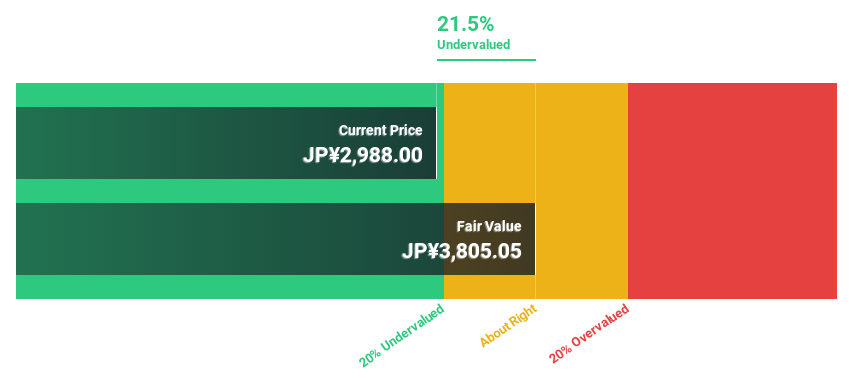

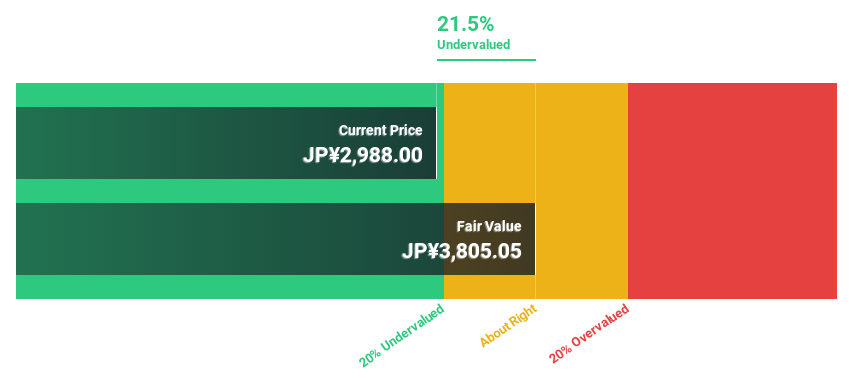

Estimated discount to fair value: 21.5%

Tokuyama trades at 2988 yen, below its estimated fair value of 3795.43 yen, suggesting a potential undervaluation of over 20%. While the company’s revenue growth is slightly above the Japanese market average at 4.7% per year, its earnings are expected to grow significantly at 20.4% annually. However, concerns include a low forecast return on equity of 11.6% in three years and an unstable dividend history despite recent increases from 45 JPY last year to 50 JPY per share for fiscal 2025.

Overview: SCREEN Holdings Co., Ltd. is a Japanese company specializing in the development, manufacture, sale and maintenance of semiconductor production equipment and has a market capitalization of approximately 1.51 trillion yen.

Operations: The company specializes in the field of semiconductor production equipment.

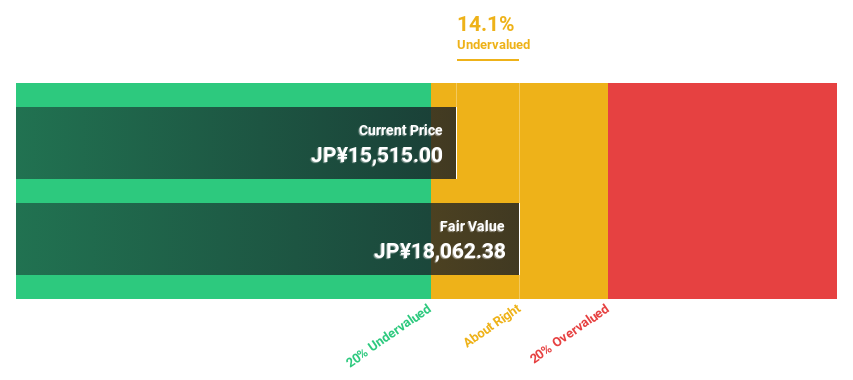

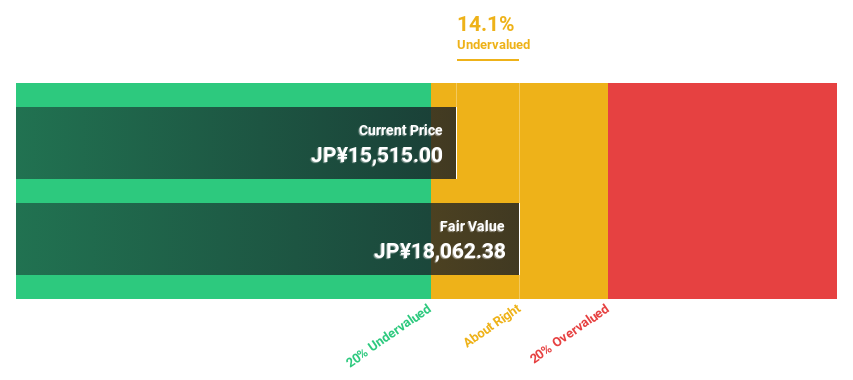

Estimated discount to fair value: 14.1%

SCREEN Holdings is considered undervalued at 15,515 yen compared to a fair value of 18,058.32 yen. The company’s revenue growth is estimated at 8.6% per year, outperforming the Japanese market average of 4.2%. Nevertheless, the earnings growth forecast of 9.7% per year only slightly exceeds the general market expectation of 8.8%. Recent index changes and a dividend cut from 167 JPY to 124 JPY per share reflect some operational and market challenges and broaden the company’s investment profile amid significant share price volatility.

The central theses

Looking for a new perspective?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include TSE:3436, TSE:4043 and TSE:7735.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]