Flight Centre Travel Group and 2 other ASX shares valued below their intrinsic value

The Australian share market has seen a slight decline of 1.4% over the past week, but is up 6.5% over the past year and earnings are expected to grow 13% annually. In such a volatile environment, identifying potentially undervalued stocks can present opportunities for investors looking for value in a growing market.

The 10 most undervalued stocks in Australia based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

GTN (ASX:GTN) |

0.445€ |

0,85 € |

47.4% |

|

MaxiPARTS (ASX:MXI) |

2.04 A$ |

3,94 € |

48.2% |

|

ReadyTech Holdings (ASX:RDY) |

3,25 € |

6,26 € |

48% |

|

Australian Clinical Laboratories (ASX:ACL) |

2,48 € |

4,73 € |

47.5% |

|

Strike Energy (ASX:STX) |

0.225 A$ |

0,45 € |

50.3% |

|

IPH (ASX:IPH) |

6,25 € |

12,00 € |

47.9% |

|

Regal Partners (ASX:RPL) |

3,29 € |

6,18 € |

46.8% |

|

Core Lithium (ASX:CXO) |

0.085 A$ |

0,17 € |

49.5% |

|

Millennium Services Group (ASX:MIL) |

1,145 € |

2,24 € |

48.9% |

|

SiteMinder (ASX:SDR) |

5,20 € |

10.02 A$ |

48.1% |

Click here to see the full list of 49 stocks from our Undervalued ASX Stocks Based on Cash Flows screener.

Let’s review some notable picks from our reviewed stocks

Overview: Flight Centre Travel Group Limited is a travel retailer serving both the leisure and corporate sectors in regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa and Asia and has a market capitalisation of approximately A$4.54 billion.

Operations: The company’s revenue comes primarily from its leisure and business travel businesses, generating A$1.28 billion and A$1.06 billion respectively.

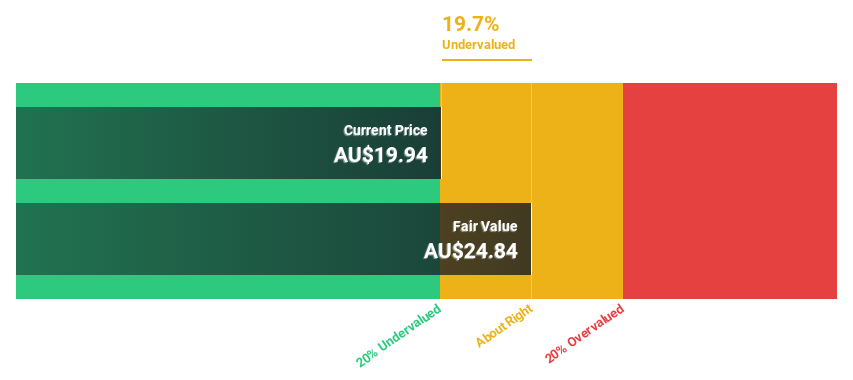

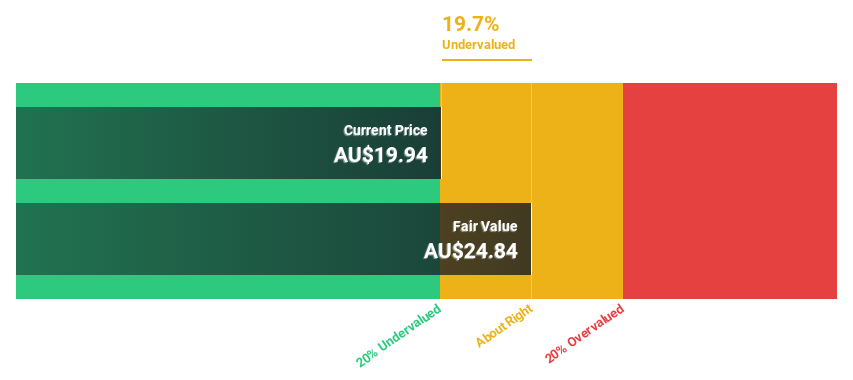

Estimated discount to fair value: 19.7%

Flight Centre Travel Group (FLT) is trading at A$20.63, below our estimated fair value of A$25.62, suggesting potential undervaluation. FLT has recently posted earnings and is expected to grow 18.8% annually, beating the Australian market forecast of 13%. Despite this growth, revenue growth of 9.7% annually exceeds the market’s 5.2% but does not reach high growth thresholds. With a forecast high return on equity of 21.8% over three years, FLT combines solid profitability prospects with moderate undervaluation based on cash flows.

Overview: HMC Capital Limited operates in Australia and manages real estate funds with a market capitalization of approximately A$2.63 billion.

Operations: The company manages real estate-focused funds and has revenues of approximately A$80.29 million.

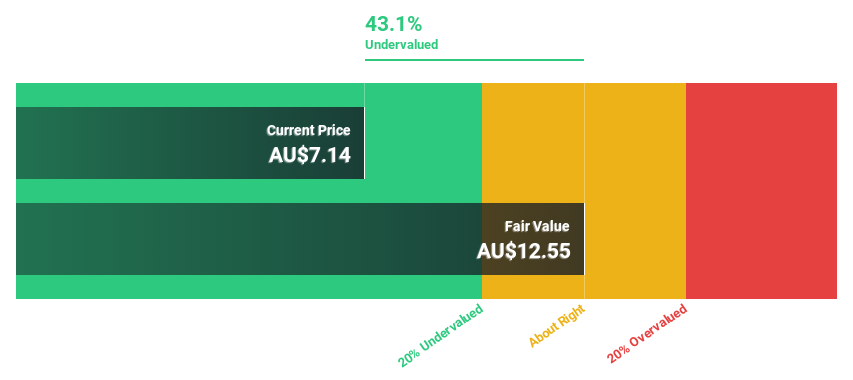

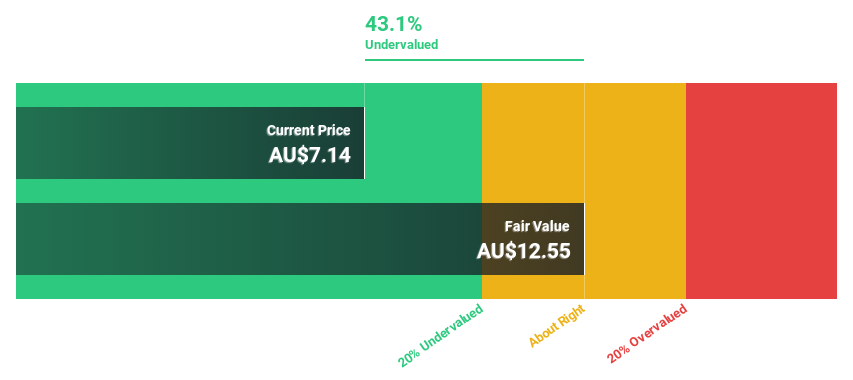

Estimated discount to fair value: 43.1%

HMC Capital appears to be undervalued at a current price of A$7.14 against an estimated fair value of A$12.55, which represents a significant discount. The company’s revenue growth is robust at 20.1% annually, outperforming the Australian market at 5.2%. Despite recent shareholder dilution through several share offerings totaling A$188.30 million, HMC’s earnings are expected to grow at 16.9% annually, outperforming the market average of 13%. However, the forecast return on equity in three years is relatively low at 10.5%.

Overview: Judo Capital Holdings Limited operates in Australia and offers a range of banking products and services tailored to small and medium-sized businesses. The company has a market capitalization of approximately A$1.38 billion.

Operations: The company generates its revenue primarily from its banking business and totals AUD 328.70 million.

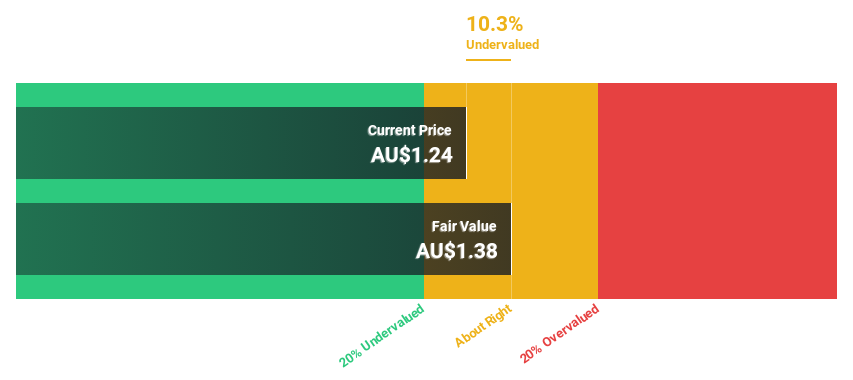

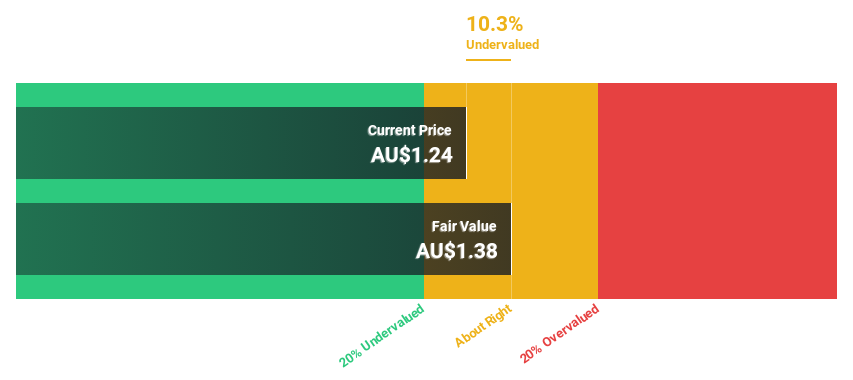

Estimated discount to fair value: 10.3%

Judo Capital Holdings is trading at A$1.24, below its calculated fair value of A$1.38. While revenue growth is estimated at 16.6% annually, outperforming the Australian market average of 5.2%, earnings are expected to grow at 26.32% annually, also above the national trend of 13%. Judo was recently added to the S&P/ASX 200 Index and shows potential despite a modest forecast return on equity of 10.1% over three years and a valuation that is not significantly undervalued on a discounted cash flow basis.

Take advantage

Looking for other investments?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ASX:FLT, ASX:HMC and ASX:JDO.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]