This undervalued stock could put Nvidia in the $3 trillion club

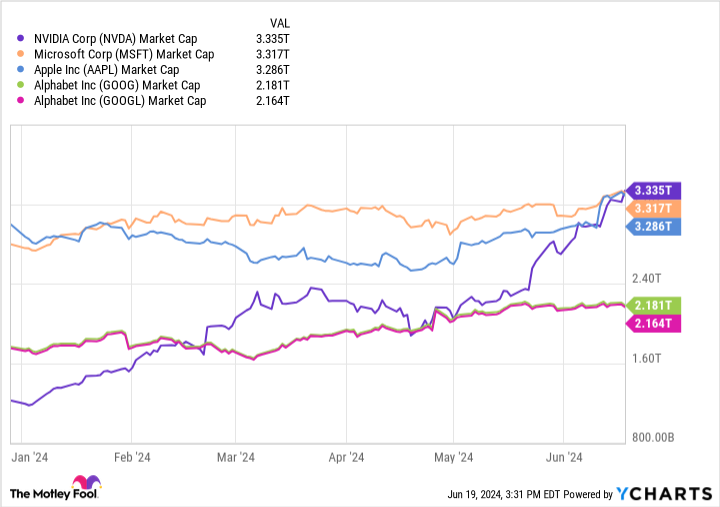

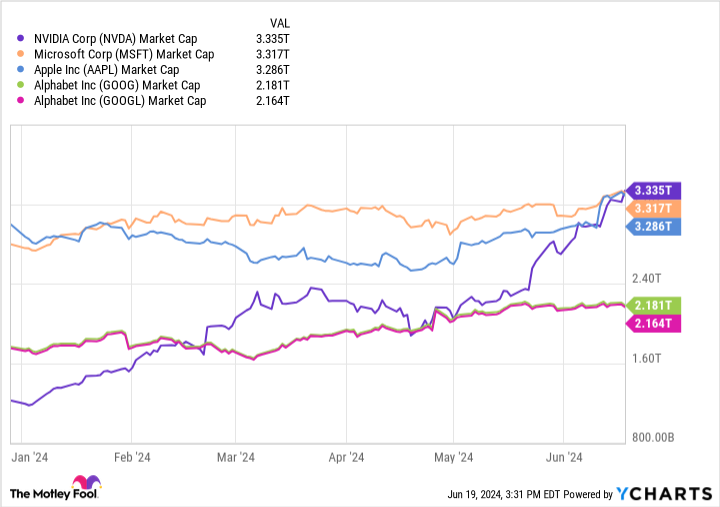

Currently there are only three S&P500 Stocks in the $3 trillion club: NVIDIA (NASDAQ: NVDA), Microsoft (NASDAQ:MSFT)And Apple (NASDAQ: AAPL). All three are worth around $3.3 trillion. With a market capitalization of just under $2.2 trillion alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) seems to be the best candidate for membership in this exclusive club. The stock would have to rise by just over 36% to achieve this.

Let’s look at three reasons why Alphabet could be the next stock in the $3 trillion club.

1. Alphabet companies retain dominant market positions

Alphabet is the dominant leader in search, while Google has a global market share of about 90%. Search is a huge business that is still growing strongly. In the first quarter of this year, Google search revenues rose 14% year-on-year to $46.2 billion. Although Microsoft has tried to challenge Google’s dominance by adding new artificial intelligence (AI) features to its Bing search engine, this has so far done little to dent Google’s dominance.

At the same time, YouTube is also a leader in video content with one of the most attractive models in the space. Because the content is created by users, the company doesn’t have to pay the high upfront fees that streaming services would otherwise pay, but instead shares revenue with its creators. Despite a lackluster advertising market, YouTube’s revenue rose 21% year over year to $8.1 billion in the first quarter. The company is just beginning to better monetize its short-form videos, competing with the likes of ByteDance’s TikTok, and has plenty of time to continue growing.

Meanwhile, Google’s fastest-growing segment is its cloud services business, with revenue increasing 28% year-on-year to $9.6 billion in the first quarter. Google Cloud has the third-largest market share in cloud services (behind 2nd Microsoft Azure and 1st Google Cloud). Amazon Web Services) and the company benefited from increased AI spending in the wider economy. As a company with many fixed costs, Google Cloud did not become profitable until 2023 and should now grow its profitability faster than revenue as the segment has operating leverage.

2. Alphabet sees upside potential in AI

Google Cloud is already benefiting greatly from the increased interest in AI, but other areas of the business are also benefiting. The company is integrating its Gemini Large Language Model (LLM) into various products, including its Pixel smartphones and Workspace product suite. Gemini for Workspace, for example, integrates with Gmail, Docs and Sheets as an add-on subscription for $20 per month and acts as an AI assistant that can perform tasks such as monitoring and tracking projects, organizing information, writing proposals, and generating images and designs.

Although the company has scaled back its use of AI search overlays for now due to initial failures, it still represents an opportunity for the future. Google currently only delivers ads for about 20% of its searches where ad inclusion is relevant to search, so new ad types for AI search represent a huge potential opportunity. The technology still needs to improve, but AI and AI-powered search are still in their infancy.

3. Alphabet is an undervalued stock

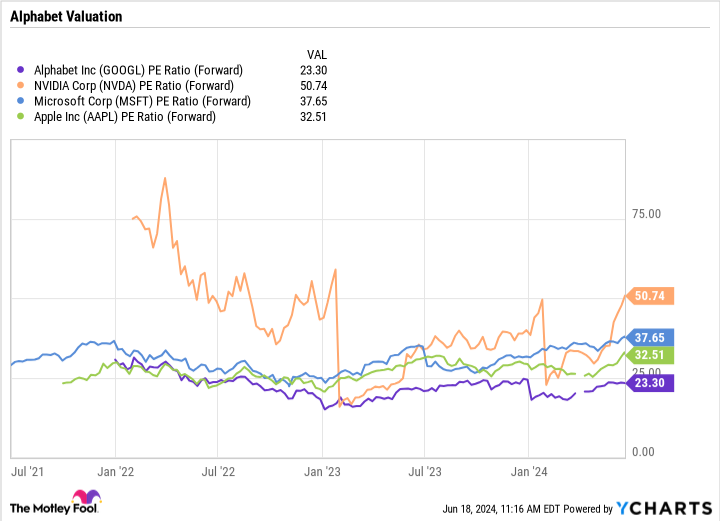

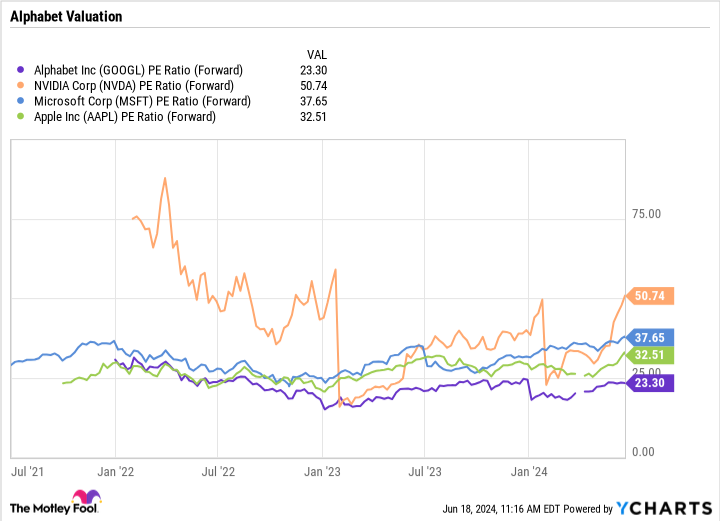

Compared to stocks already in the $3 trillion club, Alphabet is valued by far the lowest, with a price-to-earnings (P/E) ratio of just over 23. Given its current growth and future prospects, the stock currently appears severely undervalued.

If Alphabet were trading at the same P/E ratio of 32.5 as Apple, its Class A shares would be priced at $245 and have a market cap of $3 trillion. Alphabet has stronger revenue growth than Apple. In recent quarters, Apple has seen revenue decline 4% year over year, while Alphabet has seen revenue increase 15%. So it seems like it’s only a matter of time before Alphabet stock joins the $3 trillion club.

Overall, Alphabet is an undervalued stock with dominant market positions and strong growth prospects. At current levels, the stock appears to be a solid buy for long-term investors.

Should you invest $1,000 in Alphabet now?

Before you buy Alphabet stock, consider the following:

The Motley Fool Stock Advisor The analyst team has just published what they believe to be The 10 best stocks for investors to buy now… and Alphabet wasn’t among them. The 10 stocks that made the cut could deliver huge returns in the years to come.

Consider when NVIDIA created this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, You would have $830,777!*

Stock Advisor offers investors an easy-to-understand plan for success, including instructions on how to build a portfolio, regular updates from analysts, and two new stock recommendations per month. The Stock Advisor Service has more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, a subsidiary of Amazon, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has a position at Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This undervalued stock could join Nvidia in the $3 trillion club. Original article by The Motley Fool