Exploring three undervalued small caps with insider information in the region

In a week marked by modest gains in major U.S. equity indexes and a significant improvement in performance among small-cap companies, the investment landscape appears cautiously optimistic as investors await clearer signals from upcoming quarterly reports. In these conditions, examining undervalued small caps with recent insider activity could reveal potential opportunities for those looking to diversify their portfolios in this market segment.

Top 10 undervalued small caps with insider purchases

|

Surname |

SPORTS |

PS |

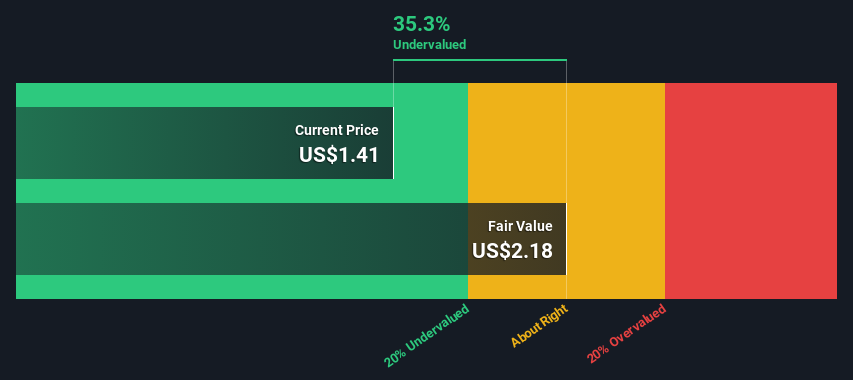

Discount to fair value |

Value assessment |

|---|---|---|---|---|

|

Columbus McKinnon |

20.9x |

1.0x |

46.09% |

★★★★★☆ |

|

Sperm Indonesia (Persero) |

12.8x |

0.7x |

23.01% |

★★★★★☆ |

|

East-West banking |

3.4x |

0.7x |

49.23% |

★★★★★☆ |

|

RAM Essential Services Ownership Fund |

N/A |

5.6x |

41.98% |

★★★★★☆ |

|

Heilius |

N/A |

0.6x |

43.72% |

★★★★★☆ |

|

Thick Data |

20.7x |

0.8x |

4.00% |

★★★★☆☆ |

|

China Leon Inspection Holding |

10.1x |

0.7x |

25.37% |

★★★★☆☆ |

|

Giordano International |

8.7x |

0.8x |

36.02% |

★★★☆☆☆ |

|

Tai Sin Electro |

15.0x |

0.5x |

5.20% |

★★★☆☆☆ |

|

Community West Bancshares |

18.7x |

2.9x |

42.25% |

★★★☆☆☆ |

Click here to see the full list of 225 stocks from our Undervalued Small Caps with Insider Buying screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Value Rating: ★★★★★☆

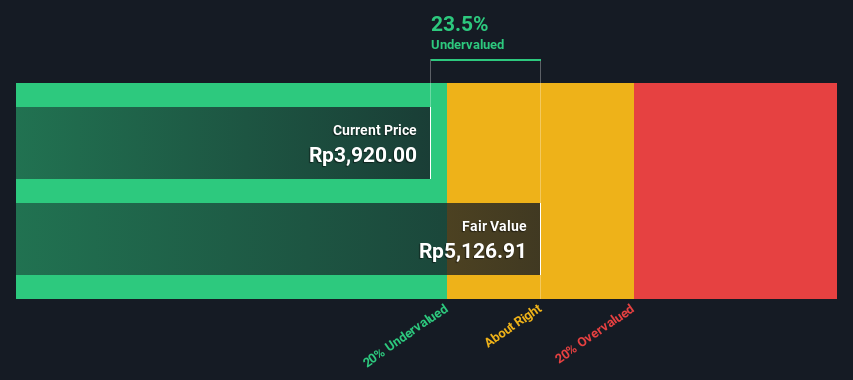

Overview: Semen Indonesia is a cement and non-cement products manufacturing company with a market capitalization of approximately IDR 34.11 billion.

Operations: The company’s main revenue generators are cement production and non-cement production, which generate IDR 34.11 billion and IDR 13.13 billion respectively. In recent periods, the gross profit margin has been variable and stood at a remarkable 0.26% at the end of the last reporting period.

SPORTS: 12.8x

Recently, Semen Indonesia has demonstrated insiders’ confidence by making acquisitions that signal belief in the company’s potential, despite first-quarter revenues declining to IDR 8,375 million year-on-year from IDR 8,935 million and net profits falling. At the Macquarie Asia Conference, the company highlighted strategies that could reverse these trends. With expected annual earnings growth of 13.5% and a sole reliance on external borrowings – with no customer deposits – the company offers compelling growth prospects compared to its industry peers.

Simply Wall St Value Rating: ★★★★☆☆

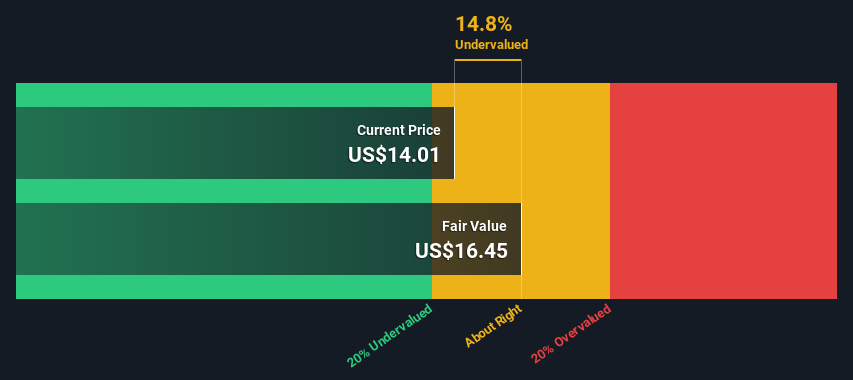

Overview: Ramaco Resources is a coal mining company with a market capitalization of approximately $699.84 million.

Operations: In the latest financial data, the company reported revenue of $699.84 million and net profit of $56.32 million. Gross profit margin was 25.27%, reflecting cost of goods sold of $522.96 million and gross profit of $176.88 million, indicating operational efficiency in managing production costs relative to revenue.

SPORTS: 13.3x

Recently, Ramaco Resources has experienced significant trust from insiders, with key figures buying shares, signaling strong confidence in the company’s future despite a difficult financial environment marked by a decline in profit margin from 17.3% to 8%. This move coincides with the company’s inclusion in several growth-oriented indices, such as the Russell 2000 and Russell 3000 growth indices, starting July 1, 2024. These developments indicate a strategic focus on growth sectors, supported by the company’s concrete commitment through equity investments.

Simply Wall St Value Rating: ★★★★★☆

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations in the Americas and Europe (including airports) and a market capitalization of approximately $0.65 billion.

Operations: The company generates its revenues in various geographic segments, including the Americas (excluding airports), Northern Europe and Airports, with respective revenues of $1.11 billion, $630.45 million and $334.74 million. In recent periods, there have been fluctuations in the gross profit margin. In the last quarter, the figure was 0.48% compared to 0.45% three months earlier, reflecting the fluctuations in cost management in relation to the revenue generated.

SPORTS: -4.9x

Recently, Clear Channel Outdoor Holdings has demonstrated insider confidence through significant stock purchases, signaling a strong belief in the company’s future despite current challenges. This optimism comes with the company’s inclusion in several Russell indexes and a large securities registry registration, suggesting a willingness to make strategic moves. Although the company reported a wider net loss this quarter than last year, the company is forecasting full-year revenue to increase to as much as $2.26 billion. These developments could indicate a potentially underappreciated value for this market participant.

The central theses

Ready for a different approach?

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include IDX:SMGR NasdaqGS:METC and NYSE:CCO.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]