Poll: Majority of Americans support federal government measures to relieve medical debt

A majority of Americans support medical debt relief, with about half saying they strongly support it, according to a new poll by the University of Chicago’s Harris School of Public Policy and the Associated Press-NORC Center for Public Affairs Research.

The survey, Firstreported by The Associated Press A poll conducted Tuesday found that 51 percent of Americans think it is “extremely or very important” that the U.S. government provide relief to people with medical debt, while another 30 percent think it is “somewhat important.”

The government’s support offers a glimmer of hope for the roughly 14 million Americans who owe $1,000 or more in medical debt – a common cause of bankruptcy in the United States – and for the even larger number of people whose credit reports include medical debt.

Janille Williams, a 38-year-old retail manager in Fairbanks, Alaska, who is burdened with $50,000 in medical debt that makes it difficult for her to buy a home, said The Associated Press that he had no choice but to take on the debt – it was the only way to save his life when he had a blood infection.

“In the hospital, you have no choice. ‘If you leave, you’re going to die,’ they told me. I had no desire to die,” Williams said. “I don’t think anyone should have to be financially ruined to survive.”

“I think fundamentally, it’s never anyone’s fault when someone has an illness. If someone gets cancer or a tumor or has a bout of diabetes that hasn’t been diagnosed yet – it’s not anyone’s fault if they develop something and then end up thousands or hundreds of thousands of dollars in debt.”

Last month, four progressive lawmakers, including Sen. Bernie Sanders (I-Vt.) and Rep. Ro Khanna (D-Calif.), introduced the Medical Debt Cancellation Act in both houses of the U.S. Congress. The bill would prevent collection of debts already accrued, create a federal debt cancellation program and take measures to limit future medical debt. Some states and cities have already taken steps to cancel medical debt, often with funds from the 2021 federal stimulus package.

Sanders and Khanna helped launch a “freedom from medical debt” initiative last year, and the Biden administration has taken steps to ease the burden of medical debt. Last week, the Consumer Financial Protection Bureau announced new rules that will ban the inclusion of medical debt on credit reports, a move aimed at preventing debt collectors from “using the credit reporting system to force people to pay.”

Vice President Kamala Harris spoke in favor of the new CFPB rules, which are not expected to be finalized before the presidential election in November.

“Medical debt makes it harder for millions of Americans to get a car loan, a home loan or a small business loan,” she said. “All of that, in turn, makes it harder to even make ends meet, let alone get ahead. And that’s just not fair.”

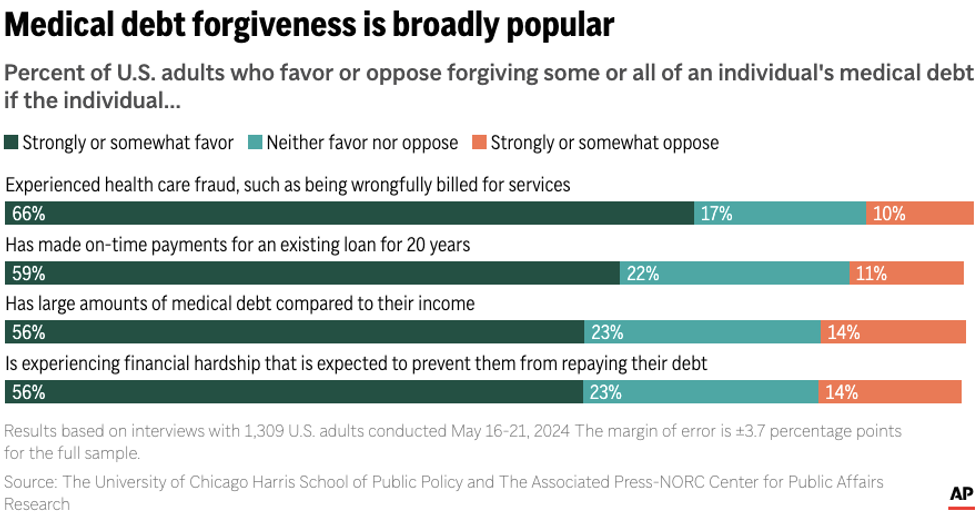

The new poll, released last week, found that medical debt forgiveness is especially popular among people who have personal experience with medical debt or billing issues. People who have been victims of healthcare fraud favor medical debt forgiveness by 66% versus 10%, and those with high medical debt relative to their income favor it by 56% versus 14%.

(Source: Associated Press)

(Source: Associated Press)

Support for health care debt relief is also strong among Democrats, according to the poll: 65 percent of Democrats said they strongly supported it, compared to just 31 percent of Republicans. Other members of both parties, however, showed some support, and only a small portion said the issue was unimportant.

The data comes from a survey of 1,309 Americans conducted between May 16 and May 21, 2024.

According to the Peterson-KFF Health System Tracker, low- and middle-income people, middle-aged people, and black people disproportionately bear the burden of medical debt.

Matt Haskell, 24, of Englewood, Florida, told the AP that he supported medical debt relief after his own expensive hospital stay. He had gotten a metal splinter in his cornea while working on rusty cars and ended up in the emergency room. The treatment cost him $4,500.

“I think fundamentally, it’s never anyone’s fault when someone has a disease,” he said. “If someone gets cancer or a tumor or has a bout of diabetes that hasn’t been diagnosed yet – it’s not anyone’s fault if they develop something and then end up thousands or hundreds of thousands of dollars in debt.”