July 2024 Insight into three SEHK stocks trading below market value

Amid a global atmosphere of cautious optimism, the Hong Kong market has recently shown signs of volatility, reflecting broader economic uncertainties and local challenges. In this context, identifying potentially undervalued stocks becomes a crucial strategy for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 undervalued stocks in Hong Kong based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

China Resources Mixc Lifestyle Services (SEHK:1209) |

HK$25.35 |

HK$48.68 |

47.9% |

|

China Cinda Asset Management (SEHK:1359) |

HK$0.66 |

1.29HK$ |

48.9% |

|

Zijin Mining Group (SEHK:2899) |

HK$16.62 |

HK$31.53 |

47.3% |

|

United Energy Group (SEHK:467) |

0.31HK$ |

0.57HK$ |

45.6% |

|

WuXi XDC Cayman (SEHK:2268) |

HK$16.64 |

31,99 € |

48% |

|

Super Hi International Holding (SEHK:9658) |

HK$13.96 |

HK$26.08 |

46.5% |

|

Genscript Biotech (SEHK:1548) |

HK$8.63 |

HK$15.92 |

45.8% |

|

Melco International Development (SEHK:200) |

HK$5.25 |

HK$10.40 |

49.5% |

|

Vobile Group (SEHK:3738) |

1.19HK$ |

HK$2.32 |

48.8% |

|

AK Medical Holdings (SEHK:1789) |

HK$4.37 |

HK$7.87 |

44.5% |

Click here to see the full list of 41 stocks from our Undervalued SEHK Stocks Based on Cash Flows screener.

Here we highlight a selection of our favorite stocks from the screener

Overview: AK Medical Holdings Limited is an investment holding company specializing in the development, production and marketing of orthopedic joint implants and related products in China and internationally, with a market capitalization of approximately HK$4.90 billion.

Operations: The company generates its revenue mainly from the sale of orthopedic implants, of which CNY 993.59 million is generated in China and CNY 152.49 million is generated in the United Kingdom.

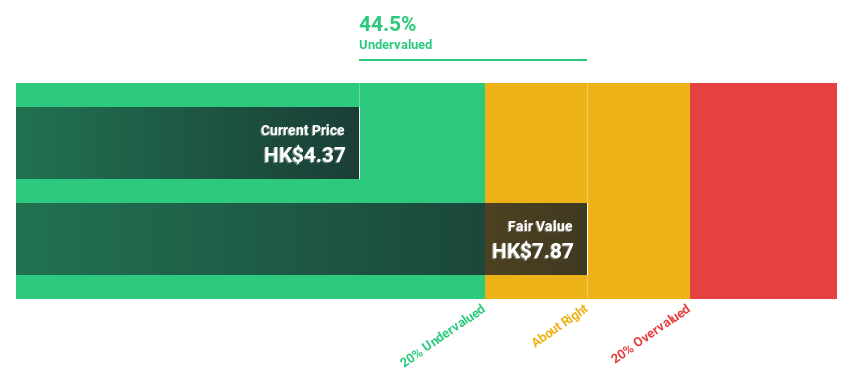

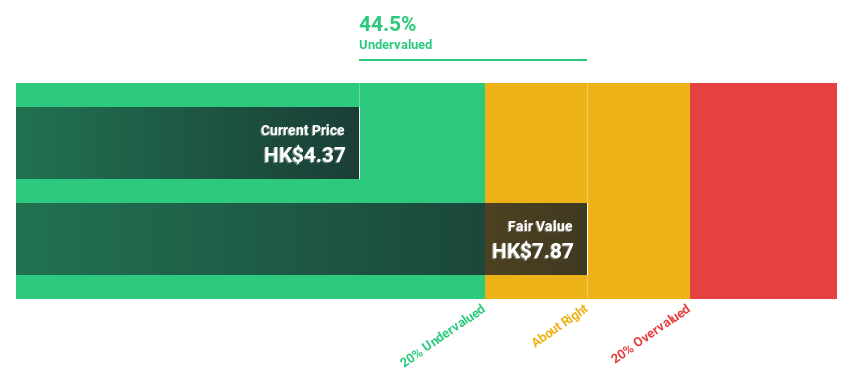

Estimated discount to fair value: 44.5%

AK Medical Holdings is significantly undervalued on a cash flow basis, trading at HK$4.37 versus fair value of HK$7.87, a significant discount. Analyst consensus estimates potential price upside of 83.5%, supported by expected annual earnings growth of 26% – outpacing the Hong Kong market at 11.3%. Despite recent dividend cuts and board changes, robust forecast annual revenue growth of 22.3% underscores its attractiveness as an undervalued asset in the region.

Overview: ESR Group Limited is engaged in the development, leasing and management of logistics properties in regions such as Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India and Europe and has a market capitalization of approximately HK$44.24 billion.

Operations: The company’s revenue is generated from three main segments: fund management of HK$774.64 million, new economy development of HK$105.48 million and investment of -HK$17.25 million.

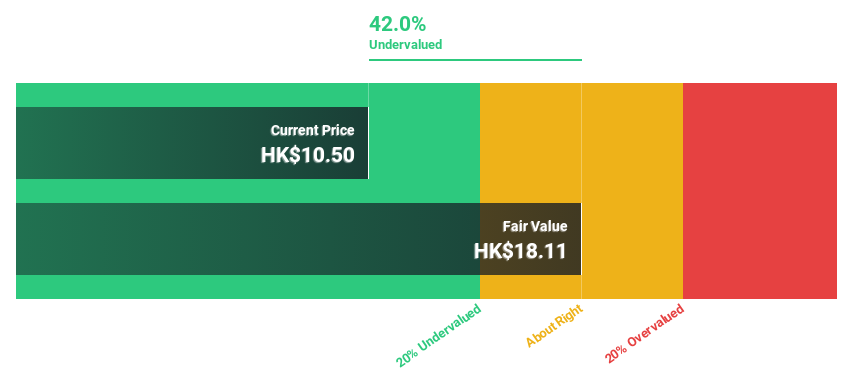

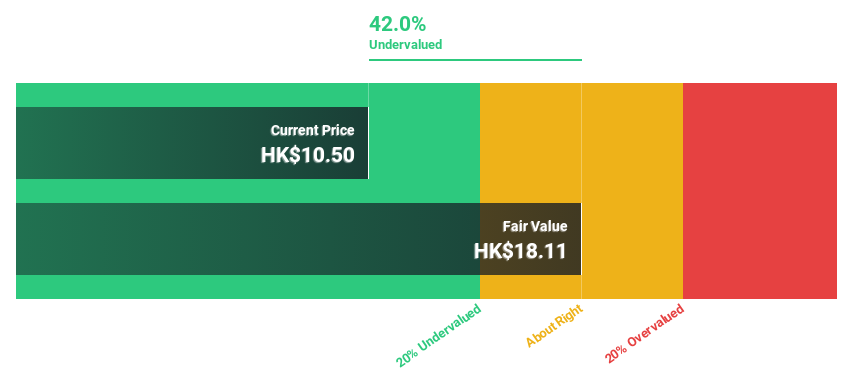

Estimated discount to fair value: 42%

ESR Group Limited currently trades at HK$10.5 and is considered undervalued with a fair value estimate of HK$18.11 based on discounted cash flows. Despite a low forecast return on equity of 7.3% in three years and a profit margin that has fallen from 54.8% to 23.9%, the company’s revenue growth is expected to outperform that of the Hong Kong market at 9.6% annually versus 7.8%. In addition, earnings are expected to grow at an impressive 26.5% per year, indicating potential for significant financial improvement and attractiveness based on cash flow metrics.

Overview: Yeahka Limited is an investment holding company operating in the People’s Republic of China that provides payment and business services to merchants and consumers and has a market capitalization of approximately HK$4.27 billion.

Operations: The company’s turnover amounts to 3.95 billion Chinese yen (approximately 121 million euros) and is generated primarily in the business services division.

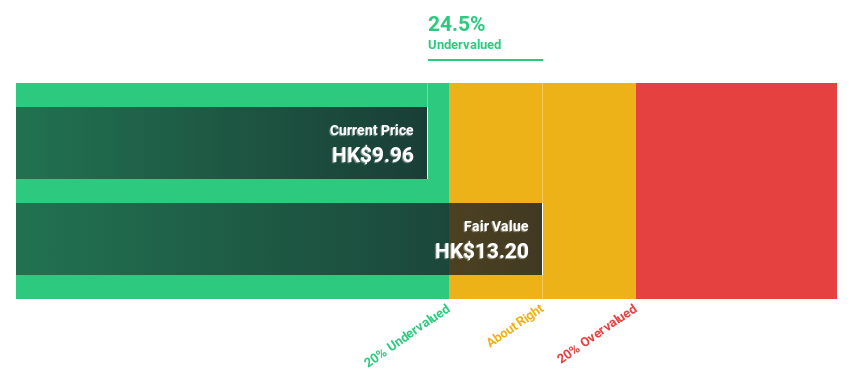

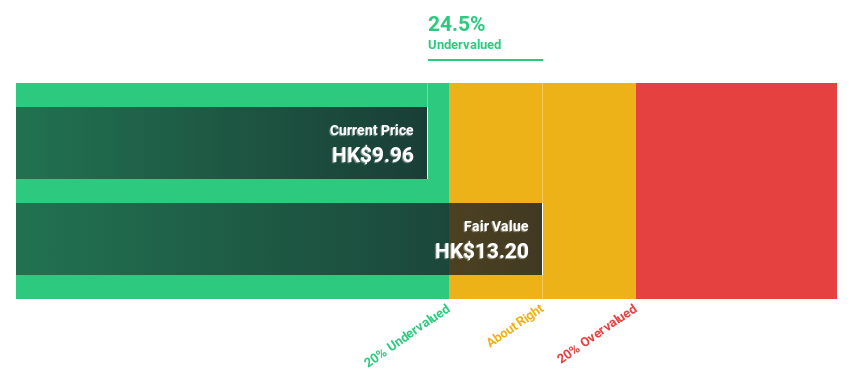

Estimated discount to fair value: 24.5%

Yeahka trades at HK$9.96, well below its estimated fair value of HK$13.20, suggesting the company is undervalued based on discounted cash flows. Despite a low return on equity of 13% in three years and a decline in profit margins from 4.5% to 0.3%, Yeahka’s revenue growth, estimated at 15.6% per year, is outperforming the Hong Kong market average of 7.8%. Analysts expect the share price to rise by 57.4%, with earnings expected to grow by an impressive 51.51% per year.

Turning ideas into action

Ready for a different approach?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

The companies discussed in this article include SEHK:1789, SEHK:1821 and SEHK:9923.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]